With he seeing nothing but political turmoil and uncertainty ahead created the worst Christmas Eve rout in market history. As Congress returns and the border wall debate resumes traders will have to stay very nimble because the Washington news spin cycle could create some extreme market whips. A market condition for only the most experienced day traders. Swing and position traders have no edge as the extreme price action chops up accounts of those unwilling to stand aside.

Technically speaking the market the market is in a short-term oversold condition that would normally indicate a relief rally is close at hand. However, with the current political turbulence sellers could easily remain in control much longer than we can stay liquid waiting and hoping for a bounce. One news report or Tweet is all it would take reversing the market direction in about half a heartbeat. Protect your capital and remain disciplined as uncertainty continues to whip.

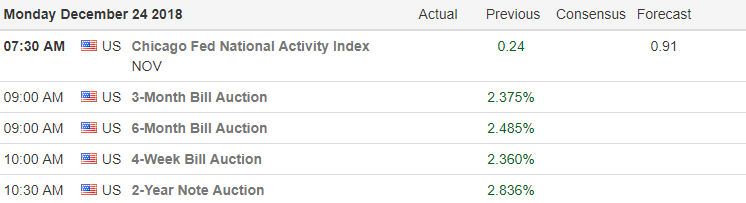

On the Calendar

Today we have 16 companies reporting earnings with LIVE being the most notable of the day. Make sure to continue checking reporting dates against current holdings.

Action Plan

If you ever needed an example of just how much the market hates uncertainty you only need to see the 653 point selloff on Monday; the worst Christmas Eve performance in market history. Although there has been no change in the uncertainty the US Futures are pointing to a bullish open this morning. Of course, that’s assuming they can maintain those positive feeling throughout the morning. Given the volatility of late, we have to assume anything is possible at the open.

The President seems to have dug in his heels regarding the border wall and so has the Senate which refuses to consider the House bill that includes funding. As Congress returns from Christmas break and the battle resumes the market will be sensitive to any news reports on the subject. Expect violent swings as the market reacts to the Washington spin cycle. Considering the market has been straight down for the last eight days of trading we should typically be on the watch for a relief rally. Unfortunately, until the market sees some resolution to the political uncertainty sellers could easily remain in control.

Trade Wisley,

Doug

Comments are closed.