With Yellen suggesting the higher rates may be on the way to prevent the market from overheating, she created a nasty market whipsaw that produced some technical damage in the QQQ. On the other hand, the DIA bounced strongly enough to set up a new record high for the index if it can follow through today. Unfortunately, that’s been the problem for the last couple of weeks; inability to follow through! With a big day of earnings and private payroll number just around the corner, one has to wonder who it will inspire today? Bulls or Bear?

Overnight Asian markets closed in the red with modest declines across the board. However, European markets are decidedly bullish this morning, with the DAX up more than 1%. Ahead of earnings and jobs data, the Dow futures are trying to add to yesterday’s whipsaw rally, pointing to bullish open. Be careful rushing in until we see some actual follow-through buying. Remember, the pop and drops of late in this wide-ranging consolidation can be very punishing.

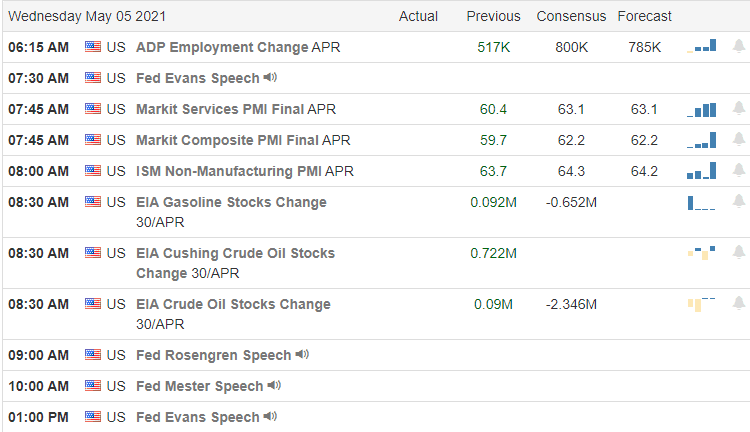

Economic Calendar

Earnings Calendar

The hump day earnings calendar is a busy one, with more than 200 companies scheduled to reveal quarterly results. Notable reports include GM, ALB, ABC, GOLD, BKNG, BWA, CERN, CF, CLH, CYBR, EMR, ETSY, FSLY, FOX, GDDY, HLT, HFC, HUBS, KTOS, LNC, LL, MTW, MRO, MET, NYT, NVO, NUS, PYPL, QRVO, QLYS, RLT, RGLD, SMG, SSYS, RGR, RUN, SKT, TRMB, TUP, HEAR, TWLO, UBER, WW, & ZNGA.

News & Technicals’

Janet Yellen spouted off about the need to raise rates to prevent the market from overheating, creating nasty whipsaw intraday. She later clarified that she is not predicting it will need to go up or as to when it will be necessary. Well, thank you very much! If the volatility created cost you some money yesterday, make sure to send her a thank you card. Yellen then said, “We propose to raise the global minimum tax and to close tax loopholes that allow American corporations to shift earnings abroad,” at the Wall Street Journal’s CEO Council Summit. Get ready for global taxation. President Joe Biden set the goal of getting 70% of U.S. adults to receive at least one dose of a Covid vaccine by July 4. The White House will also aim to have 160 million adults fully vaccinated by Independence Day, senior administration officials said. Treasury yields declined yesterday, but this morning ahead of the private payrolls, data have once again started to creep higher. The 10-year traded at 1.605% this morning, and the 30-year edged higher to 2.278%.

Yesterday’s price action produced some technical damage in the QQQ, with the index dropping through support levels of price and current trend. That left behind a somewhat significant price resistance level that the tech sector will now have to overcome. However, the DIA produced a strong bounce-off of price support to create possible new record highs if the index can find the energy to follow through today. The bounce in the SPY was also productive, but it also now has a price resistance level to deal with to move higher. One thing for sure this wide-ranging consolidation filled with chop and whipsaws is challenging and very frustrating. Be careful not to overtrade! Today begin to focus on jobs numbers, the private payrolls, jobless claim on Thursday, followed by the Employment Situation numbers Friday morning. Stay focused and flexible with more than 200 companies reporting and inflation worries and all the talk of higher rates and taxes; there is a lot for the investors to digest. Anything is possible.

Trade Wisely,

Doug

Comments are closed.