All eyes will be on the CPI report coming out before the bell. Will it continue to inspire the bulls, or will it inspire the bears with worries of inflation? Ahead of the number, the 10-year treasuries rose to 1.69%, suggesting how critical this number could be in defining the path forward. The FDA came out this morning with a recommendation to pause the use of the J&J vaccine due to blood clotting worries. The futures markets have taken a turn for the worse as a result.

Overnight Asian markets traded mixed but mostly higher as Alibaba share surge for the second straight day. European markets trade with modest results this morning, with earnings and inflation data in focus. Ahead of the CPI report, U.S. futures point to a lower open on the eve of the 2nd quarter earnings kickoff.

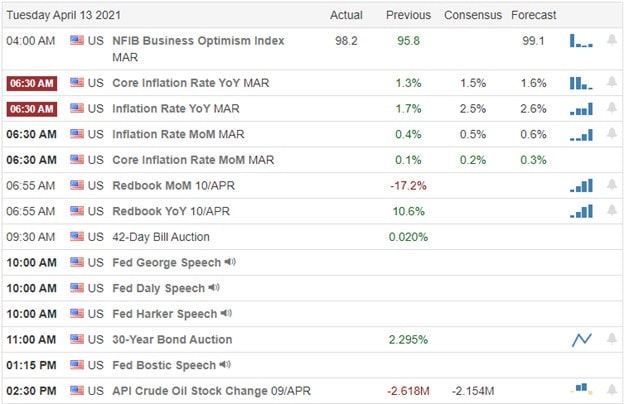

Economic Calendar

Earnings Calendar

On the Tuesday earnings calendar, we have just 14 companies stepping up to report quarterly results. Notable reports include FAST & KRUS.

News & Technicals’

Critical economic data on the inflation front is on tap before the market opens with the CPI. The consensus projects the number to come in at 0.5%; however, markets could inspire the bears if it tops expectations. Conversely, should the number come in lower than the consensus, look for bullish inspiration to occur. Directly related to our possible inflation issues is the massive stimulus spending that pushed the U.S. budget deficit to a new record of $1.7 trillion this year. The 10-year Treasury yield moves back up this morning, topping 1.69% as we wait on the CPI numbers. On the pandemic front, the U.S. hit a new daily vaccination record, but unfortunately, infection rates are rising, with the country reporting 70,000 cases per day.

Yesterday proved to be a choppy sideways day for the indexes, and as we wait for the 2nd quarter earning kickoff, it’s very likely we could see more of the same assuming the CPI comes in as expected. Index trends remain very bullish even though the SPY and QQQ charts appear pretty extended in the short term. Plan your risk carefully as we head into earnings season. With all the big investment institutions singing in a chorus that a market boom is ready to begin, one has to wonder if they have factored in the possible inflation impacts that may result. Hmm? Stay with the trend but guard against complacency if the market should stumble for this very elevated position.

Trade Wisley,

Doug

Comments are closed.