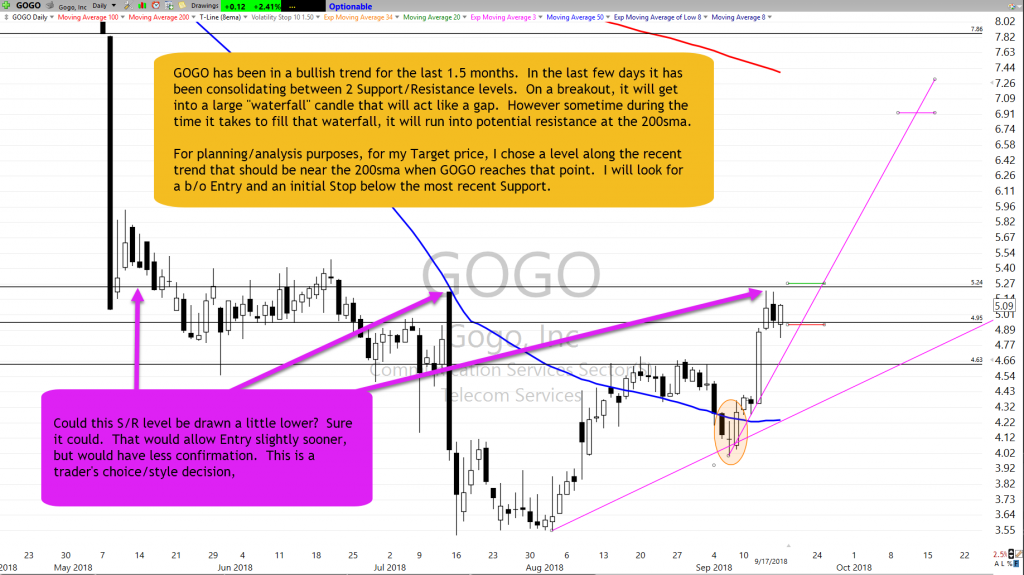

Price Action Setting Up Above The T-Line Bullish buy above $5.26 and a stop below $4.90

