Election Day Holds Center Stage

Stocks gapped modestly higher (by 0.30% to 0.40% across the 3 major indices) at the open Monday. Then from 9:30 am to 2 pm, the SPY and QQQ indices rode a roller coaster back and forth the across that gap. Over that same span, the DIA rode its own roller-coaster with a modest bullish trend. However, at 2 pm, all 3 indices started a bit stronger bullish trend. These afternoon rallies have lasted to the highs of the day at 3:30 pm and closed near the highs. This action gave us a white-bodied hammer or hanging man candles in the SPY and QQQ, while the DIA prints a large-bodied white candle with a smaller lower wick. The SPY and DIA are back above their T-line (8ema), but none are above the longer-term downtrend. It’s also worth noting the DIA has greater than average volume and both the other major indices were below average.

On the day, nine of the ten sectors are in the green with only the Utilities (-1.64%) in the red while the Energy (+1.13%) and Technology (+1.20%) sectors led the market higher. Meanwhile, SPY gained 0.96%, DIA gained 1.32%, and QQQ gained 1.10%. The VXX is down 1.1% to 17.16 and T2122 has edged up into the overbought territory at 82.87. 10-year bond yields were very volatile again and spiked to 4.216% and Oil (WTI) was down 0.82% to $91.85/barrel. So, overall, it was an indecisive morning in the market, followed by a bullish afternoon, with the mega-cap DIA leading the way all day long.

In stock news, OUST and VLDR announced they have reached a deal to merge. The deal is expected to close in the first half of 2023. Elsewhere, VillageMD (which is backed by WBA) announced it is buying Summit Health for $9 billion to expand its footprint in the healthcare business (to compete with AMZN which acquired ONEM in July, and CVS which is planning to buy Signify Health). WBA will invest $3.5 billion to support the acquisition. In other WBA news, the company cut its stake in ABC by $1.6 billion (10 million shares). WBA owned almost 53 million shares of ABC as of August 2. In legal news, it was announced Monday afternoon that the CFO of TSN (also the son of the CEO and great-grandson of the founder) was arrested Sunday for trespassing and public intoxication. In Texas, LCID filed suit against the state for blocking it from selling direct to customers in the state (as opposed to having dealerships). Meanwhile, HD workers in Philadelphia voted against forming a union the NRLB reported. It was reported by Bloomberg that D is considering selling its multi-billion dollar, 50% stake in the Cove Point LNG facility located in MD. The facility is run by BRKB (which has 25% ownership) and partly owned by BAM (25% stake). Finally, RIDE announced it is getting another $170 million in funding from Taiwan contract manufacturer Foxconn (which most notably makes iPhones for AAPL). Foxconn already owns a stake in RIDE and last summer bought the namesake RIDE plant in Lordstown Ohio.

SNAP Case Study | Actual Trade

In miscellaneous news, the US Supreme Court conservative majority appeared to be inclined to challenge the regulatory power of the FTC and SEC on Monday (based on their questioning and statements during two hours of oral arguments in cases involving both agencies). If they rule as the questioning made it appear, it will be easier for companies to appeal regulatory rulings of the Federal government. Elsewhere, the UK is set to announce a major new deal with the US (after the COP27 Climate Summit) for the US to supply Britain with LNG. Finally, Bloomberg reported after hours that US Consumer borrowing rose less than expected in September. Total credit increased by $25 billion compared to August, but the average forecast was for a $30 billion increase. This $25 included the smallest credit card borrowing increase in four months ($8.3 billion). This falls in line with V and MA both saying that consumer spending had recently slowed.

After the close, IFF, ATVI, SANM, PTVE, WELL, CBT, LYFT, DOOR, FN, QGEN, PRIM, ACCO, PAM, CLOV, OSH, and ICUI all reported beats on both the revenue and earnings lines. Meanwhile, FANG, BKD, and SEDG all beat on revenue while missing on earnings. On the other side, ASTL, CENX, AEL, DIOD, TWI, and MTW all missed on revenue while beating on earnings. Unfortunately, MOS, BHF, ARKO, VRM, TTWO, and BWXT all missed on both the top and bottom lines. It is worth noting that SANM, TPVE, ASH, FN, QGEN, and OSH all raised their forward guidance. However, IFF, WELL, CBT, JHX, LYFT, TTWO, and BWXT all lowered their forward guidance.

