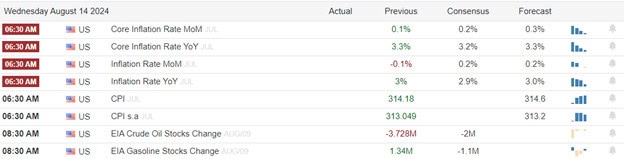

U.S. futures traded with a mix of anticipation and uncertainty, hovering around the flatline as investors awaited the release of the July Consumer Price Index (CPI) report. Scheduled for 8:30 a.m. ET, the CPI reading is expected by economists polled by Dow Jones to show a 0.2% increase from the previous month and a 3% year-over-year gain. This report follows a day after lighter-than-expected wholesale inflation figures provided a boost to stocks, adding to the market’s cautious optimism.

European stocks saw an uptick on Wednesday, driven by a mix of economic indicators and corporate performance. U.K. inflation rose to 2.2% in July, slightly below expectations but surpassing the Bank of England’s 2% target, signaling potential monetary policy adjustments. Swiss bank UBS experienced a notable increase of 2.95% after significantly exceeding net profit forecasts for the second quarter, boosting investor confidence. Sector-wise, auto stocks gained 1.2%, reflecting positive market sentiment, while mining stocks declined by 0.7%, indicating sector-specific challenges.

Asia-Pacific markets experienced a positive trend on Wednesday, buoyed by significant economic and political developments. The Reserve Bank of New Zealand’s decision to cut benchmark lending rates provided a boost to investor confidence, while Japan’s Prime Minister Fumio Kishida’s announcement of his impending resignation in September added a layer of political uncertainty. Despite these events, the Bank of Japan’s quarterly survey revealed a decline in business sentiment, with the sentiment index for manufacturers dropping to +10 in August and the non-manufacturers index falling to +24.

Economic Calendar

Earnings Calendar

Notable reports for Tuesday before the bell include ARCO, EAT, CAE, CAH, DOLE, GLBE, MRX, PFGC, RSKD, SFL, SDHC, UBS, & WKHS. After the bell include CSCO, DLO, LITE, PYCR, & STNE.

News & Technicals’

Japanese Prime Minister Fumio Kishida’s decision to not seek reelection as leader of the ruling Liberal Democratic Party paves the way for new leadership in Japan, the world’s fourth-largest economy. Kishida’s tenure has been marred by a scandal involving his party and persistent deflationary pressures on the economy. His resignation opens the door for a successor to address these challenges and steer Japan towards a more stable and prosperous future. This transition marks a significant moment in Japanese politics, with potential implications for both domestic and international economic policies.

Intel has divested its 1.18 million share stake in British chip company Arm Holdings, as revealed in a recent regulatory filing. This move comes amid Intel’s ongoing restructuring and cost-cutting initiatives, aimed at enhancing its competitive edge in the rapidly evolving semiconductor industry. The sale of its stake in Arm Holdings reflects Intel’s strategic efforts to streamline operations and reallocate resources as it navigates the challenges posed by fierce competition in the chip market.

General Motors is facing a lawsuit from the state of Texas, as announced by Attorney General Ken Paxton. The lawsuit stems from an investigation initiated in June, which is examining whether several automakers, including GM, collected and sold large amounts of data without drivers’ consent. The technology in question was reportedly installed in most GM vehicles starting with the 2015 model year. According to Paxton, insurers could potentially use this data to make decisions about raising premiums, canceling policies, or denying coverage. This legal action highlights significant concerns about data privacy and the ethical use of technology in the automotive industry.

In July, U.K. inflation rose to 2.2%, slightly below expectations but surpassing the Bank of England’s 2% target, according to data from the Office for National Statistics. The increase was primarily driven by housing and household services, with gas and electricity prices falling less than they did a year earlier. This uptick in inflation highlights ongoing cost pressures in essential services, reflecting broader economic challenges and potential implications for future monetary policy adjustments.

Up, down, sideways, and whipsaws are all possible today as the market reacts to the July Consumer Price Index report. Emotions are high and there is a lot at stake for the technical patterns in the index charts. Keep in mind Thursday is a huge day economic data as well so the wild price swings may not be finished just yet.

Trade Wisely,

Doug

Comments are closed.