Price Action Setting Up Above The T-Line

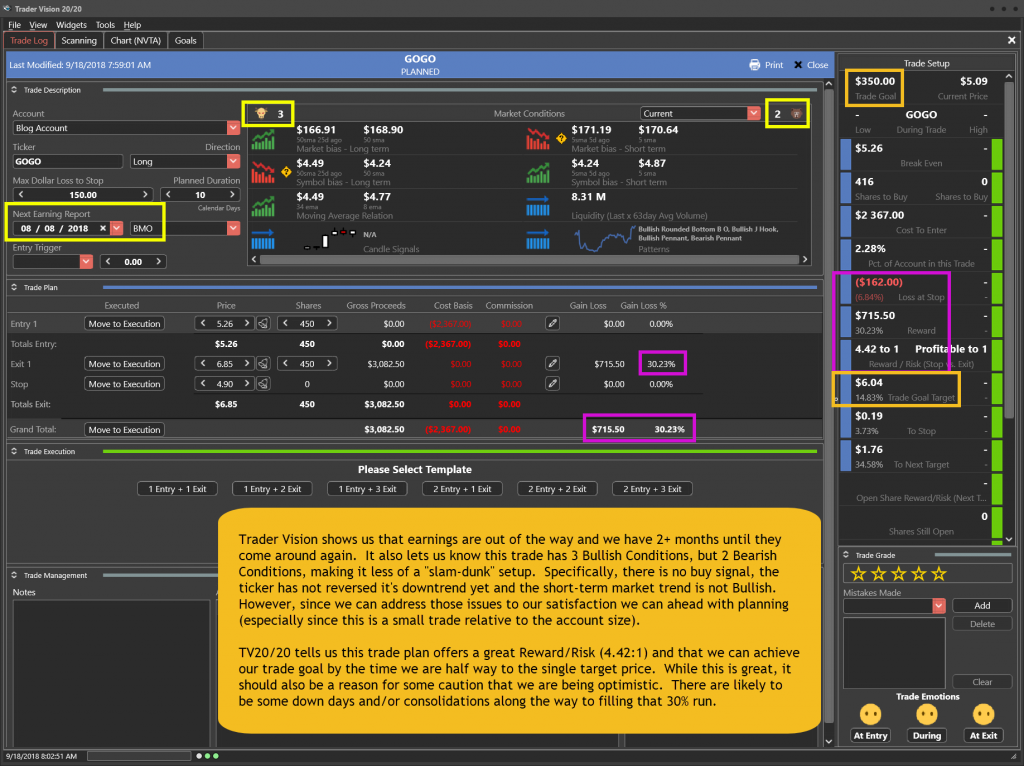

Price action is set up above the T-Line. As you can see in the past 12 days price action has swung from above the High T-Line Band down to the Low T-Line Band and now broken out above the green V-Stop dot. The past three bars are resting for the next profitable leg. GOGO is a beautiful (RBB) Rounded Bottom Breakout with almost 50% profit potential to the 200-SMA. Bullish buy above $5.26 and a stop below $4.90

- Rick’s HRC Trading Results

- Trading The T-Line Trap (YOUTUBE)

Past performance is not indicative of future returns

Good Trading, Rick, and Trading Team

[images style=”0″ image=”http%3A%2F%2Fhitandruncandlesticks.com%2Fwp-content%2Fuploads%2F2018%2F09%2FCoaching-Image.png” width=”900″ link_url=”https%3A%2F%2Fhitandruncandlesticks.com%2Fprivate-personal-coaching-right-from-the-pros%2F%3Fv%3D7516fd43adaa” new_window=”Y” align=”center” top_margin=”0″ full_width=”Y”]____________________________________________________________

SPY Evening Star

Yesterday the SPY ran into a roadblock and threw us an Evening Star that suggests a few days of a sellers party. Let’s keep in mind the trend is still pretty much intact, and I see the morning futures are trying to regain lost ground from yesterday. The day before yesterday price finished above the T-LineH and yesterday started below the T-Linh and finished below the T-Line Low. On the positive side, the recent candle lows can act as support, and we have gree V-stops below to help with support. On the dark side, we are looking at an Evening Star, the Star in a lower high. We seem to have a few pieces to the puzzle, but a few more are needed. My goal today is to protect my positions with stops, go to the back on some and maybe close losers. Could be a pretty cold wet day out there today, may just pass on hunting today.

****VXX – Yesterday printed a Bull Engulf, the morning futures today is trying to take it back, could be a fun battle today.

Focus Trading Education

Candlesticks • Price Action • T-Line • T-Line Bands • Support • Resistance • Trend • Trendlines • Chart Patterns • Buy Box • Volatility Stops • Profit Zones • Entry Zones • Protective Stops • RBB Rounded Bottom Breakout Strategy • Pop Out of The Box Strategy • Pinball Strategy • Trade Planning, Fibonacci, Stoch/RSI

Subscription Plans • Private 2-Hour Coaching

Testimonial

This is not your usual service that sends out a ton of stock recommendations, and then cherry picks the winners to show you how great they are. Hit and Run Candlesticks and Right Way Options are truly educational services. They taught me how to trade not what to trade. The entire team: Rick, Doug, Steve, and Ed are there to help and answer your questions. They are awesome. They cut years off my learning curve. And it’s a team effort. Everyone in the room (all the members) are there to help with invaluable insights and advice. The only service you will ever need. Thanks to all the team for how you have helped me and for all you do. –Jonathan Bolnick

Rare to have a service teach you how they find their choices but, HRC/RWO teach you how to fish instead of fishing for you. And, your ideas are not panned but shared, implemented, or improved. Sharing is caring. –Thomas Bradly

Past performance is not indicative of future returns

Investing and Trading involve significant financial risk and is not suitable for everyone. No communication from Hit and Run Candlesticks Inc, Right Way Option, Trader Vision 2020, Top Gun Futures or Rick Saddler, Doug Campbell, Ed Carter, Steve Risner is to be considered financial or trading advice. All information is intended for Educational Purposes Only. Terms of Service.

Rick Saddler, Doug Campbell, Ed Carter, Steve Risner is not a licensed financial adviser nor do they offer trade recommendations or advice to anyone.