Tuesday’s market extension shows a massive appetite for risk as we head into another rate increase and defiance of weak economic numbers. One thing is for sure the price action and emotion are at such a fevered pitch big point moves up or down are possible, making it a hazardous environment for retail traders. Will the market be right and Powell rolls over, or do the instructions have retail traders right where they want them? We will soon find out. Protect your capital, my friends.

Asian markets posted gains across the indexes, with the tech Hong Kong exchange leading the buying. European markets trade flat to slightly bullish this morning as they wait on the Fed’s next moves. After a considerable stretch into the Tuesday close, U.S. futures point to lower open ahead of a big day of earnings and economic reports that may make or break the current buying rally. So, buckle up; the stage is set for a wild price action day!

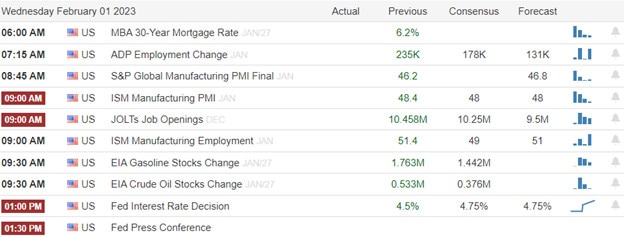

Economic Calendar

Earnings Calendar

Notable reports for Wednesday include ADTN, AFL, MO, META, ALGN, ALL, ABC, BSX, EAT, CHRW, CTVA, DXC, ELF, EBAY, EVR, FTV, HOLX, HUM, KLIC, MCK, MTH, MTG, NTGR, NVS, ODFL, OTIS, PTON, QRVO< RYN< SMG, TMO, TMUS & WM.

News & Technicals’

Annual gold demand jumped 18% to 4,741 tons (excluding over-the-counter or OTC trading) across the year. That’s the largest annual figure since 2011, fueled by record fourth-quarter demand of 1,337 tons. Key to the surge was a 55-year high of 1,136 tons bought by central banks across the year.

The Federal Reserve is expected to raise interest rates by a quarter point Wednesday, its smallest increase since it began hiking rates last March. Market pros expect Fed Chair Jerome Powell to sound hawkish, meaning he will lean toward tighter policy and keeping interest rates high. “Powell is more focused on inflation going down and staying down than trying to help the S&P 500,” said one strategist. “His legacy is not going to be determined by where credit spreads are or where the S&P is going. It’s going to be determined by whether he slayed inflation and it stayed down.”

CNBC’s Jim Cramer on Tuesday told investors that the market is in bull mode, so declines represent opportunities to buy on a dip. Stocks rose on Tuesday, with the S&P 500 reaching its best January performance since 2019 on strong corporate earnings and softer-than-expected inflation data.

The appetite for risk in defiance of economic numbers heading into another Fed rate increase is astonishing as the market continues to surge. So it seems one of two things is possible over the next couple of days. First, the markets are correct; Jerome Powell rolls over, and the market rallies despite the weakness of the consumer. Or, the institutions have the retail traders right where they want them as Powell continues his inflation fight, fleecing their accounts as the market extension falls. If that is not clear enough, there is a tremendous danger for the retail trader over the next few days! Protect your capital and plan for some big point moves up or down as the drama unfolds.

Trade Wisely

Doug

Comments are closed.