It’s now clear that the bears were ready to defend price resistance levels in index charts leaving behind disturbing bearish engulfing candles as they overwhelmed the bulls. The T2122 Indicator suggests a very oversold short-term condition exists but with the DIA now less than 2% from its 200-day average, we can’t rule out a possible test. With COVID numbers rising in the US and Europe facing the possibility of a double-dip recession, the path forward is certainly uncertain. I expect price volatility will remain very challenging in the days ahead.

Overnight, in a volatile session, Asian markets closed in the red. European markets facing a resurgence of the virus trade mixed but mostly lower this morning concerned about the global economy. Ahead of earnings, Jobless Claims, and a lot more Fed speak US Futures point to muted and mixed open. Buckle up for another challenging day.

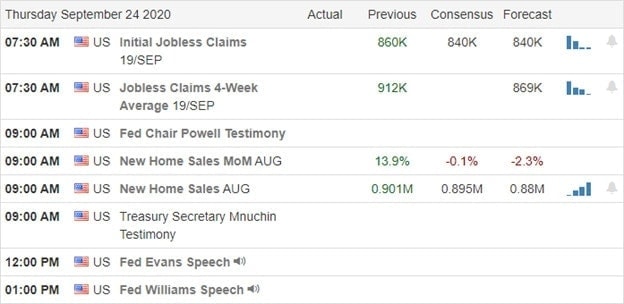

Economic Calendar

Earnings Calendar

We have our busiest earnings calendar this week, with 26 companies stepping up to report. Notable reports include DRI, COST, CAN, BB, KMX, FDX, JBL, RAD, TCOM, & MTN.

News & Technicals’

The early gap up gains quickly faded with the Dow giving up a 176 gain to finish the day down 525 points. With the DIA now less than 2% from its 200-day average, it now seems a likely target. After a Kentucky Court decision, protesters took to the streets that sadly resulted in 2 police officers shot as the protest turned violent. Thankfully both officers are expected to recover from there injuries. According to reports, Europe could be facing a double-dip recession with the pandemic spreading, creating new restrictions and obvious economic impacts. New cases are also rising again here in the US, putting a gloomy uncertainty over the market and path ahead for the US economy.

After a somewhat volatile overnight futures session, they currently point to a muted and mixed open ahead of earings, Jobless Claims, and a considerable amount of Fed speak. The technicals of the index charts are pretty ugly, but there is some hope with the T2122 Indicator suggesting a very oversold short-term condition. The significant bearish engulfing patterns left behind on the index charts are certainly dishearting, and we can’t rule out the possibility that the indexes might eventually test their 200-averages in the near future. However, if the news cycle gives us a little break, a modest relief rally could be in order. Traders will have to stay at the top of their game because wild price volatility is likely to remain quite challenging.

Trade Wisely,

Doug

Comments are closed.