On Monday, stock futures saw a slight rise to potentially breaking a seven-day losing streak, for the Dow Jones Industrial Average. Following a broad rally after President-elect Donald Trump’s November victory, the market has recently shifted to a narrower, tech-led movement. Joe Mazzola, head of trading and derivatives at Charles Schwab, noted that the market’s breadth is diminishing, with the rally becoming more concentrated in a few names. He expressed uncertainty about the sustainability of this trend but suggested it might continue through the end of the year. Investors are also looking ahead to the Federal Open Market Committee’s meeting on Tuesday and Wednesday, where officials are expected to lower the benchmark interest rate again.

European markets saw a decline as traders prepared for the final week of central bank actions for the year and the listing of three French media companies in Europe. France’s CAC 40 index fell by 0.58%, influenced by Moody’s unexpected decision to downgrade the country’s credit rating from Aa2 to Aa3, citing concerns over weakened public finances due to ongoing political instability. Investors were also focused on Berlin, where a vote of confidence in Chancellor Olaf Scholz was scheduled, potentially paving the way for snap elections in February.

Asia-Pacific markets experienced a downturn, reversing earlier gains as investors anticipated key decisions from major central banks, including the Bank of Japan and the People’s Bank of China. Despite a 3% year-over-year increase in China’s retail sales, the figure fell short of the 5% growth forecasted by economists. This underperformance contributed to declines across various indices: mainland China’s CSI 300 dropped by 0.54%, Hong Kong’s Hang Seng index fell by 1%, South Korea’s Kospi decreased by 0.22%, Japan’s Nikkei 225 saw a marginal decline, the Topix index experienced a larger loss of 0.3%, and Australia’s S&P/ASX 200 fell by 0.56%.

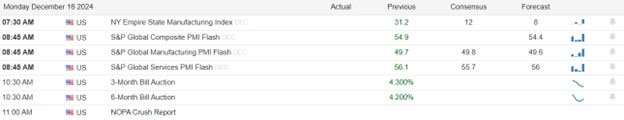

Economic Calendar

Earnings Calendar

Notable reports for Monday before the bell no notable reports. After the bell reports include CMP, & MITK.

News & Technicals’

Monday, U.S. Treasury yields remained relatively stable as investors anticipated the Federal Reserve’s final meeting of the year. The 10-year Treasury yield decreased slightly by over 1 basis point to 4.381%, after surpassing 4.4% on Friday. Similarly, the 2-year Treasury yield dipped by less than 1 basis point to 4.234%. Investors were largely expecting a 25-basis-point interest rate cut from the FOMC on Wednesday, with a 97% probability according to the CME FedWatch tool. Market participants are keenly awaiting the Fed’s updated policy statement and Fed Chair Jerome Powell’s press conference for insights into future interest rate decisions. During this blackout period, Fed officials are restricted from making public comments ahead of the meeting.

Softbank CEO Masayoshi Son is set to announce a $100 billion investment in the U.S. over the next four years during a visit to President-elect Donald Trump’s Mar-a-Lago residence in Palm Beach, Florida. This substantial investment could be sourced from various Softbank-controlled entities, including the Vision Fund, capital projects, and Arm Holdings, where Softbank holds a majority stake. Not all of the funds will be newly raised; some will include previously announced investments, such as Softbank’s recent $1.5 billion investment in OpenAI, the company behind ChatGPT. This move underscores Softbank’s commitment to expanding its footprint in the U.S. tech sector.

The Bank of Japan (BOJ) is expected to maintain its benchmark interest rate at 0.25% during its upcoming two-day meeting this week, as it seeks more clarity on domestic wage and spending trends. According to a survey conducted between December 9-13, a slim majority of 13 out of 24 economists (54%) predict that the BOJ will keep rates unchanged, while the same number anticipate a rate hike in January. The BOJ, which last raised rates in July, has indicated its willingness to tighten monetary policy further if wage growth and prices meet its projections. BOJ Governor Kazuo Ueda recently suggested that another rate hike is approaching, contingent on economic data aligning with expectations, but he also highlighted potential risks, such as wage trends next year and changes in U.S. economic policy.

Russia’s central bank is anticipated to implement a significant rate hike later this week as inflation continues to escalate in its war-impacted economy. Despite multiple rate increases aimed at curbing inflation, the consumer price index rose to 8.9% in November, up from 8.5% in October, primarily due to rising food prices. The inflationary pressure has been exacerbated by a weaker ruble, following new U.S. sanctions in November, which has increased the cost of imports. As a result, economists expect the Central Bank of Russia (CBR) to raise interest rates by 200 basis points at its meeting on December 20, bringing the key interest rate to 23%. This move reflects the ongoing economic challenges Russia faces since its invasion of Ukraine in 2022.

Although the Dow is breaking a seven-day losing streak the tech sector stocks continue to reign supreme. However, there is concern about how much longer that can continue unless market breath picks up. This week investors will be focused on the FOMC decision on Wednesday, GDP on Thursday and the Core PCE numbers coming on Friday. Also keep in mind that the current CR will run out on Friday at midnight and the government could shut down unless Congress acts.

Trade Wisely,

Doug

Comments are closed.