So far this morning, DD, BLDR, CNHI, GFS, CG, COTY, and IGT have all reported beats on both the top and bottom lines. Meanwhile, PKI, NXST, ELAN, REYN, RPRX, HAIN, and CLVT have all missed on revenue while beating on earnings. On the other side, CEG, AHCO, PLTK, CCO, and NFE all beat on revenue while missing on the earnings line. Unfortunately, PRGO, DBD, TAC, PRTY, RCM, and VTNR missed on both the revenue and earnings lines. It is worth noting that GFS and CCO raised their forward guidance while ELAN, PRGO, REYN, and RCM all lowered their own forward guidance.

Overnight, Asian markets were mostly green. Shenzhen (-0.58%), Shanghai (-0.43%), and Hong Kong (-0.23%) were the only real red in the region. Meanwhile, Japan (+1.25%), South Korea (+1.15%), and Taiwan (+0.94%) led the region higher. In Europe, the board is more mixed on modest moves at midday. The FTSE (-0.15%), DAX (+0.34%), and CAC (-0.05%) are typical of the region in early afternoon trade. However, Copenhagen (+1.09%) is an outlier and larger mover. As of 7:30 am, US Futures are pointing toward a green start to the morning. The DIA implies a +0.29% open, the SPY is implying a +0.30% open, and the QQQ implies a +0.53% open at this hour. 10-year bond yields are up slightly to 4.22% and Oil (WTI) is down two-thirds of a percent to $91.17/barrel in early trading.

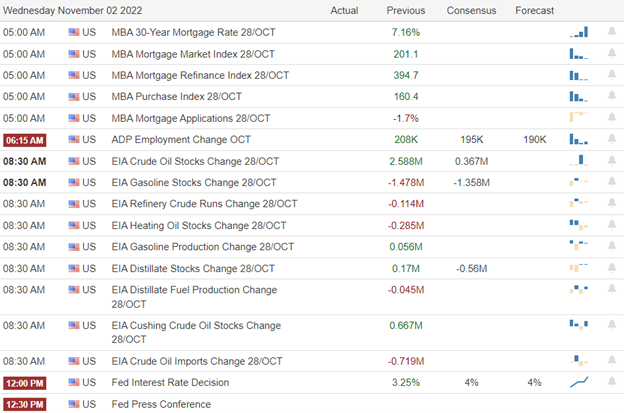

The major economic news events scheduled for Tuesday is limited to the EIA Short-Term Energy Outlook (noon). The major earnings reports scheduled for the day include AHCO, BLDR, CG, CLVT, CCO, CNHI, CEG, COTY, DBD, DD, SSP, ELAN, EXPD, GFS, IGT, LITE, NFE, NXST, PRTY, PKI, PRGO, RCM, RPRX, REYN, SCSC, SSRM, SGRY, TAC, and VTNR before the open. Then, after the close, AMKR, AKAM, AMC, DOX, ANGI, DAR, FNF, GO, GXO, IAC, JKHY, MASI, MRC, NLOK, NVAX, OXY, OSCR, OVV, PRI, SFM, VSAT, and DIS report.

In economic news later this week, on Wednesday, we get EIA Crude Oil Inventories, the WASDE Ag Report, and another Fed speaker (Williams at 3 am). Then Thursday, October CPI, Weekly Initial Jobless Claims, October Federal Budget Balance, and 2 Fed speakers (Mester at 1:30 pm and George at 2:30 pm) report. Finally, on Friday, we get Michigan Consumer Sentiment.

