A Pause Before We Get to Jackson Hole?

Markets essentially opened very slightly higher Tuesday and then ground sideways with a slight bullish lean until about 2:30 pm. At that point, we saw profit-taking right into the close. This left us with tiny, Gap-Up Doji-type candles in all 3 major indices. On the day SPY closed up 0.15% (to another new all-time high close), DIA closed up 0.08%, and QQQ closed up 0.31% (to another new all-time high close). The VXX was flat at 26.71 and T2122 rose but remains in the midrange at 70.97. 10-year bond yields moved higher to 1.299% and Oil (WTI) gained 3% to $67.66/barrel.

After the close, the House voted to approve a procedural measure that advances both the $3.5 trillion budget resolution and the bipartisan infrastructure bill. The move comes after Democratic infighting was resolved and will allow Democrats to approve the massive spending bills without any Republican votes. While still a long way off, this is another major step toward both the Infrastructure bill (great for steel, telecom, and other industries) and the Democratic budget agenda (increased social “safety net” and education spending), which may hurt industries like insurance and drug companies as well as tax increases on business and high-income.

30-year fixed mortgage rates fell to 3.03%. This was the first drop in rates in the last 3 weeks. However, mortgage demand remains light, seeing only a 1% increase in refinance applications and a 3% increase in new loan applications from last week.

JNJ reported that its Covid Booster shot is showing a promising immune response in early trials this morning. Specifically, trial participants are showing a nine-fold increase in antibodies 4 weeks after the booster shot. In other virus-related news, new US infections are continuing to rise, but with analysts saying we may have reached the peak of this surge. The totals rose to 38,968,925 confirmed cases and deaths are now at 648,161. The averages are now at 148,755 new cases and 873 new deaths per day.

Overnight, Asian markets mixed, but heavily to the green side. Taiwan (+1.35%), Malaysia (+1.06%), and Thailand (+0.85%) led to the upside. The only red was minor and came from Japan (-0.03%) and Hong Kong (-0.13%). In Europe, we also see mixed markets, but on more modest moves at this hour. The FTSE (+0.21%), DAX (-0.16%), and CAC (+0.16%) are typical of the mix across the continent at mid-day. As of 7:30 am, US Futures are pointing to a flat open. The DIA is implying a +0.04% open, the SPY implying a +0.01% open, and the QQQ implying a -0.02% open at this hour. Meanwhile, 10-year bond yields are slightly higher at 1.309% and Oil is up a third of a percent in early trading, even as the Dollar shows a little strength against other currencies.

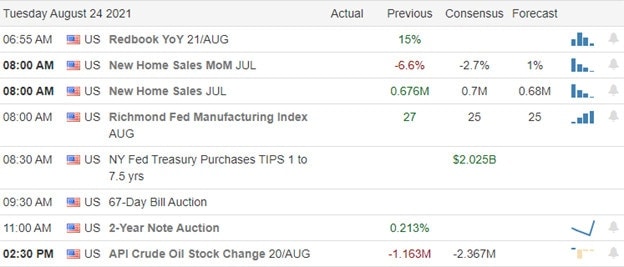

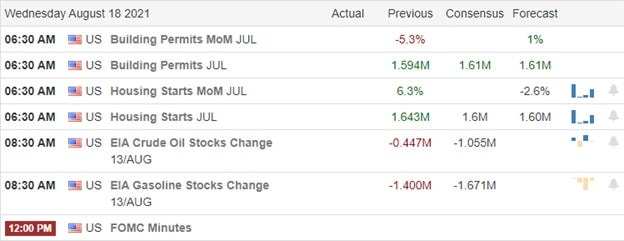

The major economic news scheduled for release on Wednesday is limited to July Durable Goods Orders (8:30 am) and Crude Oil Inventories (10:30 am). The major earnings reports scheduled for the day include DKS, LX, QH, RY, and VIOT before the open. Then after the close, ADSK, GES, NTAP, SPLK, ULTA, and WSM report.

As traders begin preparing for the Jackson Hole Symposium (Central Banker Summit, which is virtual this year), the pause may continue again today. Traders will focus on figuring out how “tapering” will be couched in the discussions and then handicapping how the market will react. While July Durable Goods and Current Oil Inventories new could theoretically move markets, the more likely scenario is that we drift as traders prepare. That’s our cue to be prepared as well. What will you need to do to your portfolio if we see a taper tantrum pullback? How about if we see an “everything’s hunky-dory” rally? Plan ahead so that you aren’t running around with your hair on fire if one of those does come to pass Thursday or Friday.

As always, manage your existing trades before you go chasing any new ones. Concentrate on the process and on managing those things you can control. Good trading rules and discipline is what separates long-term success from failure in trading. So, trade with the trend. If you miss a move, just admit it and move on to the next chart. Never chase price on an entry and remember to keep your losses small by using stops or hedges. And always consistently take profits when you have them.

Ed

Swing Trade Ideas for your consideration and watchlist: SWCH, NLOK, SBUX, DKNG, CARR, PENN, AMC, GME, CAN. You can find Rick’s review of tickers on his YouTube Channel here. Trade your plan, take profits along the way, and smart. Also, remember to check for impending earnings reports. Finally, remember that any tickers we mention and talk about in the trading room are not recommendations to buy or sell.

🎯 Mike Probst: Rick, Got CTL off the scanner today. Already up 30%. Love it.

🎯 Dick Carp: the scanner paid for the year with HES-thank you

🎯 Arnoldo Bolanos: LTA scanner really works $$, thanks Ed.

🎯 Bob S: LTA is incredible…. I use it … would not trade without it

🎯 Malcolm .: Posted in room 2, @Rick… I used the LTA Scanner to go through hundreds of stocks this weekend and picked out three to trade: PYPL, TGT, and ZS. Quality patterns and with my trading, up 24%, 7% and 12%…. this program is gold.

🎯 Friday 6/21/19 (10:09 am) Aaron B: Today, my account is at +190% since January. Thanks, RWO HRC Flash Malcolm Thomas Steve Ed Bob S Bob C Mike P and everyone that contributes every day. I love our job.

Hit and Run Candlesticks / Road To Wealth Youtube videos

Disclosure: We do not act on all trades we mention, and not all mentions acted on the day of the mention. All trades we mention are for your consideration only.

Free YouTube Education • Subscription Plans • Private 2-Hour Coaching

DISCLAIMER: Investing / Trading involves significant financial risk and is not suitable for everyone. No communication from Hit and Run Candlesticks Inc, its affiliates or representatives is not financial or trading advice. All information provided by Hit and Run Candlesticks Inc, its affiliates and representatives are intended for educational purposes only. You are advised to test any new trading approach before implementing it. Past performance does not guarantee future results. Terms of Service