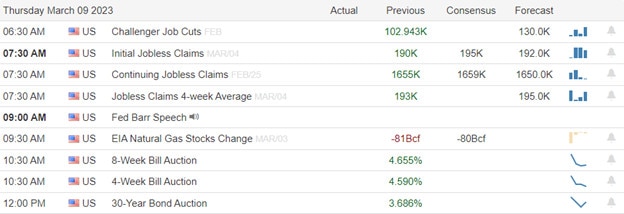

Disappointing economic data and continued hawkish comments from Powell kept the bears engaged Wednesday. Still, the bulls defended vital price support levels at the close, raising hope of a near-term relief rally while evidence of a pending recession grows. Today investors will deal with Jobless Claims and more Fed comments as we wait for the potentially market-moving Employment Situation report Friday before the bell. Big point moves and substantial intraday whipsaws remain likely, so plan your risk carefully.

While we slept, Asian markets traded mixed as China reported inflation growth of 1%, the slowest pace so far this year. This morning, European markets trade with modest declines across the board as investors grapple with higher interest rates and growing recession concerns. However, U.S. futures trade near the flat line this morning as we wait on Jobless claims while hoping for a relief rally inspired by the buying into the Wednesday close. Expect the challenging price action to continue as we wait for the Friday Employment Situation report.

Economic Calendar

Earnings Calendar

Notable earnings for Thursday include AOUT, BIRD, BJ, DOCU, LOCO, FCEL, GPS, GCO, JD, FIZZ, SWBI, TTC, MTN, WPM, ULTA & ZUMZ.

News & Technicals’

The Netherlands has become embroiled in political tensions between the United States and China, with the former looking to ensure that Beijing does not use the most advanced chip technology. As a result, Dutch Foreign Trade Minister Liesje Schreinemacher said, “the existing export control framework for specific equipment used for the manufacture of semiconductors needs to be expanded in the interests of national and international security.” China has been working to bolster its domestic semiconductor industry, but it remains far behind the likes of Taiwan, South Korea, and the U.S. New semiconductor export controls have been imposed by the U.S. on China, and the eurozone nations will soon follow suit.

President Joe Biden this week called for higher taxes on wealthy Americans to extend Medicare funding as part of his 2024 budget. The plan would increase the net investment income tax to 5%, from 3.8%, for earnings of more than $400,000, including regular income, capital gains, and so-called pass-through business income. However, the plan is unlikely to pass in the Republican-controlled House of Representatives.

Solanezumab’s failure is a blow to efforts to treat Alzheimer’s in people in the very early stage of the disease and has not yet shown clinical symptoms. In addition, Solanezumab did not clear or halt the accumulation of brain plaque and did not slow cognitive decline in the treatment participants. Lilly is developing two other Alzheimer’s treatments in late-stage clinical trials.

Inflationary economic data and the continued hawkish comments from the Fed kept the bears engaged on Wednesday though the VIX showed little fear and key price supports held in the major indexes. However, the U.S. dollar remained strong, and the bond inversion worsened during the day, suggesting a recession that will likely be made worse by the Fed having to raise rates to combat inflation. Evidence is mounting that it’s much less a question of whether the market will decline but more of when the decline gains strength. That said, the current short-term oversold condition may trigger a little relief rally but don’t ignore the overhead resistance as the likely area where the bear could gather for the next attack.

Trade Wisely,

Doug

Comments are closed.