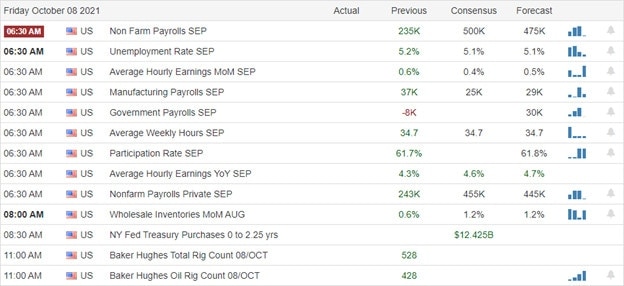

The bulls recovered a lot of ground in yesterday’s short squeeze but fell short of breaking downtrends or breaching price resistance levels. With bonds on the rise this morning, there is a lot at stake as we wait on the Employment Situation report. Consensus is looking for a growth of 500,000 nonfarm payrolls. There is a fine line here; an overly robust report could set the stage for a Fed taper, or a miss on the expectation could both bring back the bears. What do we love the most; jobs or newly printed money? That could be the question of the day?

The Chinese market reopened after a 4-day holiday with a modest rally as the Nikkei surged 1.34%. European market trade cautiously lowers this morning as they wait on the U.S. Jobs data. However, U.S. is trying to put on a brave face ahead of the data pointing to modest gains ahead of the release. So will Friday be a winner or loser? Your guess is as good as mine. So let’s hurry up and wait.

Economic Calendar

Earnings Calendar

We have no notable reports on the Friday earnings calendar as we make our way toward the 4th quarter reports that begin next week.

News & Technicals’

Ireland, which held out against the global minimum tax, gave in yesterday, raising its corporate tax rate from 12.5% to 15%. The new rate will affect 1556 companies in Ireland employing 500k people, including AAPL, GOOG, AMZN, and FB. In addition, the Senate Democrats passed the short-term debt ceiling increase to allow a 450 billion limit that should get the government to December 3rd. The bill will not move to the U.S. for a vote. Tesla officially moved its headquarters from Palo Alto, California, to Austin, Texas CEO Elon Musk announced at its 2021 annual shareholder meeting. In April 2020, on a Tesla earnings call, Musk lashed out at California government officials calling their temporary Covid-related health orders “fascist” in an expletive-laced rant. Fed Governor Lael Brainard should figure prominently as President Joe Biden weighs who will chair the central bank and specifically supervise banks. Even without getting the chair’s position, Brainard can be a major influence on banks. If she is not nominated as chair, she’s a good bet to be named the vice chair for supervision. There are likely three areas where her influence would be most felt: Climate change, central bank digital currency, and getting banks to raise capital during prosperous times. Treasury yields traded higher on Friday morning, with the 10-year hitting 1.601% before setting back down to 1.598%. The 30-year climbed to 2.157%.

The bulls recovered a lot of ground yesterday on the technical front, squeezing out short traders as the Dow tested its 50-day average as resistance. The Spy came close to a 50-day average test but ran into some price resistance, as did the QQQ, before pulling back, leaving behind some shooting star candle patterns. The overall downtrends remain intact as we turn out attention to the Employment Situation number. Consensus is looking for 500,000 nonfarm payroll increases and expects unemployment to fall from 5.2% to 5.1%. With futures relatively flat ahead of the report, a hopefulness job grew but an evident uncertainty as we wait. A strong number could set the stage for a Fed taper to begin, bringing out the bears. So buckle up it could prove to be wild price action morning.

Trade Wisely,

Doug

Comments are closed.