Crude prices rise sharply after Iranian attacks on Saudi oil fields forced the shut down of nearly 50% of their daily production. The President has authorized the opening of the US Strategic supplies in response. The UAW has officially placed 48,000 General Motors on strike, but negotiations are set to resume this week. What a difference a weekend can make! With the market hopeful of FOMC rate decision and forecasts on Wednesday afternoon and the weekend disruptions, we should prepare a bit more price volatility in the days ahead.

Overnight Asian markets closed mostly lower as higher oil prices could pressure and the already challenged Chinese economy. European markets are seeing red across the board in reaction to oil prices and the obvious geopolitical tensions it’s likely to occur. US Futures had bounced slightly off of overnight lows pointing to a gap down open. One has to wonder what comes next as a response to the attack on world energy supplies?

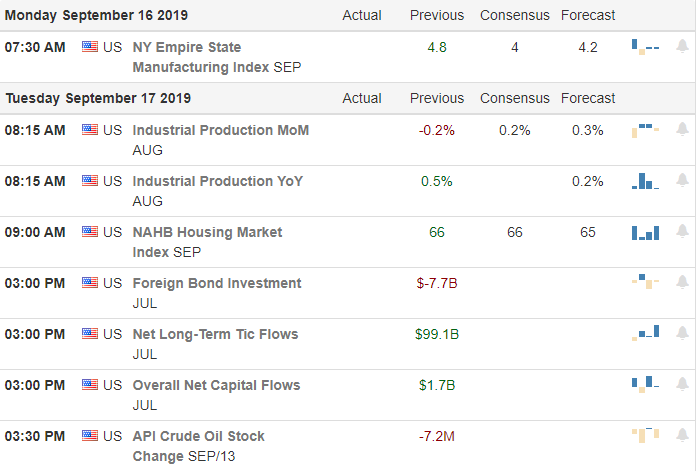

On the Calendar

Although were nearing the end of the quarter we still have stragglers yet to report. Today we have 21 companies expected to report but is see none that are particularly notable.

Action Plan

Iranian attacks on Saudi Arabian oil fields wiped out 5% of the global supply and forced the shutdown of nearly 50% of their daily production. Not surprisingly crude price rose sharply as futures markets reopened. What’s more, unsettling is what comes next? Disrupt the supply of energy, and a significant military response is not likely far behind. Aerospace and Defense sector stocks may join in the rally with oil prices. Tuesday begins the 2-day FOMO meeting with their announcement on rates and forecasts at 2:00 PM Eastern Wednesday.

Typically the market tends to chop with lighter than normal volume ahead of an FOMC announcement but, normal may be difficult to achieve today with the new uncertainty of energy. US Futures have improved from overnight lows but continue to point lower this morning with the Dow expected to gap down about 100 points. Keep in mind the 8-day rally has put the indexes in a short-term overbought condition with 50-moving average support significantly lower so we should not rule out the possibility of a test. However the hopefulness of lowered interest rates could inspire the bull to hold firm.

Trade Wisely,

Doug

Comments are closed.