CPI Report

Although the Wednesday rally was nice this morning, traders and investors now hold their breath for the CPI report. Consensus estimates suggest inflation increased in January and may come in at more than a 40-year high! If true, will that push the FOMC to act more aggressively in the March meeting, raising the interest rate by 50 basis points? Toss in a slew of earnings reports, and the stage is set for another day of challenging price action.

Overnight Asian markets closed green across the board with relatively modest gains waiting on the inflation data. European trade mixed but mostly higher with all eyes on the U.S. ahead of the CPI report. U.S. futures traded mixed ahead of critical inflation data and a bevy of earnings reports likely to keep traders guessing and price volatility high on Thursday. So, let’s get ready to rumble.

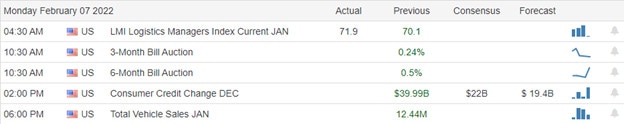

Economic Calendar

Earnings Calendar

We have another big Thursday on the earnings calendar, with about 210 companies expected to report throughout the day. Notable reports include KO, AFRM, MT, AZN, BE, APRN, CC, NET, CIGI, COUR, CS, CYBR, DDOG, DVA, DXCM, DUK, EB, EXPE, FLO, GDDY, HUBS, HII, ILMN, K, LH, MLM, MHK, MCO, PTEN, PEP, PCG, PM, PIPR, QLYS, SSTK, TEX, TTE, TWTR, UPWK, VRSN, WU, YELP, ZBRA, ZEN, & Z.

News & Technicals’

This week, the Biden administration rolled out a plan to allocate $5 billion to states to fund electric vehicle chargers over five years as part of the bipartisan infrastructure package. The historic investment is part of the administration’s broader plan to combat human-caused climate change and advance the clean energy transition. Despite a rise in EV sales in the U.S. in recent years, the transportation sector is still one of the largest contributors to U.S. greenhouse gas emissions. Disney reported earnings for the fiscal first quarter that beat analyst estimates. In addition, disney+ subscriptions beat estimates, adding nearly 12 million subscribers in the quarter. Disney’s parks, experiences, and consumer products division saw revenues reach $7.2 billion during the quarter, double the $3.6 billion it generated in the prior-year quarter. According to people with knowledge of the matter, Salesforce co-CEOs Marc Benioff and Bret Taylor spoke about the company’s vision for an NFT cloud service. The discussion came during an online sales kickoff on Wednesday. In a December blog post, a director of the market strategy at Salesforce predicted that 2022 would be a big year for NFTs. Shares of Delivery Hero plummeted around 29% Thursday. Analysts pointed to Delivery Hero’s 2022 guidance as to the reason behind the negative market reaction. The Germany-based food delivery firm forecast core profit margins between 1% and 1.2%. Unilever’s CEO has ruled out any “transformational” acquisitions after its failed £50 billion GSK bid. Alan Jope told CNBC said major deals were “off the table” after receiving pushback from investors. Instead, the company pointed to further price risings in 2022 as it reported its results Thursday. Treasury yields moved slightly higher in early Thursday trading, with the 10-year inching higher to 1.9406% and the 30-year rising to 2.2465%.

After a nice rally Wednesday, the market will now turn its attention to inflation as we wait for the CPI report. Some suggest the number will come in hot with inflation running at the highest level in more than 40 years. If that is the case, it will pressure the FOMC to act more aggressively in the March meeting. It’s hard to know how the market will react to the CPI reading. However, if the market sees the chances of a 50 basis point rate increase rising, we should not rule out the possibility of an adverse reaction. Though the DIA broke through its 50-day average yesterday, the SPY, QQQ, and IWM remain in a precarious technical position if the bears happen to reengage. Toss in a huge day of earings, and the recipe for another day of volatile price is complete.

Trade Wisely,

Doug