Though beginning with a volatile pop and drop, the bulls finally mustered the energy to breach the wide-range consolidation, briefly touching a new record high. Unfortunately, the pop and drop won the day in the SPY, QQQ, and IWM closing below the previous day. Today, we have nearly 375 earnings reports and a jobless number, so expect the challenging price action to continue. Futures are pumping up the premarket, so keep an eye out for yet another pop and drop open.

Asian markets traded mixed but mostly higher, led by the NIKKEI surging 1.80% even as the SHANGHAI closed marginally lower. European markets chop around the flatline as they wait on the Bank of England policy decision. U.S futures are pushing for a bullish open with a big day of earnings data and the latest reading on jobless claims. Buckle up and remember to plan for the employment situation number before the bell Friday morning.

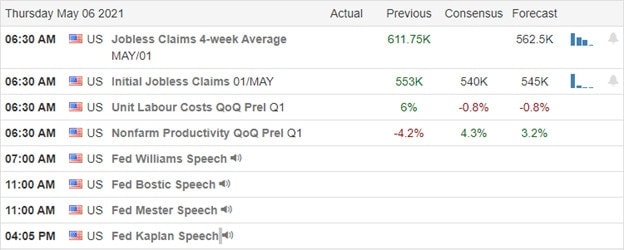

Economic Calendar

Earnings Calendar

Today we have the largest number of earnings reports so far this quarter, with nearly 375 fessing up to quarterly results. Notable reports include AMC, AL, ALL, ABEV, AIG, ANGI, BUD, APLE, MT, BLL, BDX, BYND, APRN, BIP, CAH, CARS, CVNA, CNP, NET, ED, DDOG, XRAY, DBX, LOCO, ET, EXPE, FVRR, FLIR, GPRO, GPRN, HL, IAC, IRM, K, LYV, MGA, MAIN, MCK, MCHP, MRNA, MNST, MUR, NCLH, NRG, OTE, PZZA, PK, PTON, PENN, PLNT, POST, PLL, RMAX, REGN, ROKU, SBH, SEAS, SHAK, SFM, SQ, STMP, STOR, SPWR, TPR, TDC, THS, TRIP, UMH, OLED, VER, VIAC, W, WPM, YELP, & ZTS.

News and Technicals’

We finally had a slight breach of the wide-range consolidation that began nearly three weeks ago as the Dow managed to reach out to a new record high yesterday briefly. India’s health ministry showed more than 412,000 new infections over 24 hours, pushing 21 million. Worries are growing that the prolonged outbreak could lead to new variants that would threaten the global progress of the pandemic. On a bright note, in the suffering tech sector, the 10-year treasuries note slipped lower this morning to 1.58% though the 30-year crept higher to 2.262% ahead of the weekly Jobless Claims. The forecast is that 527,000 new unemployment claims were filed last week.

As the DIA breaks the consolidation log jam, the tech-laden SPY popped and dropped yesterday, still challenged by the price resistance above. The QQQ also tried to move higher yesterday morning, but sellers eventually won the day, closing the day below the previous day’s close. IWM also slid slightly lower even as the oil and financial sectors pushed higher. With a considerable number of earnings reports and Jobless Claims before the open, the futures are again trying to pump the buying enthusiasm currently pointing to a bullish open. At the risk of sounding like a broken record, watch out for the possible pop and drop at the open. Keep in mind as you plan your risk forward, we will get the employment situation number before the open Friday. An open gap is possible, so plan accordingly.

Trade Wisely,

Doug

Comments are closed.