Friday to Start Very Modestly Green

Stocks gapped a bit higher on retail earnings from BABA, BIDU, DG, DLTR, WSM, and M…even after Q1 GDP came in worse than expected. However, then the bulls really got running and rallied hard the first hour, continuing at a slower pace all the way into 1 pm. At that point, a sideways grind started near the highs in all 3 major indices that lasted more or less into the close. Consumer Cyclicals and Technology led the way on this risk-on day with the likes of TSLA, BABA, AMZN, HD, and NIO leading them higher. This left us with large white candles that had small upper wicks. On the day, SPY gained 2.00%, DIA gained 1.61%, and QQQ gained 2.77%. The VXX continued its fall to 23.26 and T2122 climbed even deeper into the overbought territory at 89.59. 10-year bond yields fell slightly to 2.742% and Oil (WTI) spiked 3.25% to $113.92/barrel.

During the day, Bloomberg reported that MSFT has told its MS-Office and Windows divisions to be more selective in hiring. The executive conveying the message cited tightening economic conditions. This falls in line with similar messages put forth by other tech giants like FB and NVDA. It also fits with the SNAP company-wide email saying the company would significantly miss its own guidance in at least the coming quarter.

After the close, COST, DELL, ULTA, ADSK, and MRVL all reported beats on both the revenue and earnings lines. Meanwhile, GPS and WDAY beat on revenue while missing on earnings. On the other side, FTCH missed on revenue while beating on earnings. However, AEO missed on both lines. It is worth noting that GPS slashed its forward guidance for the remainder of the year.

SNAP Case Study | Actual Trade

In other stock news, TWTR shareholders have sued Elon Musk claiming that he has manipulated the market, costing them a huge amount of money (TWTR is down 40% from when Musk’s stake was disclosed). The suit alleges that Musk is complaining about bots and making other tweets in order to manipulate the stock and negotiate a better price for the deal. Elsewhere, DAL has cut about 100 flights per day in the US in order to relieve pressure on its schedule. The airline said this will give them more flexibility to avoid flight delays caused by weather and especially staff shortages. BP has said it is now reviewing its investment plans in the face of the UK’s new 25% windfall profit tax on energy companies.

On the Russian invasion story, Russian leader Putin offered to allow Ukrainian grain exports from Odesa…if all sanctions against Russia are dropped. This nonstarter was just another attempt to divide the West as the UK and other “coalition of the willing” countries prepare their navies to sail to the Black Sea to force Russian compliance. Meanwhile, Russia is making slow, but steady gains in the Donbass region as Ukraine simply does not have the artillery, mortars, and air support to stack up against concentrations of Russian forces. This comes as it is reported the US will finally send long-range rocket systems to Ukraine. (This likely will not arrive until mid to late July.) Finally, Russia is also expected to default on their debt at midnight Moscow time. The US declined to give them a renewed exception from sanctions to allow them to pay through US banks.

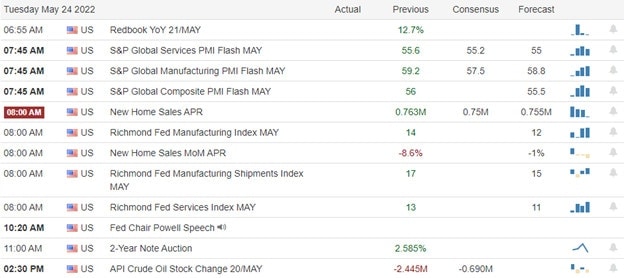

Overnight, Asian markets were mostly green on the day. Hong Kong (+2.89%), Taiwan (+1.86%), and India (+1.13%) led the region higher. In Europe, we see a similar story with only a flat Russia (-0.04%) and down Portugal (-1.13%) in the red at mid-day. The FTSE (+0.21%) lags again, but the DAT (+0.78%) and CAC (+0.84%) are leading the region higher. As of 7:30 am, US Futures are pointing toward a modestly green start to the day. The DIA implies a +0.10% open, the SPY is implying a +0.30% open, and the QQQ implies a +0.50% open ahead of data this morning. 10-year bond yields are down to 2.725% and Oil (WTI) is off a half of a percent to $113.54/barrel in early trading.

