With the news the DOJ may begin anti-trust investigations of Google, Amazon and Facebook the QQQ dipped into correction territory yesterday. Amid all the current market uncertainty they choose now to pile on more uncertainty? There timing is impeccable considering that Fed member James Bullard said it might be necessary to lower rates sooner than later to deal with the economic impacts as the trade war uncertainty persist.

Futures are pointing to gap up open around 100 Dow points and perhaps signaling a relief rally may be in order. Remember a relief rally can be very brief so don’t mistake a little short covering as a recovery. We have significant technical damage that needs to be repaired as well as key price resistance levels above that must be reclaimed before recovery can begin. Consider your risk carefully and remember price volatility is likely to remain high.

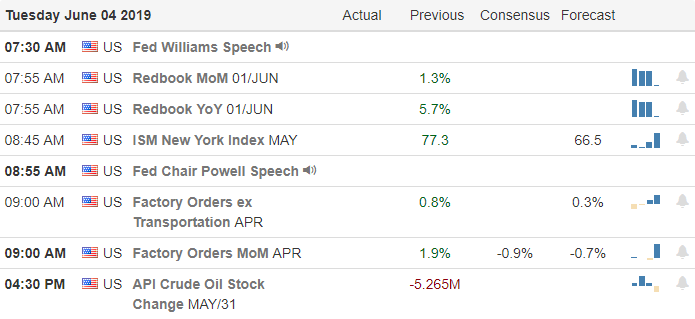

On the Calendar

On the Earnings Calendar we have just 19 companies reporting quarterly results. Notable reports include GME, CRM, CBRL & TIF.

Action Plan

It seems rather remarkable amid trade war concerns, Mexican tariffs and global slow down worries the DOJ has decided to begin anti-trust investigations against Google, Amazon and Facebook after years of complaints. Their timing is impeccable don’t you think? James Bullard a voting member of the CBOE suggested yesterday that trade war concerns may warrant a reduction in the interest rate raising fears of economic impacts. His comments created significant price volatility as the market grappled with the implications.

US Futures are currently suggesting a gap up of more than 100 points this morning and perhaps signaling a relief rally to test resistance levels of price and downtrend. There is tremendous technical damage so I would not expect the bulls to rush back in a big way but perhaps we have found at least a short-term bottom after the QQQ officially reached correction territory yesterday. Be careful not to chase the morning gap to avoid the possible pop and drop pattern like we experienced yesterday. Remember volatility is likely to remain high so intra-day whips and reversals may challenge the resolve of even the most experienced traders.

Trade Wisely,

Doug

Comments are closed.