Last week’s financial failures quickly highlighted how fragile our banking system has become with a slowing economy and a quantitative tightening cycle to battle inflation. However, as federal regulators work to backstop the SVB failure, worries grow about just how far the contagion has already spread. Add in a massive week of market-moving economic data and the stage for another week of wild price volatility as investors face a very uncertain path forward. Expect face-ripping whipsaws of significant overnight reversals as the market comes to grips with inflation, a possible recession, and a slowing economy.

Asian markets trade mixed as Hong Kong surges 1.95% and Japan falls 1.11% as uncertainty grips the financial system. On the other hand, European markets trade decidedly bearish this morning as banks sell off 5.7% as the bank failures ripple through the monetary system. U.S. futures went on a rollercoaster ride at night after regulators announced a backstop plan for SVB as investors worry about the potential contagion spreading to other banks. Prepare for another wild day of price action.

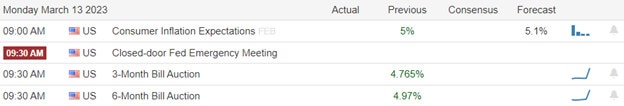

Economic Calendar

Earnings Calendar

With first-quarter earnings winding down and the stock buyback blackout period about to begin, so will all the hyper-earnings emotion until we begin the 2nd quarter silly season. Notable reports for Monday include GTLB & KOD.

News & Technicals’

Regulators approved plans Sunday to backstop depositors and financial institutions associated with Silicon Valley Bank. Officials will unwind both SVB and Signature Bank, ensuring that depositors can access their funds on Monday. The Federal Reserve stepped in with a separate facility that will provide loans for up to one year for institutions affected by bank failures. “Today, we are taking decisive actions to protect the U.S. economy by strengthening public confidence in our banking system,” leading regulators said in a joint statement.

Billionaire investor Bill Ackman said the U.S. government’s intervention to protect depositors after the implosion of Silicon Valley Bank is “not a bailout” and helps restore confidence in the banking system. In a tweet, Pershing Square CEO said SVB’s fallout on Monday noted the government did the “right thing.” But not all Wall Street analysts are convinced the regulator’s action will shore up confidence in the U.S. banking system and limit the fallout. “I don’t think that you can understate the danger that the American banking system is in,” veteran bank analyst Dick Bove told CNBC’s “Squawk Box Asia” on Monday.

“In light of the stress in the banking system, we no longer expect the FOMC to deliver a rate hike at its next meeting on March 22,” Goldman economist Jan Hatzius said in a Sunday note. The firm expects the latest measures to “provide substantial liquidity to banks facing deposit outflows” and boost confidence among depositors.

The failures of Silvergate and SVB banks brought out the bears in a big way last week, bringing to light just how fragile our banking system has become in the slowing economy. Suddenly the Fed is back into bailout mode as the market worries just how far the banking contagion might spread. Nevertheless, the futures market rallied sharply during evening trading after the decision to announce the SVC backstop plans to regulators. However, the bailout enthusiasm seems to have faded substantially this morning, and traders should plan for considerable price volatility as the market comes to grips with the uncertainty of what comes next. With a massive week of market-moving economic data, prepare for just about anything in the week ahead.

Trade Wisely,

Doug

Comments are closed.