Bank Earnings Start Strong with PPI Next Up

Thursday was a profit-taking day in the markets. After, good CPI data, SPY opened +0.02%, DIA opened +0.09%, and QQQ opened +0.06%. However, at that point we saw divergence with the broader SPY and QQQ selling off briskly before bobbling near the lows to close out the say. Meanwhile, DIA rallied and sold off and meandered sideways in positive territory the rest of the day. This action gave us large, black-body Bearish Engulfing candles in the SPY and QQQ. QQQ also crossed back below its T-line (8ema) for the first time in nine days. (SPY did print another all-time high, but not all-time high close.) At the same time, DIA printed a modest gap-up, large-legged Doji. This happened on above-average volume in QQQ and DIA, as well as modestly below-average volume in the SPY.

On the day, nine of the 10 sectors were in the green with Basic Materials (+2.07%) out in front leading almost all of the rest of the sectors higher. Meanwhile, Technology (-1.34%) was by far (by more than 1.80%) the weakest sector as we may have seen some rotation out of the big dog tech names that have led the market for a long, long time. At the same time, SPY lost 0.86%, DIA gained 0.09%, and QQQ lost 2.19%. VXX gained a little most than half a percent to close at a still extremely low at 10.34. T2122 spiked for the second-straight day into extreme overbought territory at 97.97. On the bond front, 10-year bond yields were down again to 4.207% and Oil (WTI) gained 1.08% to close at $83.00 per barrel. So, Thursday was a major profit-taking day or rotation on good CPI news. (Perhaps traders think the CPI data foreshadows a rate cut and/or change in economic cycle position.) Regardless of the cause, all 10 of the big dog names were down more than 1% for the day, led by TSLA (-8.44%), NVDA (-5.57%), and META (-4.11%).

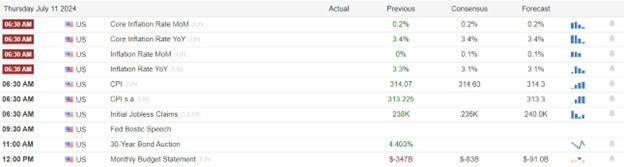

The major economic news scheduled for Thursday included June Core CPI (month-on-month), which fell and was below expectations at +0.1% (compared to a forecast and May reading of +0.2%). On a Year-on-Year basis, June Core CPI was also down at +3.3% (versus a forecast and May value of +3.4%). On the headline number, June CPI (month-on-month) actually fell and was below predictions at -0.1% (compared to a forecast of +0.1% and a May reading of 0.0%). On the Year-on-Year basis, June CPI was also down and below what was anticipated at +3.0% (versus a +3.1% forecast and a May +3.3% number). At the same time, Weekly Initial Jobless Claims were notably down at 222k (compared to a 236k forecast and a 239k previous week reading). For the Weekly Continuing Jobless Claims, number was also down at 1,852k (versus a 1,860k forecast and the prior week’s 1,856k value). Later, the June Federal Budget Balance was a bit better than expected at -$66.0 billion (compared to a forecast of -$71.2 billion and drastically down from May’s -$347.0 billion). Then, after the close, the Weekly Fed Balance Sheet showed a modest increase of $2 billion at $7.224 trillion (versus the prior week $7.222 trillion).

In economic speak news, on Thursday, San Francisco Fed President said that the recent better inflation data area relief. She said, “With the information we have received today, which includes data on employment, inflation, GDP growth, and the outlook for the economy, I see it as likely that policy adjustments, some policy adjustments, will be warranted.” At the same time, St. Louis Fed President Musalem indicated that Thursday/s CPI data was encouraging. He said, “The June Consumer Price Index points to encouraging further progress toward lower inflation.” Later, Chicago Fed President Goolsbee told a group interview, “My view is, this is what the path to 2% looks like.” He also indicated yesterday’s report was “excellent news” that indicate the stronger than expected May CPI data was just “a bump in the road.” He went on to say, “The reason to be as restrictive as that and the reason to tighten in real terms would be if you thought the economy was overheating. This is not in my view what an overheating economy looks like.”

In stock news, on Thursday, MSTR announced it will undergo a 10-for-1 split for the holders of record on August 1. Later, PFE announced it will move ahead with a pill form of its GLP-1 weight loss drug. This comes after a 20-person study showed concerns over side effects from the pills. At the same time, RTX was awarded a $1.2 billion contract to provide additional Patriot missile systems to Germany. Later, QS said it has signed a strategic partnership with VLKAF (Volkswagen) to develop new battery technologies. (QS closed up 30.50% on the day on this news.) At the same time, BCSF announced it will buy ENV for $4.5 billion. Later, IBATF announced it has become the first company to commercialize a lithium extraction technology, selling a license to its filtration technology to private miner US Magnesium. (Beating RIO and SLI to this milestone.) At the same time, GM announced plants to invest $900 million to retool an MI plant to build electric vehicles. Meanwhile, Bloomberg reported that TSLA will delay the launch of its robotaxis until October. (This was yet another delay from the previously announced August 8 unveiling.)

In stock legal and governmental news, on Thursday, the EU antitrust regulator said AAPL has agreed to open its “tap-and-go” payments system to rivals in order to avoid sanctions under one of three ongoing EU antitrust investigations of the company. This came even as the head of the agency said “so far is that we have not seen a change in behavior on Apple’s side when it comes to our preliminary findings.” Later, the Dept. of Energy awarded GM and STLA nearly $1.1 billion in grants to build electric vehicles and components. Meanwhile, CVX and HES announced they expect the FTC to review their proposed merger in Q3. (This announcement came after Bloomberg reported the FTC would delay its decision on the merger until Q4.) At the same time, the EPA and Dept. of Justice announced MRO had agreed to a $241 million settlement (including a $64 million fine) for violations of the Clean Air Act. Later, DG agreed to pay a $12 million penalty to the Dept. of Labor for alleged safety violations.

