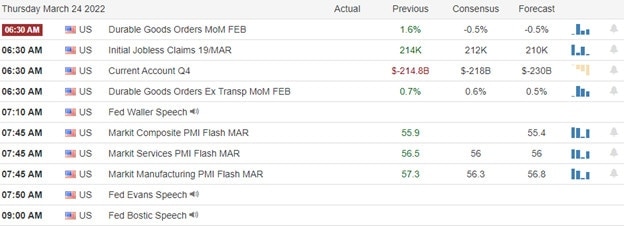

The bears reemerged yesterday, snapping the six-day winning streak and pushing the DIA below its 50- day average. However, the bulls held the SPY, QQQ, and IWM above the critical technical level. This morning we will turn our attention to Durable Goods, Jobless Claims, PMI, and the news coming out of the NATO meeting. As commodities prices continue to rise, so does inflation and the chances that the Fed will be forced to act more aggressively in May, keeping traders on edge and price action challenging. Plan your risk carefully.

During the night Asian market closed, mixed easing Covid restrictions but concerned about rising energy prices. European markets trade near the flatline this morning, focusing on the NATO meeting results today. U.S. futures markets are doing the standard premarket pump up ahead of economic data that could bring an extra dose of volatility should the durable goods number disappoint.

Economic Calendar

Earnings Calendar

As usual, Thursday is the biggest earnings day of the week, with about 80 companies listed with several unconfirmed. Notable reports include AMPS, CODX, DRI, FDS, MCW, NEOG, NIO, SGLB, SMRT, TITN, TMDI, & UFAB.

News and Technicals’

Russian President Vladimir Putin has been in power for more than two decades and, during that time, has carefully cultivated an image of himself as an authoritarian, strongman leader. Now, analysts say his decision to invade Ukraine is the biggest mistake of his political career and has weakened Russia for years to come. As a result, both economically and geopolitically, Russia’s position looks increasingly isolated and vulnerable. Three pressing threats loom large over the summit, requiring the alliance to determine its response and whether military intervention would be needed. That includes mistaken fire on an allied nation, cyberattacks on a NATO member state, and the possibility of chemical or biological warfare within Ukraine. NATO leaders are also expected to announce more humanitarian aid to Ukraine, particularly the embattled port city of Mariupol, a fresh round of sanctions and new pressure on Moscow’s energy sector. In addition, it is the first suspected launch of an ICBM since November 2017 during heightened tensions between North Korea’s Kim Jong Un and former U.S. President Donald Trump. While North Korea has conducted a flurry of ballistic missile tests in recent months, Thursday’s suspected launch of an ICBM represents a significant escalation. Clean energy and low-carbon-emitting companies would stand to benefit. Fossil fuel production companies stand to lose. Higher carbon footprint companies such as heavy manufacturing and industrial chemical companies will not be expected to decarbonize overnight, but they will need to disclose their emissions data. Compliance and auditing service companies will see a surge in demand, as will software companies that automate the processes. Treasury yields are back on the rise again this morning, with the 10-year trading up to 2.39% early Thursday morning and the 30-year rose slightly to 2.5313%.

The bears reemerged yesterday to relieve the recent rally’s short-term overextension slightly. While the DIA closed the day back below its 50-day average, the bulls were able to defend this critical technical level in the SPY, QQQ, and IWM. With no significant market-moving earnings report this morning, we will turn our attention to the Durable Goods number that analysts expect to come in with a negative reading. Nevertheless, it may give us some insight into the inflationary impacts on consumers and if it suggests a slowing of our economy is underway. Commodities prices continue to surge, with Brent crude topping 121 a barrel yesterday, but the national average gas prices stood firm at $4.24 and diesel at $5.14. We may also be sensitive to today’s NATO meeting with the U.S. sending more troops and leveling more sanctions against Russia with fears of chemical weapons rising. So, expect price volatility to remain challenging and keep an eye on the bond yields as they inch closer and closer toward inversion.

Trade Wisley,

Doug

Comments are closed.