A big weekend of buyout news combined Friday afternoon bounce that left the DIA and SPY hovering above there 50-day averages has the overnight futures pointing toward a substantial gap up this morning. However, keep a close on the overhead resistance above as new cases of COVID-19 begin to rise, and the presidential election that adds significant uncertainty to the path forward.

Asian markets rallied overnight as Japan’s Softbank lept by 9% after the announcement that Nvidia will buy Arm Holdings from them in a 40 Billion dollar deal. However, European indexes are flat and mostly lower this morning, giving up early gains as Brexit challenges persist. US Futures suggest a gap up of 250 points in the DOW ahead of a light day of earnings and economic reports. Traders should expect challenging price volatility to continue.

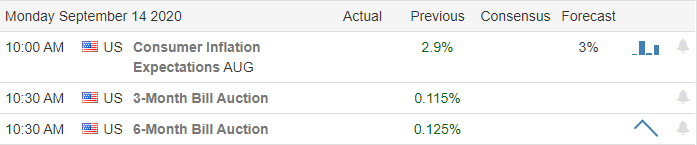

Economic Calendar

Earnings Calendar

On the Monday earnings calendar, we have a light day with just 14 companies stepping up to report. Looking through the list, there is only one, LEN, that stands out as a notable report.

News & Technical’s

As more than 100 wildfires continue to burn, across California, Oregon, and Washington, the search for missing people has begun. Millions of acres have burned with some entire communities decimated as high winds continue to challenge firefighter efforts. With college in full swing around the country, cases of COVID-19 are starting to tick higher once again. The Whitehouse medical advisor warned this weekend to brace for a problematic fall with the likely spread of the virus picking up pace. As of now, nearly 200,000 Americans have fallen victim to the pandemic. Nvidia is spending 40 billion to buy Arm Holdings from SoftBank in a busy weekend news cycle of buyouts. Innunmedics shares doubled after news that Gilead agreed to by the cancer drug maker in a 21 million dollar deal. In the battle for TikTok, it looks like Oracle may have emerged the winner to partner with the popular social media app only days before the ban deadline. According to reports, Chinese owners reject Microsoft’s offer in favor of Oracle this weekend.

The DIA & SPY continue to hover above their 50-day moving averages bouncing Friday afternoon. The QQQ also bounced but lacked the energy to recover its 50-day average by the close. All the buyout news seems to have inspired the bulls this morning, with Futures pointing to a gap up open in the DOW of nearly 250 points. The bullish price action could trigger a bit of a short squeeze this morning but let’s not forget the resistance above the selloff as created. The historically low rates favor the bulls, but the uncertainty of rising COVID-19 cases and the upcoming presidential election could also inspire considerable price volatility.

Trade Wisely,

Doug

Comments are closed.