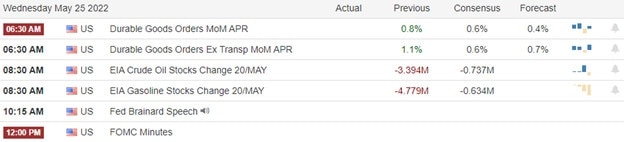

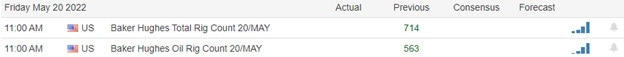

The major economic news scheduled for release Friday includes April Trade Goods Balance, April PCE Price Index, April Retail Inventories, and April Personal Spending (all at 8:30 am), and Michigan Consumer Sentiment (10 am). We also hear from Fed speaker Bullard (7:35 am). The major earnings reports scheduled for release include, BIG, PDD, and SAFM before the open. There are no earnings reports scheduled for after the close.

So far this morning PDD has reported beats on both lines. However, BIG and HIBB have reported misses on both the revenue and earnings lines.

The bulls did a great job on Thursday but will have their hands full preventing a fade today with the 3-day weekend ahead of us. So, be very wary of chasing moves today. The Bulls are challenging the downtrend, but there is still a lot of resistance and technical damage that will need to be overcome in the weeks ahead if we are destined to reclaim the all-time highs from the start of the year. Flat, nimble, or hedged might be the best way to go into the long weekend news cycle with inflation, recession, and geopolitical risks all on the table.

Remember, you do not need o trade every day or every week. Sitting out the markets and times that don’t give you an edge is smart, not lazy. Remember that the first rule of making big money in the market is to not lose big money in the market. Trading is a job. So, do the work and work the process. Stick with your trading rules, trade with the trend, and consistently take profits when you have them. Always move your stops in your favor. Don’t be stubborn. If you have a loss, just admit you were wrong and take it before it grows. As they say, the best time to have taken a $500 loss is when you are now staring at a $1,500 loss.

Ed

Swing Trade Ideas for your consideration and watchlist: No tickers today. You can find Rick’s review of tickers on his YouTube Channel here. Trade your plan, take profits along the way, and smart. Also, remember to check for impending earnings reports. Finally, remember that any tickers we mention and talk about in the trading room are not recommendations to buy or sell.

🎯 Mike Probst: Rick, Got CTL off the scanner today. Already up 30%. Love it.

🎯 Dick Carp: the scanner paid for the year with HES-thank you

🎯 Arnoldo Bolanos: LTA scanner really works $$, thanks Ed.

🎯 Bob S: LTA is incredible…. I use it … would not trade without it

🎯 Malcolm .: Posted in room 2, @Rick… I used the LTA Scanner to go through hundreds of stocks this weekend and picked out three to trade: PYPL, TGT, and ZS. Quality patterns and with my trading, up 24%, 7% and 12%…. this program is gold.

🎯 Friday 6/21/19 (10:09 am) Aaron B: Today, my account is at +190% since January. Thanks, RWO HRC Flash Malcolm Thomas Steve Ed Bob S Bob C Mike P and everyone that contributes every day. I love our job.

Hit and Run Candlesticks / Road To Wealth Youtube videos

Disclosure: We do not act on all trades we mention, and not all mentions acted on the day of the mention. All trades we mention are for your consideration only.

Free YouTube Education • Subscription Plans • Private 2-Hour Coaching

DISCLAIMER: Investing / Trading involves significant financial risk and is not suitable for everyone. No communication from Hit and Run Candlesticks Inc, its affiliates or representatives is not financial or trading advice. All information provided by Hit and Run Candlesticks Inc, its affiliates and representatives are intended for educational purposes only. You are advised to test any new trading approach before implementing it. Past performance does not guarantee future results. Terms of Service