VXX Remains a Bullish Chart

VXX Remains a Bullish Chart

The VXX chart remains a bullish chart pattern, yesterday in the trading room I mentioned that as long as the VIX is a bullish chart pattern, the market will remain bearish.

Holly cow, another 300 point drop this morning in the DOW, and a test of yesterdays low. And we are flirting with January 1, 2018 numbers. The SPY and the DIA charts are bearish patterns even with the Harami that printed yesterday.

The 80/20 rule has been a valuable rule for me over the years, 80% of stock follow the SPY/SP-500, something to think about.

YouTube Education

Today’s Featured YouTube Video is How To Setup The T-Line Bands; Please don’t forget to subscribe to my FREE YouTube Channel.

New Live Day Trading Room Open House

Top Gun Day Trading is a new division of Hit, and Run Candlesticks with its very own trading room. Come check it out until October 31, for free. Login Here

[button_2 color=”blue” align=”center” href=”http://hitandruncandlesticks.webinato.com/room3″ new_window=”Y”]Day Trading Open House – Free Entry Until October 31[/button_2]Past performance is not indicative of future returns

Happy Friday!

Good Trading, Rick, and Trading Team

Membership Services • Private 2-Hour Coaching

—————————————————————————————-

Past Performance Is No Guarantee of Future Results

Investing and Trading involve significant financial risk and is not suitable for everyone. No communication from Hit and Run Candlesticks Inc, Right Way Option, Trader Vision 2020 or Rick Saddler, Doug Campbell, Ed Carter, Steve Risner is to be considered financial or trading advice. All information is intended for Educational Purposes Only. Terms of Service.

Rick Saddler, Doug Campbell, Ed Carter, Steve Risner is not a licensed financial adviser nor does he offer trade recommendations or advice to anyone.

It would appear that after the very disappointing earnings results from AMZN and GOOG that the so-called FANG has a cavity. Indeed a very big cavity that spread its pain all around the world. Both, Asian and European market are both lower this morning. US Futures indicate that yesterday’s 400 point Dow rally will be completely wiped out this morning with an ugly gap down open.

It would appear that after the very disappointing earnings results from AMZN and GOOG that the so-called FANG has a cavity. Indeed a very big cavity that spread its pain all around the world. Both, Asian and European market are both lower this morning. US Futures indicate that yesterday’s 400 point Dow rally will be completely wiped out this morning with an ugly gap down open.

The news-driven selloff seems to have finally reached a capitulation point yesterday. Sadly those that sold yesterday afternoon had also to suffer the indignity of seeing the futures bounce strongly almost immediately after the closing bell. Although we should expect volatility to remain very high with very fast and challenging price action, I think we have reached the point where institutions and value buyers will begin to support current prices.

The news-driven selloff seems to have finally reached a capitulation point yesterday. Sadly those that sold yesterday afternoon had also to suffer the indignity of seeing the futures bounce strongly almost immediately after the closing bell. Although we should expect volatility to remain very high with very fast and challenging price action, I think we have reached the point where institutions and value buyers will begin to support current prices. Yesterday’s wild price fluctuations may have left many traders with a nasty case of whiplash. Unfortunately, it looks like the volatility is here to stay and with more than 200 companies reporting earnings today and more than 300 tomorrow, anything is possible.

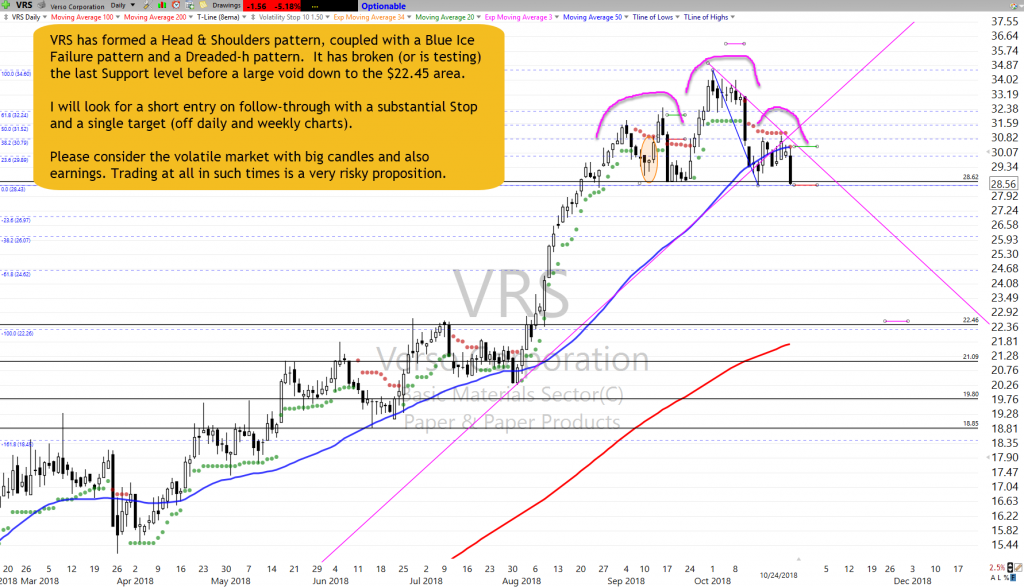

Yesterday’s wild price fluctuations may have left many traders with a nasty case of whiplash. Unfortunately, it looks like the volatility is here to stay and with more than 200 companies reporting earnings today and more than 300 tomorrow, anything is possible. Lately, I repeatedly mentioned the necessity of caution with the current market condition. It’s a message that traders never like to hear, but that doesn’t make it any less true. Currently, the futures are pointing to a gap down on nearly 400 points. A brutal reminder that the market will punish those trading a bias rather than heeding the warnings in the price action of the chart.

Lately, I repeatedly mentioned the necessity of caution with the current market condition. It’s a message that traders never like to hear, but that doesn’t make it any less true. Currently, the futures are pointing to a gap down on nearly 400 points. A brutal reminder that the market will punish those trading a bias rather than heeding the warnings in the price action of the chart.