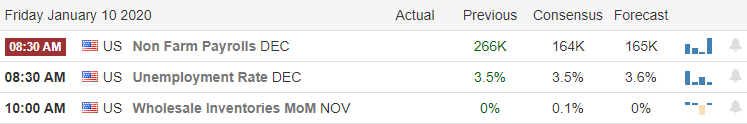

The bulls are running with wild abandon breaking records in what seems an insatiable desire to buy up stocks. Closing at a new record high and only a few points away for 29,000, the only stumbling block ahead is the Employment Situation number that consensus estimates suggest a possible decline. Next week begins the 1st quarter earnings season and the current rally seems to suggest tremendous confidence in strong earnings outcome. Companies will need to produce some impressive results to support current prices. Consider your rick carefully as we head into the weekend.

Overnight Asian markets closed the week mixed but mostly higher. This morning European markets are mostly bullish across the board as they continue to monitor US-Iran tensions. US Futures have been bullish throughout the night and suggest a modest gap up open ahead of the Employment Situation number. With the weekend quickly approaching and the beginning of earnings season just around the corner, it may be a really good time to take some profits and reduce some risk.

On the Calendar

On the Friday earnings calendar, we have just six companies fessing up to quarterly results. However, the only notable report today comes from INFY before the bell.

Action Plan

Another big day a rally yesterday as the bulls seems to have an insatiable desire to buy up stocks. The market gapped up to new record highs and continued to find more buyers throughout the day. Futures this morning continue to reach out for new highs ahead of the Employment Situation number at 8:30 AM eastern. Such an exuberant rally ahead of earnings suggests the market believes we will see substantial earnings growth this quarter. Analysts, however, are suggesting negative growth is possible, which could create an interesting situation when earnings season kicks off next week.

According to analysts, the price to earnings ratio is near a 20 year high. That could put a lot of pressure on companies to perform nearly perfectly or suffer the result of disappointing investors. It’s looking more and more likely that Iran shot down the 737 with a Russian made missile. Iran has threatened additional retaliation. Amidst this uncertainty, the House passed a resolution attempting to limit the Presidents’ power to take action with Iran. With the Dow, just a few points from reaching 29,000 for the first time ever, I’m guessing the institutions will do as much as possible to get that headline. The only possible stumbling block to that goal is the Employment number that consensus suggests may decline today.

Trade Wisely,

Doug

Comments are closed.