It is a bit lighter week of earnings reports as, on Wednesday, BHG, CLMT, CPRI, GIB, COHR, CRBG, DHI, GGB, HBI, HGV, ICL, LTH, MIDD, NOMD, PFGC, RBLX, RCI, SEAS, SWX, SPTN, TRP, TGNA, WEN, WWW, ADV, ATO, BGS, BRFS, CANO, CPNG, CRGY, ENS, FSM, G, JXN, JAZZ, KGC, LNW, MFC, RBT, NGL, RXT, RDFN, RNG, RIVN, STE, TTEK, TTEC, VET, and WYNN report. On Thursday, we hear from AZN, AZUL, BDX, BAM, CAE, CEPU, EPC, GBTG, KELYA, EYE, NICE, PRMW, RL, SBH, SIX, TPR, TDG, USFD, WRK, WE, YPF, BZH, COMP, EDR, FLO, ITUB, STN, and TOST. Finally, on Friday, AQN reports.

All eyes are on the US mid-term elections today. However, crypto markets are all tumbling overnight as major crypto exchange Binance sold off all of its remaining FTT tokens ( the token of FTX, another crypto exchange). With that said, as mentioned above, there are some earnings in the news this morning. Chief among these was the DD report which beat on both the top and bottom lines.

With that background, it looks like the bulls want to retest the T-line in the QQQ today (at least going by premarket action). Meanwhile, the DIA looks to test the breakout level of its J-hook pattern and the SPY is testing its 50sma. The divergence between the mega-cap DIA and the other two main indices tells us that the market is still seeking the safety of the stodgy, traditionally less volatile Dow 30. Take that to heart. While the reality of the economy will not change tonight, Mr. Market is likely to knee-jerk stocks (for no good reason) in one direction or the other based on surprises (or non-surprises) in the results. So, don’t be in a hurry. Unless you are a volatility trader (scalper) there isn’t a lot of reason to jump in before the dust settles. Keep firm hold of your FOMO and your fear in general.

Be deliberate and disciplined, but don’t be stubborn. Remember that it is 100 times more important to avoid big mistakes than it is to pick big winners. If you have a loss, admit you were wrong and take the loss before it gets out of hand. And when price does move in your direction, always move your stops in your favor and take a little profit off the table. (You have to remember the “Legend of the man in the green bathrobe“…in that situation, it is NOT HOUSE MONEY you’re betting, it’s all OUR MONEY!). Finally, trading is not your hobby. It’s a job. The money is real. So, treat it that way. Do the work and follow the process. Stick to your trading rules, trade with the trend, and take those profits when you have them. I know the Powerball is huge right now, but give up that lottery ticket mentality.

See you in the trading room.

Ed

Swing Trade Ideas for your consideration and watchlist: EGHT, PTON, F, OUST, ACB. You can find Rick’s review of tickers on his YouTube Channel here. Trade your plan, take profits along the way, and smart. Also, remember to check for impending earnings reports. Finally, remember that any tickers we mention and talk about in the trading room are not recommendations to buy or sell.

🎯 Mike Probst: Rick, Got CTL off the scanner today. Already up 30%. Love it.

🎯 Dick Carp: the scanner paid for the year with HES-thank you

🎯 Arnoldo Bolanos: LTA scanner really works $$, thanks Ed.

🎯 Bob S: LTA is incredible…. I use it … would not trade without it

🎯 Malcolm .: Posted in room 2, @Rick… I used the LTA Scanner to go through hundreds of stocks this weekend and picked out three to trade: PYPL, TGT, and ZS. Quality patterns and with my trading, up 24%, 7% and 12%…. this program is gold.

🎯 Friday 6/21/19 (10:09 am) Aaron B: Today, my account is at +190% since January. Thanks, RWO HRC Flash Malcolm Thomas Steve Ed Bob S Bob C Mike P and everyone that contributes every day. I love our job.

Hit and Run Candlesticks / Road To Wealth Youtube videos

Disclosure: We do not act on all trades we mention, and not all mentions acted on the day of the mention. All trades we mention are for your consideration only.

Free YouTube Education • Subscription Plans • Private 2-Hour Coaching

DISCLAIMER: Investing / Trading involves significant financial risk and is not suitable for everyone. No communication from Hit and Run Candlesticks Inc, its affiliates or representatives is not financial or trading advice. All information provided by Hit and Run Candlesticks Inc, its affiliates and representatives are intended for educational purposes only. You are advised to test any new trading approach before implementing it. Past performance does not guarantee future results. Terms of Service