In the early evening, it looked like we could be in for a very nasty day after the US Commerce Dept. officially labeled China, a currency manipulator. US Future plunged more than 600 points as it appeared the Trade War had devolved into a very dangerous currency war. Luckily cooler heads prevailed as China finally took steps to stabilize the Yuan during the night and lifting the US Futures into positive territory. With 400 companies reporting earnings today and market emotions at a fevered pitch, we should prepare for very the challenging price volatility to continue.

Overnight Asian markets saw red across the board at the close though they recovered substantially from early session lows. European markets have turned modestly bullish this morning in reaction to the stabilized Yuan slightly eased trade war tensions. Ahead a big day of earnings reports, the US Futures point to a bullish open, with the Dow currently suggesting a gap up near 200 points at the open. With such wild volatility, we should not rule out the possibility of a pop and drop pattern, so stay on your toes and remain focused on price action for clues. Anything is possible when emotions are so high.

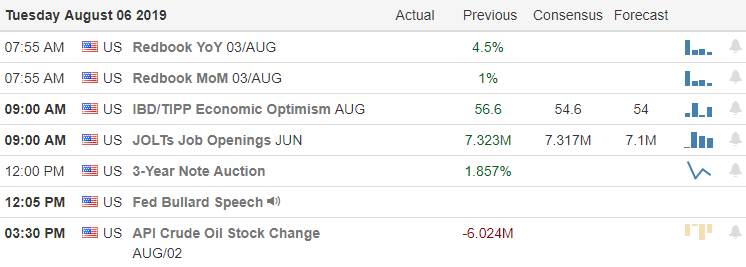

On the Calendar

We have a big day on the Tuesday earnings calendar with 400 companies set to report results. Some of the notables include ANDE, AINV, WT, ADM, BDX, APRN, CRCM, DIS, DISCA, DUK, ENR, STAY, FLT, FTR, HST, HUBS, NDLS, NUS, OIH, PBI, PAA, RHP, SSTK, SWN, VOYA, WYNN & ZAGG.

Action Plan

There was a lot of futures turmoil after the bell yesterday when the US Commerce Department officially labeled China, a currency manipulator after devaluing the Yuan. At one point the Dow Futures indicated a gap down of more than 650 points during the early evening as it appeared the trade war had evolved into a very dangerous currency war. Fortunately, during the night, China took measures to stabilize its currency, and the US Futures breathed a sigh of relief not only recovering the losses but moving back into the green. Whew, that could have been ugly!

As I write this, the US Futures are pointing to a bullish gap up around 200 points ahead of a huge day of earnings reports. Although I think the odds of testing the overnight futures lows have declined significantly over the last few hours, we can’t completely rule out the possibility considering the harsh volatility the market is currently experiencing. Emotions are high, so prepare for challenging price volatility fueled by news and earnings reports to test the metal of even the most experienced traders.

Trade Wisely,

Doug

Comments are closed.