After cutting rates for the second time, the market seems a bit disappointed this morning the, FOMC didn’t clearly signal more rate cuts this year. With Powell pointing to strong US economic indicators and with three dissenting committee members on this cut, the path to future reductions looks challenging. During the night the BOJ held current rates, and this morning the Bank of England did the same. Unfortunately, there is still plenty of uncertainty with a possible Iran retaliation action, Brexit, US/China trade talks & scheduled tariff increases to make the weeks ahead challenging.

Asian markets closed mixed but mostly higher with Hong Kong markets continuing to slide south as the unrest in the country continues. This morning European markets are all modestly higher after the BOE decision to stand fast on interest rates. US Futures point to modest declines at the open ahead of a busy morning on the economic calendar of possible market-moving reports. Keep your seat belt fastened the road ahead could still be very challenging to navigate.

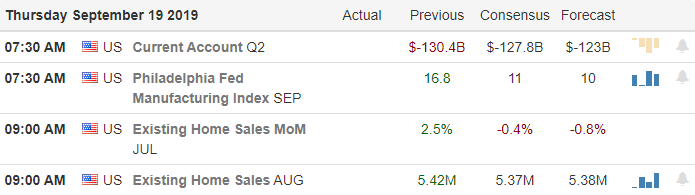

On the Calendar

On the Thursday earnings calendar, we have just 11 companies reporting results with DRI as one of the most notable on the day.

Action Plan

Evidence is growing from the remnants of the drones and cruise missiles used in the Saudi oil fields attack that Iran is the culprit. Saudi Arabia will present its evidence to the United Nations and framing the incident as a global community threat. The President has ordered much tougher sanctions against Iran but to this point has shown constraint for a military confrontation. A day after the FOMC decision US Futures point to a modestly lower open seemingly disappointed with the FOMC decision.

During the evening the Bank of Japan choose to hold rates steady, and this morning Bank of England decided to stand pat on interest rates even as Brexit uncertainty grows. With that now out of the way the market will likely focus on the coming US/China trade talks early next month, the issues surrounding the intensifying Brexit decision, as well as the coming 4th quarter earnings. A possible retaliation attack on Iran remains a wild card that could upset the applecart in the short-term.

Trade Wisely,

Doug

Comments are closed.