FEYE 2-Day Bullish Engulf FEYS bullish above $19.05 Stop below $18.20

FEYE 2-Day Bullish Engulf

FEYE has printed a 2-day Bullish Engulf after a bullish pullback. Mid August FEYE started its turn from bearish to bullish, and the current Bullish Engulf on the 2-day chart or gap on the daily chart is the clue I need to add FEYE to our watchlist. Also take a look at the weekly chart, if that doesn’t excite you. I don’t know what will. Current trade: FEYE bullish above $19.05 Stop below $18.20 targets $21.00 $23.60. Our trade ideas are found using TC2000 Software

Featured YouTube Video

Understanding Candlesticks Q-Why don’t Candlestick signals work every time?

A-Reversal patterns are more clues of what could come, rather than what is.

Q-What is follow through?

A-Follow through is when price action moves higher than the clue candle.

Q-What is positive trading?

A-Positive trading is when price action works within the clue candle range

Candlesticks within a tight chart pattern are building a candle in a longer time frame

Membership Services

Trading Equipment

- LTA – Live Trading Alerts

- TC2000 Charting Save $25.00 Today

- TradeHawk Trading Platform

Past performance is not indicative of future returns

Good Trading, Rick, and Trading Team

____________________________________________________________

SPY • Price In The Band

The recent price action of the last few days was a clue that the buyers are starting to circle, yesterday’s gap held fairly well into the closed above our lower T-Line Band. The futures are pointing a little higher this morning. In a perfect world, I would like to see the SPY closed up above our upper T-line Band Which is about $275 .70, of course by then we’re going to need a little profit taking and that could set us up for our low high/higher low and higher high chart pattern. Once above upper T-Line Band, the $280.00 price target is possible.

Bottom line is if the bulls can keep this up we could soon see the T-Line Bands turn positive, if not a test of the recent low.

Free YouTube Education • Subscription Plans • Private 2-Hour Coaching

****VXX – The VXX chart is still a bullish chart pattern and can raise it’s head anytime. We did buy a few PUTS on it yesterday for a quick trade.

YouTube Videos

Trading at the Beach • How to set up the T-Line Regression Lines • MetaStock Automated • Trading the T-Line Trap • Shorting the Blue Ice Pattern

Testimonial

This is not your usual service that sends out a ton of stock recommendations, and then cherry picks the winners to show you how great they are. Hit and Run Candlesticks and Right Way Options are truly educational services. They taught me how to trade not what to trade. The entire team: Rick, Doug, Steve, and Ed are there to help and answer your questions. They are awesome. They cut years off my learning curve. And it’s a team effort. Everyone in the room (all the members) are there to help with invaluable insights and advice. The only service you will ever need. Thanks to all the team for how you have helped me and for all you do. –Jonathan Bolnick

Rare to have a service teach you how they find their choices but, HRC/RWO teach you how to fish instead of fishing for you. And, your ideas are not panned but shared, implemented, or improved. Sharing is caring. –Thomas Bradly

Past performance is not indicative of future returns

Investing and Trading involve significant financial risk and is not suitable for everyone. No communication from Hit and Run Candlesticks Inc, Right Way Option, Trader Vision 2020, Top Gun Futures or Rick Saddler, Doug Campbell, Ed Carter, Steve Risner is to be considered financial or trading advice. All information is intended for Educational Purposes Only. Terms of Service.

Rick Saddler, Doug Campbell, Ed Carter, Steve Risner is not a licensed financial adviser nor do they offer trade recommendations or advice to anyone.

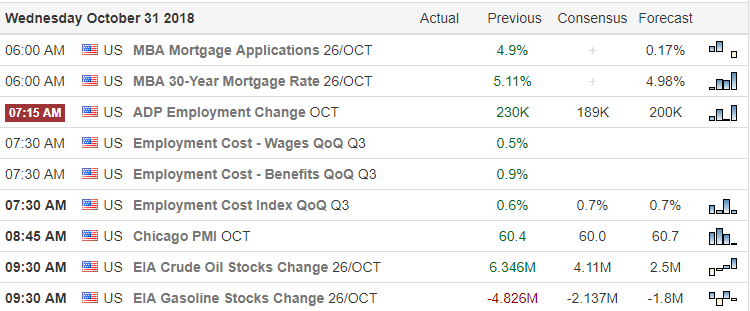

Markets are once again gaping higher this morning as this wild ride of volatility continues. With nearly 450 companies reporting earnings today and a busy economic calendar, anything is possible. Price resistance did its job yesterday rejecting the days high. This mornings gap brings the price right back up to those same price resistance levels. I intend to very cautious this morning and will watch price action closely to see if this gap is actually going to be supported by buyers.

Markets are once again gaping higher this morning as this wild ride of volatility continues. With nearly 450 companies reporting earnings today and a busy economic calendar, anything is possible. Price resistance did its job yesterday rejecting the days high. This mornings gap brings the price right back up to those same price resistance levels. I intend to very cautious this morning and will watch price action closely to see if this gap is actually going to be supported by buyers.

Bullishness in the Asian and European market has the US Futures suggesting the first possible follow-through rally in nearly a month! Certainly exciting to see but as the indexes challenge price resistance levels, we can’t rule out the possibility of profit-taking. As a result, traders will need to say on their toes focused on price action and aware of the current market volatility.

Bullishness in the Asian and European market has the US Futures suggesting the first possible follow-through rally in nearly a month! Certainly exciting to see but as the indexes challenge price resistance levels, we can’t rule out the possibility of profit-taking. As a result, traders will need to say on their toes focused on price action and aware of the current market volatility.