Winter Storm and Earnings Lead News

Markets were dead most of the day Friday, but a strong rally on volume the last half hour took all 3 major indices on near the highs of the day. This created large-body Bullish Engulfing candles in the SPY and QQQ, while the DIA missed engulfing by 7 cents. On the day, SPY gained 0.51%, QQQ gained 0.56%, and DIA lagged at +0.11%. With that said, all 3 of the major averages closed at another all-time high close. The VXX fell over 3% to 15.74 and T2122 remains well into the overbought territory at 88.11. 10-year bond yields spiked to 1.205% and Oil (WTI) gained almost 2.5% to close at $59.66/barrel.

Also on Friday, ahead of their taking this week off, House Democrats pushed forward the parts of the relief plan that cover the $1,400 direct payments, payments to families with children (up to $3,600/child under age 6), and an extension of unemployment. These portions are out of committee and are still on track to be passed as a single “budget” bill to be reconciled with Senate versions by the end of the month. In unrelated news, President Biden called on Congress to pass “commonsense gun laws” on Sunday. The specifics called for are an elimination of immunity for gunmakers, universal background checks, and a ban on selling “assault-style” weapons and high-capacity magazines. This may well move gun stocks like RGR, SWBI, VSTO, etc.

Interesting news out of oil giant RDS. The Dutch company said on Monday that they believe the world hit “peak oil production” in 2019 with the Covid outbreak accelerating the move away from Oil. In fact, RDS said they main profit center will become liquified natural gas as time moves forward. With that said, the price of oil has hit a pandemic high this this last week, with WTI trading at $61.77 at one point, and is holding above $60 in the winter storm, which theoretically ought to stoke more production. Still, carmakers like GM are fast-tracking the move to electric vehicles with Chevy also adding 2 new electric models to their Bolt line on Monday.

Related to the virus itself, US infections continue to be of concern in the US. The totals have risen to 28,317,703 confirmed cases and 498,203 deaths. However, the number of new cases continues to fall quickly and is back down to the October level as the average new cases are now 87,603 new cases per day. However, deaths remain at a stubbornly high level of 2,481 per day. While new cases are down 62% this week, the CDC also announced Sunday that they have identified 7 new US-originated variants. Still, PFE and MRNA are contracted to deliver another 130 million doses over the next 6 weeks (versus the 70 million that have been delivered so far). So, we may be turning a corner.

Globally, the numbers rose to 109,747,785 confirmed cases and the confirmed deaths are now at 2,420,609 deaths. In good news, the world’s average of new cases is down again to 379,868 per day, but mortality remains high at 11,084 new deaths per day. NVAX announced Monday that the Phase 3 trials for its own COVID vaccine are now fully subscribed. This comes as some countries are easing social distancing measures despite warnings about relaxing too early. The latest to follow this trend are Hong Kong, Netherlands, and Israel.

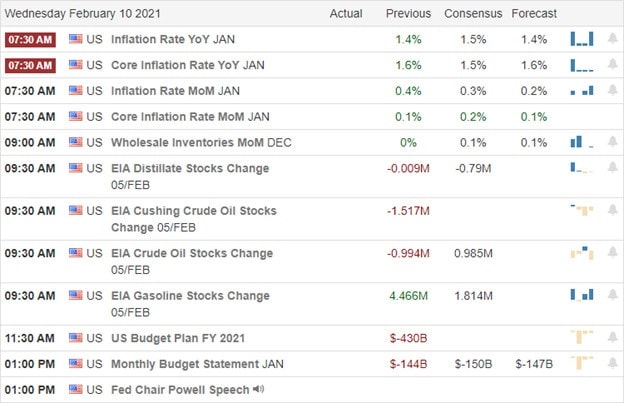

Overnight, the few Asian markets that were open were mostly green. Japan (+1.28%) and South Korea (+0.52%) led the way. In Europe, markets are mostly modestly green so far today. The FTSE (+0.24%), CAC (+0.05%), and DAX (+0.03%) are a typical spread with a few minor exchanges like Portugal (+1.57%) standing out. As of 7:30 am, US Futures are pointing toward a green open. All 3 major indices are implying a moderate gap higher lower of about +0.55% on average at the opening bell.

