It could be a painful day for all the buy-the-dip traders that rushed into positions as we headed for a 3-day weekend. Surging bond yields and spiking oil prices suggest a substantial reversal at the open just as the 1st quarter earnings season ramps up. All this uncertainty will likely create extreme levels of price volatility. Very high stock valuations, a hawkish Fed with economic data hinting at a slowing economy during earnings season could be the perfect storm of uncertainty. Get ready for substantial gaps, whipsaws, and overnight reversals to challenge even the most experienced traders.

Asian markets closed mostly lower overnight, losing momentum amid rising bond yields and geopolitical tensions spiking energy prices. This morning, European markets see red across the board as a hawkish Fed appears ready to fight inflation. Moreover, with 1st quarter earnings season ramping up, U.S. futures point to nasty gap down open, reversing Friday’s dip-buying rally and potentially creating significant technical damage in the index charts. So, buckle up; the path ahead appears volatile and uncertain.

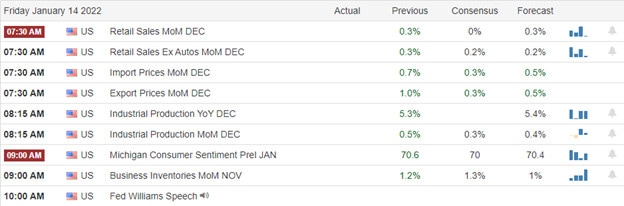

Economic Calendar

Earnings Calendar

Nearly 30 companies listed as earnings season ramps up on the Tuesday earnings calendar. Notable reports include BAC, BK, SCHW, CNXC, HWC, IBKR, JBHT, MBWM, ONB, PNFP, PNC, PRGS, SBNY, TFC & UCBI.

News & Technicals’

The United Arab Emirates has vowed to retaliate against Houthi militants for a deadly attack on its capital Abu Dhabi on Monday that killed three people. International benchmark Brent crude was trading at $87.75 on Tuesday at 11 a.m. in Abu Dhabi, its highest level since 2014. The UAE is the world’s seventh-biggest oil producer, pumping over 4 million barrels per day. In addition, major U.S. airline CEOs warned of an impending “catastrophic” aviation crisis on Wednesday when AT&T and Verizon were set to deploy the new 5G service. The airlines said the new service could potentially make a significant number of widebody aircraft unusable and “could potentially strand tens of thousands of Americans overseas.” The FAA has warned that potential interference could affect sensitive airplane instruments such as altimeters and impact low-visibility operations. The U.S. has reported nearly 800,000 cases per day on average over the past week, according to data compiled by Johns Hopkins University. That’s more than three times the level seen during last winter’s previous record. But there are signs of a possible turning point in the surge in places hit early by omicron. Treasury yields jumped to a two-year high in early Tuesday trading, with the 10-year rising to 1.8305% and the 30-year climbing to 2.1492%.

On Friday, the gap down selling was met with a surge of buy-the-dip traders choosing once again to economic data. But, unfortunately, they will suffer some punishment this morning as treasury yields surge and oil prices spike to a seven-year high on UAW tensions. As a result, though the DIA recovered its 50-day average pressure this morning will likely see it open below, joining SPY, QQQ, and IWM already below that critical psychological support. With 1st quarter earnings ramping up, expect the challenging price action to continue. Company valuations are very high, so they will have to perform at near perfection to support current prices. That may be a challenge with rising inflation combined with a tightening Fed. The current market condition is not a time for wild speculation. Instead, exercise caution, perhaps trading a mix of well-planned long and short positions to manage the high volatility risk. The other option may be to stand aside protecting your capital until a more transparent market direction develops instead of all the whipsaws.

Trade Wisely,

Doug

Comments are closed.