With the bulls inspired by Hong Kong election results, renewed trade hopes, and a huge day merger news made setting new record highs in the DIA, SPY,and QQQ look easy as they quickly recovered last week’s pullback. Today, the attention will likely shift to earnings and economic reports to find inspiration. After such a big move yesterday and heading toward a major holiday. It will be interesting to see if bulls can find the energy to continue their relentless march higher.

Asian markets closed mixed but modestly higher with Alibaba making a huge splash in Hong Kong markets. European markets are treading cautiously with mixed results as they continue to monitor US/China trade news. US Futures are rather subdued this morning ahead of earnings reports and several potential market-moving economic reports. With markets at new record highs consider your risk carefully as the holiday shutdown approaches.

On the Calendar

On the Tuesday Earnings Calendar nearly 50 companies reporting results. Notable reports include BBY, ADSK, BNS, BOX, CHS, CBRL, DELL, DKS, DLTR, EV, GES, HRL, HPQ, MOV, VEEV, and VMW.

Action Plan

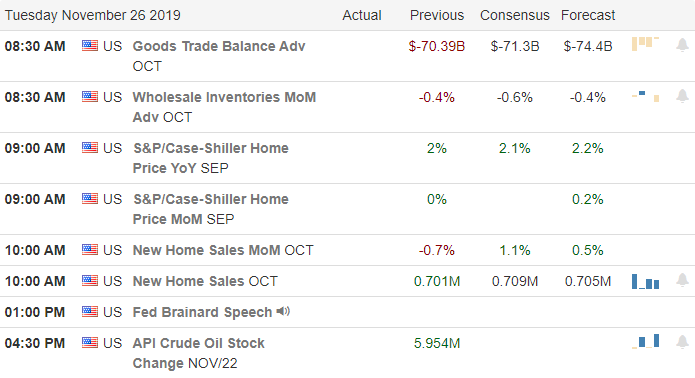

Monday became on the biggest merger days in history, providing additional energy to an already bullish sentiment setting new records in the DIA, SPY, and QQQ in the process. T2122 suggests this bull run still has some upside potential but could soon reach a short-term overbought condition if the bulls continue to find inspiration to rally. Earnings reports could provide that inspiration, or perhaps it will be the New Home Sales and Consumer Confidence reports at 10:00 AM Eastern. One thing for sure is that the bulls remain firmly in control of a trend that shows no price action clues of ending at this point.

Futures markets seem much more subdued this morning, perhaps needed a little rest after such a big effort yesterday. It is also possible with the Holiday looming and the nasty weather conditions moving across the country that traders will try and escape early. Don’t be too surprised if volumes begin to decline quickly with price action becoming very light and choppy after the morning rush Wednesday. As we push new market highs, plan your risk carefully heading into the holiday.

Trade Wisely,

Doug

Comments are closed.