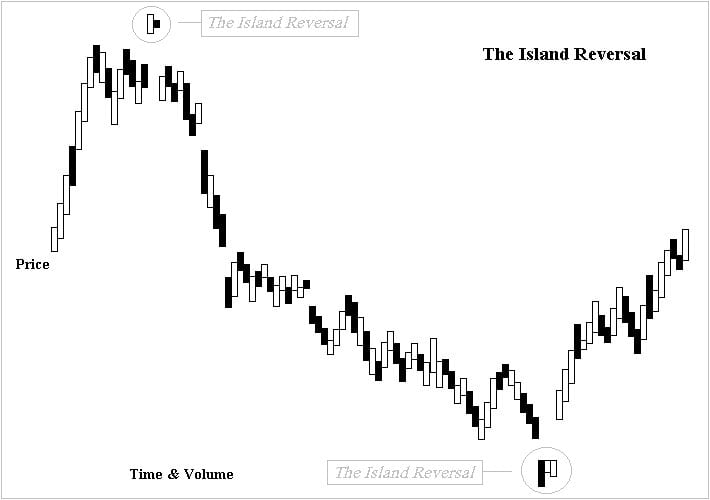

When a candlestick drifts away from an established downtrend, gaps down, and then gaps back up into an uptrend, it becomes an island—a Bullish Island Reversal, to be exact. The further the candlestick drifts, the stronger the pattern’s implications. Although these islands aren’t very common, they are interesting and important nevertheless. In fact, the insight they provide could be pivotal as you decide your next trading move. To help you get started on your quest to find an Island Reversal, today we’re discussing the formation and meaning of the bullish variety.

Bullish Island Reversal

Formation

The Bullish Island Reversal is known as an island because it is on its own, some distance away from the rest of the price action. The dramatic gaps that precede and follow the candlestick’s formation point toward a strong reversal. However, before you get carried away on this island, be sure that you’ve actually spotted a Bullish Island Reversal by identifying the following criteria:

First, a clear downtrend must be in progress. Second, the price must gap down, creating an unfilled space in which no trading takes place. So the candle’s high will be below the low of the previous day. Third, that same candle must then gap back up, creating another unfilled space, which should overlap with the first gap. So its high must also be below the next day’s open. Finally, to confirm the pattern, look for the start of an uptrend after the gap up.

If you spot the opposite of a Bullish Island Reversal (an uptrend followed by a gap up, a candle, a gap down, and then a downtrend), you have likely found a Bearish Island Reversal.

Finally, like a Bearish Island Reversal, a Bullish Island Reversal can be composed of more than one candlestick. If several candles form between the gap down and gap up, you can call the signal an Island Cluster.

Meaning

A Bullish Island Reversal strikes during a downtrend. The bears have been in control, pushing the price lower and lower. In fact, they cause a downward gap. The price remains low for a day or more, but then a momentous shift takes place. The bulls take the reins and push the price dramatically higher, creating a gap up. This sudden shift in investor sentiment may reflect a recent news story that was released before the market opened or after it closed.

If you’re not sure whether you can rely on a Bullish Island Reversal, look at the strength of the initial downtrend. The stronger that downtrend is, the stronger the signal. The pattern is also more trustworthy if the two gaps are very large.

_____

Although it’s tough to spot Bullish Island Reversal patterns due to their rarity, if you do come across one, don’t ignore it. Confirm it, assess its strength, and respond accordingly. Good luck!

If you’re interested in mastering some simple but effective swing trading strategies, check out Hit & Run Candlesticks. Our methods are simple, yet powerful. We look for stocks positioned to make an unusually large percentage move, using high percentage profit patterns as well as powerful Japanese Candlesticks. Our services include coaching with experienced swing traders, training clinics, and daily trading ideas. To sign up for a membership, please click here.

Comments are closed.