Inspired by selling pressure around the world, the bears continued to drive the indexes lower, pushing the SPY below 4000 and the QQQ below 3000 at the close of the day. Today, we have another busy day of earnings data, a Fed speakers parade, and a 3-year bond auction. Indicators suggest a short-term oversold condition, but traders will need to remain nimble with key inflation numbers coming Wednesday and Thursday. So, plan your risk carefully with challenging price action expected in the days ahead!

Asian markets traded mostly lower as we slept, with Hong Kong extending Monday’s losses by another 1.84%. European markets see green across the board this morning rebounding to relieve some selling pressure though the indexes remain in downtrends. U.S. futures also look ready for a bit of relief in the selling this morning, pointing to a gap up open ahead of a busy day of earnings. AS you plan forward, remember the CPI number coming out before the market opens on Wednesday.

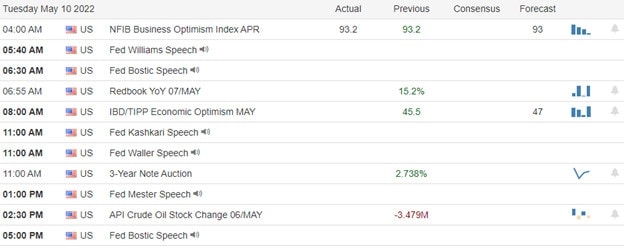

Economic Calendar

Earnings Calendar

Tuesday is a busy day with nearly 250 companies listed on the earnings calendar. Notable reports include OXY, BIRD, ARMK, BHC, SKIN, BLDR, ELY, CHH, COIN, CRON, EA, FOXA, FTCI, GFS, GMED, HL, IIVI, KGC, LI, LBTYA, MTTR, NXST, KIND, PTON, PLNT, RXT, REAL, RBLX, RKT, SOFI, SU, SWCH, SYY, TDW, TTD, U, VERX, WMG, WELL, FREE, WKHS, XL & XPEL.

News & Technicals’

According to new data from Realtor.com, the supply of homes for sale is finally showing signs of improvement. In April, inventory was 12% lower than the year-earlier month, the smallest year-over-year decline since 2019. The shift in supply is likely due to a slower sales pace stemming from the recent increase in mortgage rates, making expensive homes even pricier. However, the number of active listings is still down 67% from pre-pandemic levels. The most valuable publicly traded company, Apple, had seen its market capitalization trimmed by over $200 billion since Wednesday when the Fed raised interest rates by a half percentage point. However, like Campbell Soup, General Mills and J.M. Smucker, Staples have outpaced Big Tech in three trading days. Moscow last week made payments to holders of two dollar-denominated Russian sovereign bonds, maturing in 2022 and 2042 and worth a collective $650 million. Russia has benefited from an exemption in U.S. sanctions that allows bond payments to be made on Russian sovereign debt from sources authorized by the Treasury on a case-by-case basis. However, this exemption expires on May 25, and MSCI suggested that unless extended, it could trigger a default event when several Russian bond payments are due on May 27. Crypto project Terra is buying billions in bitcoin to support UST, a controversial stablecoin. Its creator Do Kwon believes bitcoin can become the “reserve currency” of the Terra ecosystem. However, that belief is being tested as UST falls below its $1 peg. Amazon recently fired two employees involved in the organizing effort at a Staten Island warehouse, where workers voted to join a union last month. Tristan Dutchin and Matt Cusick, who are part of the Amazon Labor Union’s organizing committee, said they were fired by Amazon last week. Treasury yields pulled back in early Thursday trading, with the 10-year trading at 3.02% and the 30-year declining to 3.13%.

The bears continued to drive the indexes lower Monday, with the SPY closing below 4000 and the QQQ ending the day below 3000. The Dow set a new 2022 low by a few ticks as the IWM pushed sharply lower. Interestingly even as the VIX rose, it seemed somewhat controlled, with the indexes largely chopping in a range most of the afternoon. The T2122 indicator is in a short-term oversold condition suggesting a relief rally may be possible soon. However, with a big day of earnings data and the tense geopolitical events, traders will have to stay focused on watching for intraday whipsaws. With the CPI number out Wednesday morning, get ready for another dose of volatility that could squeeze out short traders if there is an improvement or quickly inspire the bears to keep pushing for new market lows. So, buckle up as the wild ride continues!

Trade Wisely,

Doug

Comments are closed.