Rounded Bottom Breakout | Member E-Learning

Replay of the Rounded Bottom Breakout pattern and how approach it an trade it.

Replay of the Rounded Bottom Breakout pattern and how approach it an trade it.

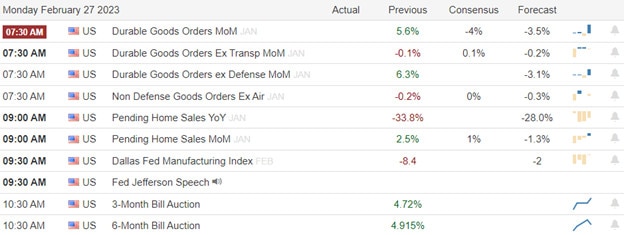

Although it was good to see the bulls defend critical moving average supports in the SPY, QQQ, and IWM, the lower highs followed by, the lower lows add some uncertainty with the mixed technical and price patterns. On the earnings calendar, we have a retail theme this week that may have been complicated by the weakening looked forward provided by HD and WMT last week. The first thing today is a potential market moving Durable Goods, with consensus estimates suggesting a substantial decline. Plan for the whipsaws and overnight reversal continues as the bulls fight to defend supports and bears line up to defend resistance levels.

Asian markets moved modestly lower during the night as they grappled with higher rates and slowing consumer activity. However, European markets want to shake off last weeks selling with a decidedly bullish bounce this morning. U.S. futures also want to bounce this morning, pushing upward in the morning pump but with the Durable Goods report pending, anything is possible by the open. Watch for whipsaws this morning.

The earnings calendar this week has a heavy retail theme. Notable reports for Monday include AAON, ACAD, AES, DAR, FSR, FRPT, GRPN, JRVR, TREE, LI, RIDE, OSH, OXY, PNW, RRC, TTEC, UHS, WDAY, & ZM.

The two top retailers issued cautious U.S. consumer outlooks for 2023 last week. Walmart said consumer spending would start the year strong but fade. Home Depot expects revenue to be flat this year but bolstered by home equity. The retail sector had its worst week since July 2022, yet the latest inflation and retail sales data show consumer spending to be stronger than economists forecast.

Several big economies are gearing up for the mass rollout of electric vehicles. As the number of EVs on the road increases, a workforce with the knowledge to fix and properly maintain them will be needed. There are concerns, however, that a skills gap may emerge in the near future, creating a big headache for both the automotive sector and drivers.

In a joint statement Sunday, Sunak and von der Leyen said they had “agreed to continue their work in person towards shared, practical solutions for the range of complex challenges around the Protocol on Ireland and Northern Ireland.” The U.K. may have left the EU on Jan 31, 2020, but the Northern Ireland Protocol has caused persistent disagreement ever since.

Mixed technical and price patterns could make for some uncertainty as the indexes try to bounce back from last weeks selling. Though the SPY and QQQ held above critical technical supports, they also confirmed downtrends inking lower highs and lower lows in price action. We will start the week with possible market-moving Durable Goods, then begin a big week of retail earnings data. Will they also foresee the same weakening in the consumer and a slowing economy in the last half of this year, like HD and WMT? If so, it would be wise to watch downtrends, and overhead resistance levels as the bulls work to defend the bears and may entrench themselves to fight for the downtrend. So stay sharp and expect the big price swings of late to continue.

Trade Wisely,

Doug

In this Members E-learning I go over my rules for choosing the right option based on my rules. We get into Delta, Gamma, Theta, Open Interest, Bid/Ask Spreads and Implied Volatility. I hope you find it helpful to your trading decisions.

The reading of chart price action is one of the most important skills in the business of trading. So often we get lost in the indicators, scans and wild gyrations created by news volatility. However, slowing down, putting a little more effort into price action and anyone can Improve their chart reading skills.

We dive into Moving Average Patterns and find with little extra study they can very handy increasing your trading success.

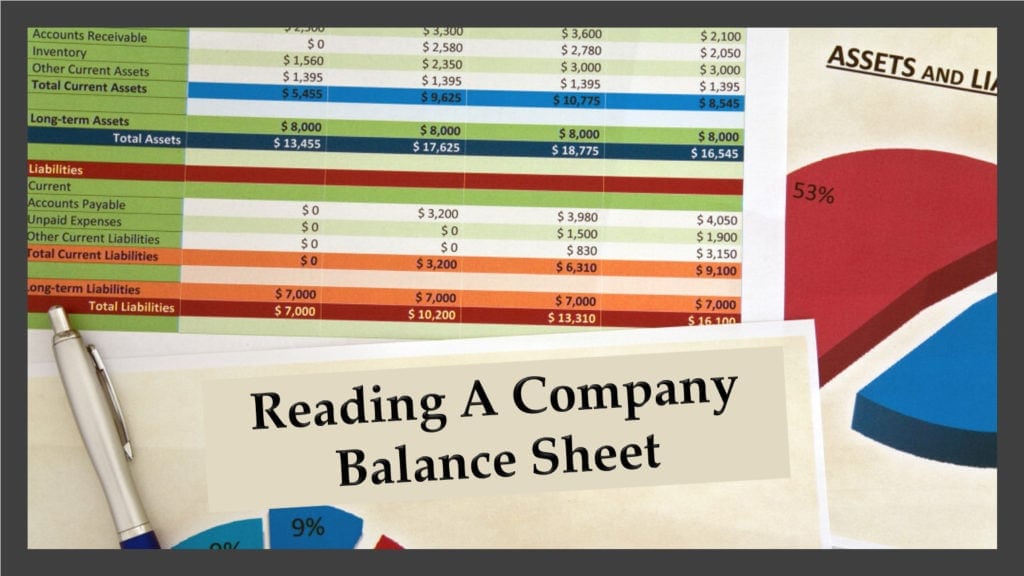

We dedicate the entire E-learning session to reading a company balance sheet and fundamental analysis. We dig into the details and point out red flags for those wanting longer term positions.

In this E-Learning calls I talk about methods I use to hedge individual positions. I cover not only how I use options to reduce risk but also enhance profits of individual trades.

Tuesday 2-2-21 e-Learning

In this E-Learning session I discuss my method for hedging my entire portfolio using options. Markets don’t always go up and this method has saved my bacon many times turning an ugly correction into a profitable possibility.

Tuesday 2-9-21 e-Learning

Members E-Learning and I think the title says it all.

Member E-Learning discussing the traders win/loss ratio and that quality trades is more important than a quantity of trades.