Suffering another nasty whipsaw the indexes fell into correction territory with the worst week of selling since Oct. 2008. We could certainly use some good news to lift the market spirits but as of now there seems to be only bad news as the outbreak continues to spread. Moody’s now places the offs of a global recession at 40% due to the impact of the outbreak. As we head into another weekend of uncertainty all we do is hope for the best prepare for the worst. When this is over there will be some screaming deals on very good stocks, but for now the wise thing to do is protect your capital.

Asian markets close the week with heavy volume selling as a portion of Japan declared a state of emergency. European markets continue to selloff strongly this morning declining as much as 4%. After a wild night where the Dow Futures dropped another 500 they have recovered slightly but continue to point to a bearish open. Hold on tight and expect extreme volatility to continue as we approach the uncertainty of the weekend.

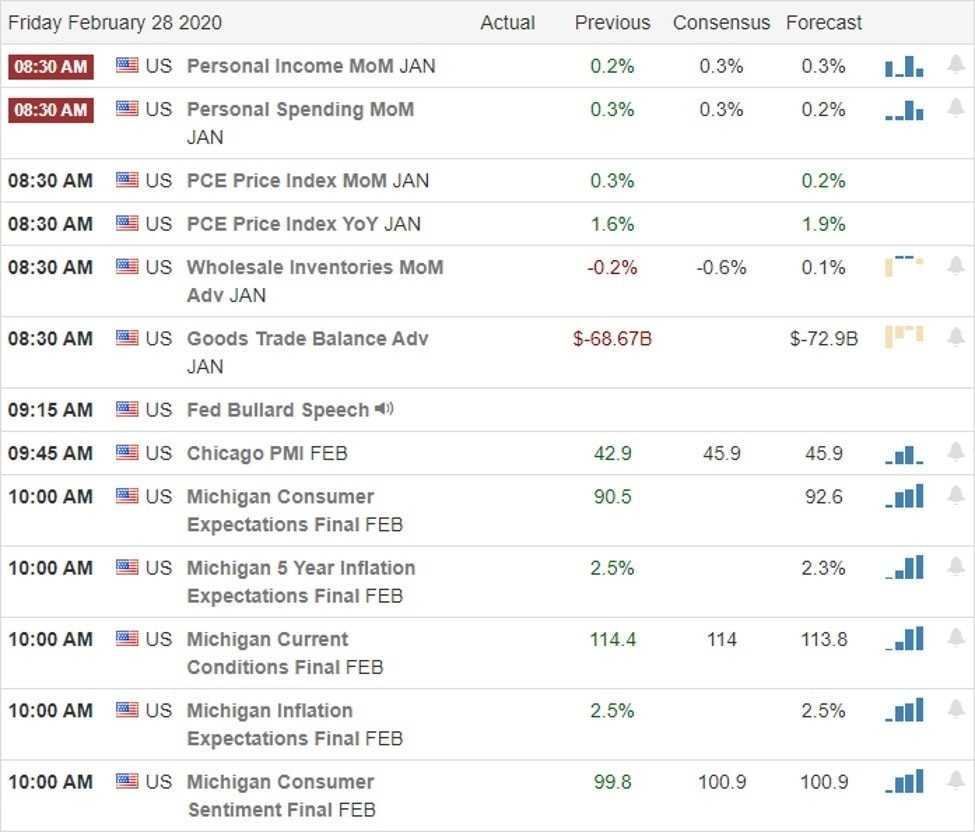

On the Calendar

On the Friday earnings calendar we get a little break with only 70 companies reporting. Among the notable are FL, SSP & W.

Action Plan

With another huge whipsaw we ended the day selling off more than 1100 Dow points. In just 6-trading days we have gone from new record highs into full correction with indexes down more than 10% in the worst week since October 2008. I would love to say the worst of the selloff is over but as we head into the uncertainty of the weekend we could easily see more selling. Global markets have now erased more than 5 trillion as the virus continues to spread. Schools in Iran have now been closed and Japan has closed schools for a month with one area of the country declaring a state of emergency. Moody’s has now raised the chance of a global recession to 40%.

When you take a look at the index charts it hard to find anything technically traders can base any logical decision as to what comes next. With panic in full bloom and extreme price volatility trading now is little more than wild speculation and gambling. During the night Dow futures dropped another 500 points but have since recovered some of those losses currently indicating a gap down. However, a retest of the overnight lows after the open is not out of the question. In fact, as we head into the weekend the worry we face is will the low overnight hold?

Trade Wisely,

Doug

Comments are closed.