Powell calms the waters with more transitory inflation talk in Congress while at the same time the Social Security Office prepares for the highest cost of living adjustment in decades due to inflation. Hmm, you can’t make this stuff up, folks! Beginning today, up to 36 million families will begin receiving more stimulus checks from the IRS each month through the end of the year, and the FOMC will continue to print $120 billion per month to keep the party going. Markets will have a lot to digest this morning, with several economic reports as the number of earnings events ramp up.

Overnight Asian markets closed the day mixed with the NIKKEI down 1.15%, while the SHANGHAI rose 1.02% after China reports its economy grew in the second quarter. However, across the pond, European markets see red across the board this morning. Ahead of a big day of earnings and economic data, U.S. futures currently point to mixed open with the Dow looking lower and Tech Sector trying to hold on to some green. So buckle up; it could be a bumpy ride as we react to all the data from this extended market condition.

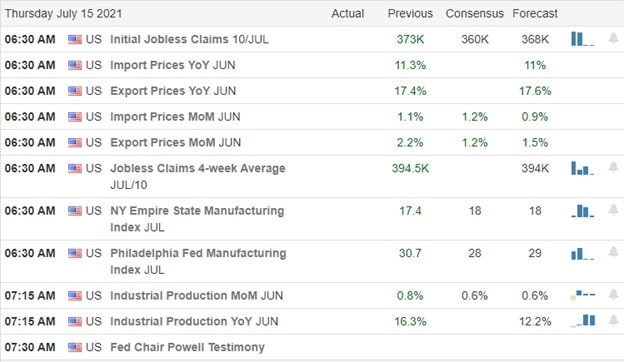

Economic Calendar

Earnings Calendar

On the Thursday earnings calendar, we have our biggest day of the week of reports with 35 companies listed. Notable reports include AA, AOUT, BK, CTAS, MS, PBCT, PGR, TSM, THC, USB, UNH, & WIT.

News & Technicals’

Seniors could receive the highest cost of living adjustment in decades. Based on estimates from the Consumer Price index data, the increase could be as high as 6.1%. Hmm, how can that be when Jerome Powell told us yesterday that inflation is transitory and that the Fed will continue printing $120 billion per month. About 36 million families will start receiving monthly IRS checks starting today through the end of 2021! The Biden Rescue Plan increases the payments up to $3600 per child. General Motors warns Bolt EV owners not to park the vehicle inside or to charge them unattended overnight due to a fire risk. Approximately 69,000 Bolt’s between 2017-2019 are involved in the recall. Treasury yields fell this morning after the Jerome Powell testimony in Congress yesterday. The 10-year fell to 1.317% this morning, with the 30-year sliding 1.94%

Markets bulls surged in early morning trading yesterday but could not hold onto the early gains pulling back by the close. As a result, the QQQ squeaked out a 0.16 cent gain while the DIA, SPY & QQQ ended the day with modest losses. However, the only index suffering technical damage was the IWM after failing its 50-day average, creating a lower high within a downtrend pattern. This morning we will get the latest reading on the Jobless Claims, Philly Fed MFG, Empire State MFG, Import/Export Prices, Industrial Production, and more Jerome Powell talk in Congress. If that’s not enough, we will also have a busy morning of potential market-moving earnings reports. So buckle up and expect anything to occur as the market sorts through the data in a very extended condition.

Trade Wisely,

Doug

Comments are closed.