A deal on infrastructure and another Trillion in deficit spending inspired the bulls to record highs in the SPY and QQQ, with the technicals in the DIA and IWM continuing to improve. After the bell, the big banks all passed their stress tests, and blowout earnings from NKE continued to inspire buyers in the overnight futures session. Assuming we get past the pesky inflation data coming out before the bell, it looks like we can bullishly party on right into the weekend.

Asian markets closed green across the board, lead by the HSI, which surged 1.40% by the close. Across the pond, European markets trade mixed with inflation worries and fears of tapering raising caution. However, U.S. markets don’t seem to at concerned about inflation, pointing to a bullish open ahead of key inflation data. After such a strong recovery rally, don’t forget to take some profits as we slide into the weekend.

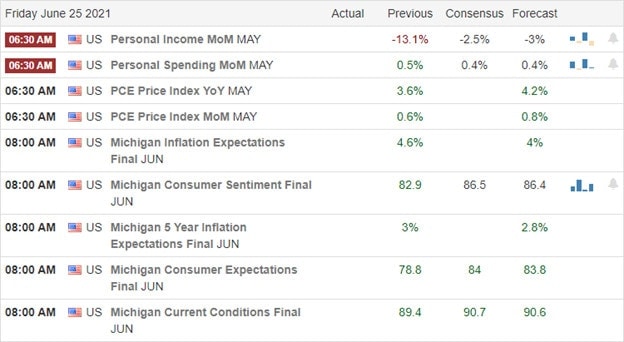

Economic Calendar

Earnings Calendar

On the Friday earnings calendar, we have a total of 16 companies listed, with just six verified reports. Notable reports include KMX, JKS, & PA.

News and Techinicals’

The big banks get clean bill health after all passing their stress tests as expected, with the FOMC continuing to push 120 billion a month. A bipartisan Senate group agreed on an infrastructure bill totaling nearly $1 Trillion without a plan to pay for it other than printing more money. The market surged high on this news because there is nothing this market likes more than deficit spending. It makes you wonder if they will be as inspired when it comes time to pay the piper? According to the National Association of Manufacturers, supply chain disruptions and inflated prices are not diminishing due to workforce shortages, and demand exceeds supply. Hackers are now attacking PC gamers with the malware “Crackonosh” hidden in free versions of games. Once installed, it hijacks the computer’s processing power to mine cryptocurrencies for the hackers. The 10-year Treasury yields edge higher this morning ahead of inflation data, trading this morning at 1.489%, with the 30-year dipping slightly to 2.093%.

Yesterday’s big gap up at the open quickly lost momentum until the announcement of another trillion of deficit spending was on the way for infrastructure. For now, deficit spending is like stock market crack, and we can’t seem to get enough these days. New records in the SPY and QQQ and the technicals continued to improve in the DIA and IWM. After the bell, the banks passed their stress tests, continuing to inspire the bulls in the overnight futures session with the DIA set to recover its 50-day on the opening gap. There is just one hurdle to cross this morning on inflation with the Personal Income and Outlays report before the bell. If there is no stumble there, a bullish push to close the week strong looks very likely. Party on!

Trade Wisley,

Doug

Comments are closed.