It has been 11 weeks since the bears have a chance to eat and yesterday snack was just a reminder they are still there and still hungry. Yesterday, price action was also a reminder that no matter how strong a trend may appear, price resistance in the chart should be respected by traders at all-times! Notice I didn’t say that resistance is something to fear, only that it must be respected an approached with a little caution and a plan for the what if.

Although yesterdays selloff created some market fear and volatility, technically very little damage was done at least at this point. If the bulls get back to work then yesterday move could prove to just that reminder that the bears are still lurking about and we can never get complacent in our trading. On the other hand if the bulls stumble again we could see a push down to test the next levels of support. Keep in mind price resistance is still above and the bears have given us a gentle reminder of their willingness to defend it so plan your risk accordingly.

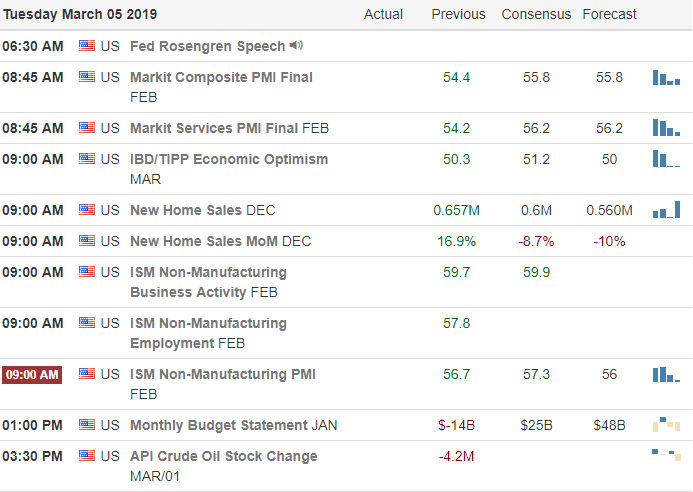

On the Calendar

On the Earnings Calendar we have nearly 120 companies reporting results today. Among the notable reports are: CRM, AVAV, AMBA, CIEN, KSS, ROST, SINA, TGT, URBN, VSLR & WB.

Action Plan

After a painful pop and drop yesterday futures are pointing to a modest open but there is a challenge ahead on the Economic Calendar that has the potential to trip the bulls. At 10:00 AM Eastern we will get the New Home Sales numbers that disappointed the market in the last report. The last reading was 657K, analysts lowered the consensus target to 590K today. If they lowered the expectation enough perhaps it won’t be a problem but if the actual number comes in less than expected once again we could see some additional selling.

Yesterday selloff certainly created a little fear but overall the technical damage is minimal at this point. If the bulls can step up their efforts we could easily see the indexes slide right back into consolidation as we wait for news on a US/China trade deal. However, if the bulls happen to stumble again the bears could be emboldened to test lower supports. Once again that 10 AM report could be very important as to which side gains the edge. As always stay focused on price and remember to trade the chart for what it is, not what you want it to be.

Trade Wisely,

Doug

Comments are closed.