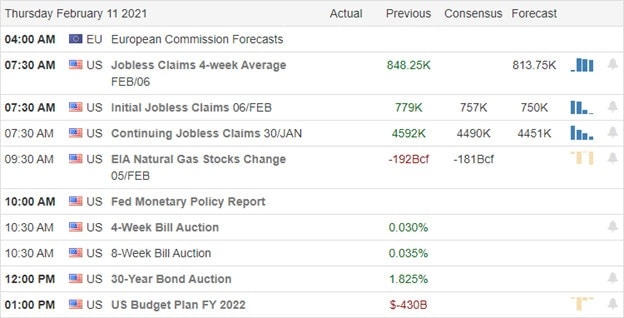

The major economic news for Tuesday is limited to NY Fed Empire State Mfg. Index (8:30 am) and a Fed speaker (Daly 3 pm). Major earnings reports on the day include AAP, ALLE, AN, BRKR, CVS, ECL, EXPD, JELD, LPX, TRU, USFD, VMC, and ZTS before the open. Then after the close, A, AIG, ANDE, CAR, BYD, CLR, DVN, MCY, and OXY report.

With Congress gone for the week and limited news today, it looks like the bulls are still in charge. The winter storm gripping most of the country is likely to dominate the news. Even earnings are limited today. So, over-extension seems to be the main thing that might slow the bulls stepping back in after the 3-day weekend.

Follow the trend, respect support and resistance levels, and don’t chase the moves you missed. It’s all about achieving trade goals and sticking to your discipline. So, keep locking in your profits when you have them. Stick with your plan, maintain discipline and work your process. Remember it’s Friday and we have a 3-day weekend coming. So, pay yourself and get your portfolio set for the long weekend.

Ed

Swing Trade Ideas for your consideration and watchlist: DAL, HYLN, UAL, VLO, WYNN, PENN, MRVL, ALLY, SOHU. You can find Rick’s review of tickers on his YouTube Channel here. Trade your plan, take profits along the way, and smart. Also, remember to check for impending earnings reports. Finally, remember that any tickers we mention and talk about in the trading room are not recommendations to buy or sell.

🎯 Mike Probst: Rick, Got CTL off the scanner today. Already up 30%. Love it.

🎯 Dick Carp: the scanner paid for the year with HES-thank you

🎯 Arnoldo Bolanos: LTA scanner really works $$, thanks Ed.

🎯 Bob S: LTA is incredible…. I use it … would not trade without it

🎯 Malcolm .: Posted in room 2, @Rick… I used the LTA Scanner to go through hundreds of stocks this weekend and picked out three to trade: PYPL, TGT, and ZS. Quality patterns and with my trading, up 24%, 7% and 12%…. this program is gold.

🎯 Friday 6/21/19 (10:09 am) Aaron B: Today, my account is at +190% since January. Thanks, RWO HRC Flash Malcolm Thomas Steve Ed Bob S Bob C Mike P and everyone that contributes every day. I love our job.

Hit and Run Candlesticks / Road To Wealth Youtube videos

Disclosure: We do not act on all trades we mention, and not all mentions acted on the day of the mention. All trades we mention are for your consideration only.

Free YouTube Education • Subscription Plans • Private 2-Hour Coaching

DISCLAIMER: Investing / Trading involves significant financial risk and is not suitable for everyone. No communication from Hit and Run Candlesticks Inc, its affiliates or representatives is not financial or trading advice. All information provided by Hit and Run Candlesticks Inc, its affiliates and representatives are intended for educational purposes only. You are advised to test any new trading approach before implementing it. Past performance does not guarantee future results. Terms of Service