Overnight, Asian markets were mixed but leaned toward the green side. Hong Kong (+2.59%) was by far the biggest gainer. Meanwhile, Japan (-2.45%) and Taiwan (-1.94%) were by far the biggest losers, following Thursday’s US Tech selloff. In Europe, we see mostly green at midday. The CAC (+0.69%), DAX (+0.41%), and FTSE (+0.31%) lead the region higher in early afternoon trade. In the US, as of 7:30 a.m., Futures are pointing toward a mixed, flat start to the morning. The DIA implies a +0.09% open, the SPY is implying a +0.01% open, and the QQQ implies a -0.09% open at this hour. At the same time, 10-Year bond yields are back up a bit to 4.217% and Oil (WTI) is up almost another percent to $83.37 per barrel on hopes for economic stimulus from the Fed.

The major economic news scheduled for Friday include June Core PPI and June PPI (both at 8:30 a.m.), Michigan Consumer Sentiment, Michigan Consumer Expectations, Michigan 1-Year Inflation Expectations, and Michigan 5-Year Inflation Expectations (all at 10 a.m.), and the WASDE Ag report (noon). The major earnings reports before the open include BK, C, ERIC, FAST, JPM, and WFC. However, there are no major reports scheduled for after the close.

In miscellaneous news, following Thursday’s CPI data, the CME Fedwatch tool shows that 8.8% of fed fund futures trades expect a rate cut at the July 31 meeting, but 91.2% expect no cut. However, for the September 18 meeting, Fed Fund futures indicate a 92.7% probability of a rate cut. Elsewhere, more than 1.2 million residences and businesses remain without power in South TX following hurricane Beryl and officials said 500k will remain without power into next week. Finally, the EU said early Friday that Elon Musk’s former Twitter deceives users and breaches EU online content rules. If confirmed, X (Twitter) could face a fine up to 6% of global annual turnover.

So far this morning, BK, JPM, and WFC all reported beats (easily) on both the revenue and earnings lines. Meanwhile, FAST missed slightly on revenue while coming in in-line of earnings. On the other side, ERIC beat easily on revenue while missing on the earnings line. (C reports at 8 a.m.)

With that background, it looks as if markets have all moved modestly, but indecisively bullish in the premarket. SPY and DIA are printing Doji in the early session while QQQ has put in a white-body candle that recovered from a premarket opening gap lower. The SPY and DIA remain above their T-line (8ema) while QQQ seems just about ready to retest its own T-line from below this morning. So, regardless of your timeframe, the market trend (short-term, mid-term, or longer-term) remains very bullish despite yesterday’s big black candle. In terms of extension, DIA is now the only one of the three major index ETFs stretched above its T-line. However, the T2122 indicator is in the top end of its overbought range. Therefore, oddly after yesterday’s candle, the market may be in need of more rest or a pullback. With regard to those 10 big dog tickers, they are split 50-50 this morning with 5 in the green and 5 in the red. META (-1.76%) is the biggest mover while TSLA (-0.91%) has traded the most dollar volume in the early session. NVDA (+0.49%) is just behind TSLA in dollar-volume this morning.

As always, be deliberate and disciplined…but don’t be stubborn. If you have a loss, admit you were wrong and take that loss before it gets out of hand. And when the price does move in your direction, always move your stops in your favor and take a little profit off the table. You have to keep the “Legend of the Man in the Green Bathrobe” in mind. In a winning situation, it is NOT HOUSE MONEY you’re betting, it’s YOUR MONEY! There is no reason to keep raising your bet (risk) size just because you’ve had a win. Finally, remember that trading is not a hobby, it’s a job. The gains are real and so is the risk. So, treat it that way. Do the work and follow the process. Stick to your trading rules, trade with the trend, and take those profits when you have them. Do the work!

See you in the trading room.

Ed

🎯 Mike Probst: Rick, Got CTL off the scanner today. Already up 30%. Love it.

🎯 Dick Carp: the scanner paid for the year with HES-thank you

🎯 Arnoldo Bolanos: LTA scanner really works $$, thanks Ed.

🎯 Bob S: LTA is incredible…. I use it … would not trade without it

🎯 Malcolm .: Posted in room 2, @Rick… I used the LTA Scanner to go through hundreds of stocks this weekend and picked out three to trade: PYPL, TGT, and ZS. Quality patterns and with my trading, up 24%, 7% and 12%…. this program is gold.

🎯 Friday 6/21/19 (10:09 am) Aaron B: Today, my account is at +190% since January. Thanks, RWO HRC Flash Malcolm Thomas Steve Ed Bob S Bob C Mike P and everyone that contributes every day. I love our job.

Hit and Run Candlesticks / Road To Wealth Youtube videos

Disclosure: We do not act on all trades we mention, and not all mentions acted on the day of the mention. All trades we mention are for your consideration only.

Free YouTube Education • Subscription Plans • Private 2-Hour Coaching

DISCLAIMER: Investing / Trading involves significant financial risk and is not suitable for everyone. No communication from Hit and Run Candlesticks Inc, its affiliates or representatives is not financial or trading advice. All information provided by Hit and Run Candlesticks Inc, its affiliates and representatives are intended for educational purposes only. You are advised to test any new trading approach before implementing it. Past performance does not guarantee future results. Terms of Service