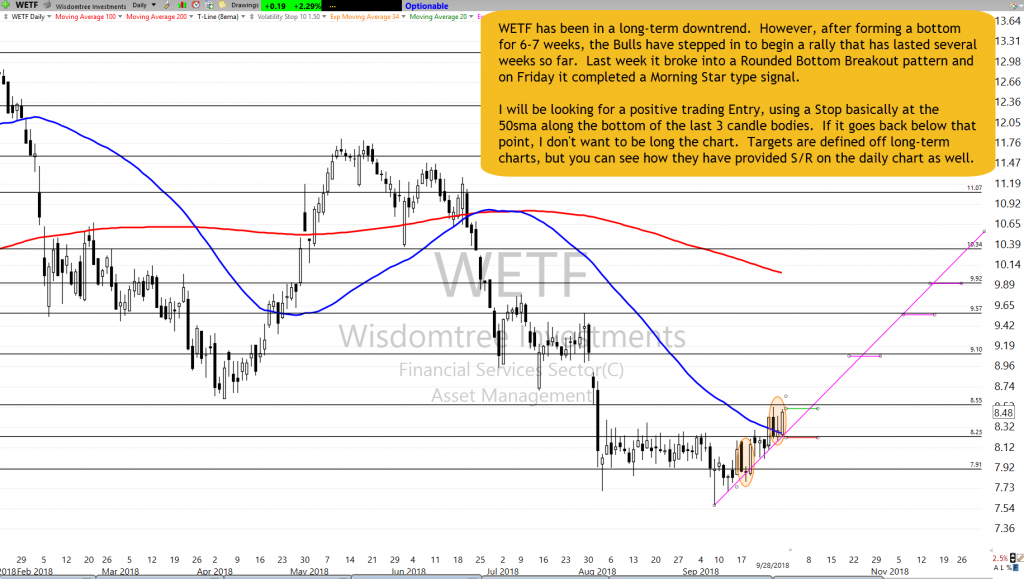

HAL Morning Star J-Hook Setup The (RBB) Rounded Bottom setup

HAL Morning Star J-Hook Setup

HAL is presenting with a Bullish Morning Star J-hook setup after a bullish breakout over the 50-SMA with a resting pull back to the 50-SMA and the T-Line. HAL also became an (RBB) Rounded Bottom Breakout on September 24. Bullish above $41.50 gives the HAL trade about 13% to the 200-SMA main target zone. Always use a protective stop. The 50-SMA and the V-Stop are about $40.30.

The (RBB) Rounded Bottom setup is now used worldwide by thousands of swing traders. On October 17th I will be presenting a workshop/Clinic on the (RBB) to read more about the clinic and to take advantage of the discount that ends tonight click here

[images style=”0″ image=”http%3A%2F%2Fhitandruncandlesticks.com%2Fwp-content%2Fuploads%2F2018%2F10%2FRBB-10-2.png” width=”706″ link_url=”https%3A%2F%2Fob124-10cd91.pages.infusionsoft.net%2F” new_window=”Y” align=”center” top_margin=”0″ full_width=”Y”]“Plan your trade and trade your plan.”

Past performance is not indicative of future returns

Good Trading, Rick, and Trading Team

____________________________________________________________

SPY •

Nice pop and profits yesterday, but for the most part, the SPY lost energy early on. Price was on it’s way to the breaking of the upper T-Line Reg Line then settled for a Doji close between the upper and lower T-Reg line. Price is in the weak territory on the hourly chart, and the 200-SMA may need to be tested. If the 60-Min 200-SMA can’t hold price may want to visit $289.50

****VXX – A bit of fear stepped in yesterday but not enough to put us over the T-Line. Over $27.75 price would run to the 50-SMA.

Focus Trading Education

Candlesticks • Price Action • T-Line • T-Line Bands • Support • Resistance • Trend • Trendlines • Chart Patterns • Buy Box • Volatility Stops • Profit Zones • Entry Zones • Protective Stops • RBB Rounded Bottom Breakout Strategy • Pop Out of The Box Strategy • Pinball Strategy • Trade Planning, Fibonacci, Stoch/RSI

Subscription Plans • Private 2-Hour Coaching

Testimonial

This is not your usual service that sends out a ton of stock recommendations, and then cherry picks the winners to show you how great they are. Hit and Run Candlesticks and Right Way Options are truly educational services. They taught me how to trade not what to trade. The entire team: Rick, Doug, Steve, and Ed are there to help and answer your questions. They are awesome. They cut years off my learning curve. And it’s a team effort. Everyone in the room (all the members) are there to help with invaluable insights and advice. The only service you will ever need. Thanks to all the team for how you have helped me and for all you do. –Jonathan Bolnick

Rare to have a service teach you how they find their choices but, HRC/RWO teach you how to fish instead of fishing for you. And, your ideas are not panned but shared, implemented, or improved. Sharing is caring. –Thomas Bradly

Past performance is not indicative of future returns

Investing and Trading involve significant financial risk and is not suitable for everyone. No communication from Hit and Run Candlesticks Inc, Right Way Option, Trader Vision 2020, Top Gun Futures or Rick Saddler, Doug Campbell, Ed Carter, Steve Risner is to be considered financial or trading advice. All information is intended for Educational Purposes Only. Terms of Service.

Rick Saddler, Doug Campbell, Ed Carter, Steve Risner is not a licensed financial adviser nor do they offer trade recommendations or advice to anyone.

A huge bullish gap to begin the first day of trading of the 4th quarter after inking a new trade agreement between the US and Canada fired up the futures last night. Asian markets closed up across the board, and European markets are currently showing green across the board. As I write this, US Futures suggest a huge morning gap 200 points.

A huge bullish gap to begin the first day of trading of the 4th quarter after inking a new trade agreement between the US and Canada fired up the futures last night. Asian markets closed up across the board, and European markets are currently showing green across the board. As I write this, US Futures suggest a huge morning gap 200 points. The light volume choppy rally yesterday was ultimately unable to hold onto gains by the end of the day leaving more questions than answers. There were noticeably fewer companies moving up supporting the rally. There is nothing in the charts that’s particularly bearish, but I do think there is a reason to be a little cautious as we head into the weekend.

The light volume choppy rally yesterday was ultimately unable to hold onto gains by the end of the day leaving more questions than answers. There were noticeably fewer companies moving up supporting the rally. There is nothing in the charts that’s particularly bearish, but I do think there is a reason to be a little cautious as we head into the weekend.