As the corporate earnings season accelerates, stock futures fell in premarket trading on Tuesday. Investors are closely watching third-quarter earnings, with about 20% of the S&P 500 companies set to report their results this week. So far, approximately 14% of the companies in the index have shared their earnings. Despite being early in the season, there are concerns on Wall Street that expectations for corporate America might be too high. Megan Horneman, Chief Investment Officer at Verdence Capital Advisors, believes that 2025 estimates are overly optimistic, even after recent adjustments. She also noted that investors will be paying close attention to discussions on interest rates, inflation, and the overall economic outlook during this earnings season.

On Tuesday, European markets saw a decline as investors evaluated earnings reports from key companies across the region. Despite the overall downturn, technology stocks managed to rise by 0.8%, driven by a notable performance from SAP. The software giant’s shares surged over 5% to a record high following an upward revision of its revenue guidance, fueled by robust growth in its cloud business. Conversely, the utilities and telecom sectors were the day’s laggards, falling by 2.05% and 1.43%, respectively. Shipping giant Maersk initially saw its shares climb 3.3% after upgrading its full-year earnings forecast due to strong container demand, but the gains were short-lived as the stock reversed to close 1% lower.

On Tuesday, Asia-Pacific markets experienced a general downturn, with most indices closing in the red amid a light day for economic data from the region. Australia’s S&P/ASX 200 dropped 1.66% to 8,205.7, marking its lowest point in nearly two weeks. South Korea’s Kospi fell 1.31% to 2,570.7, and the small-cap Kosdaq saw a significant decline of 2.84%, reaching its lowest level in over a month. Japan’s Nikkei 225 decreased by 1.39% to 38,411.96, while the broader Topix index fell 1.06% to 2,651.47. In contrast, Hong Kong’s Hang Seng index edged up 0.12% in its final hour of trading, and mainland China’s CSI 300 rose 0.57% to close at 3,957.78.

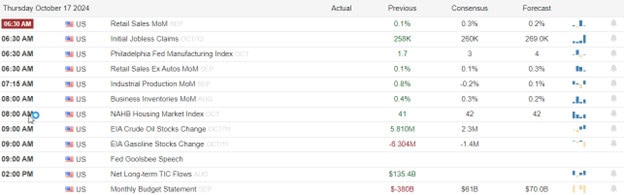

Economic Calendar

Earnings Calendar

Notable reports for Tuesday before the bell include GE, VZ, MMM, AOS, AUB, BANC, CMCSA, CBU, DHR, DENN, FL, GATX, GPC, HRI, IVZ, KMB, MCO, ONB, PCAC, PNR, PM, PII, PHM, DGX, RTX, & SHW. After the bell reports include ADC, BKR, BDN, CNI, CSGP, EWBC, ENVA, ENPH, HIW, JBT, MANH, MTDR, NBR, NBHC, PKG, PFSI, RRC, ROIC, RHI, STX, LRN, TXN, TRMK, VMI, VBTX, & VICR.

News & Technicals’

On Tuesday, Russia is hosting the latest BRICS summit, welcoming its allies in a display of strength aimed at the West. Originally formed as a coalition of rapidly developing economies, the BRICS group—comprising Brazil, Russia, India, China, and South Africa—has evolved into a significant geopolitical forum. The group’s influence has further expanded with the addition of Egypt, Ethiopia, Iran, and the United Arab Emirates in January. Russian President Vladimir Putin often speaks of his vision for a “new world order” designed to challenge and potentially surpass the geopolitical and economic dominance of the U.S.-led Western world.

HSBC has announced a significant restructuring, introducing a new geographic setup, streamlined operations, and appointing its first female Chief Financial Officer. This marks the second major leadership change for the bank in recent months, following the appointment of former finance chief Georges Elhedery as CEO in July. The reorganization will see HSBC divided into four key divisions: Hong Kong, U.K., international wealth and premier banking, and corporate and institutional banking. This overhaul aims to enhance the bank’s operational efficiency and strategic focus across its global markets.

The U.S. government is in the final stages of reviewing measures aimed at restricting investments into China, particularly in sensitive technologies such as artificial intelligence. According to a recent update, the Treasury Department will soon require notifications for outbound investments into these areas. The final rules are expected to be released within the next week. The Treasury Department highlighted the potential risks to U.S. national security posed by the military, intelligence, surveillance, and cyber applications of these technologies, especially when developed by countries of concern like China.

The U.S. government is in the final stages of reviewing measures aimed at restricting investments into China, particularly in sensitive technologies such as artificial intelligence. According to a recent update, the Treasury Department will soon require notifications for outbound investments into these areas. The final rules are expected to be released within the next week. The Treasury Department highlighted the potential risks to U.S. national security posed by the military, intelligence, surveillance, and cyber applications of these technologies, especially when developed by countries of concern like China.

Gold has entered a new bullish phase, according to Paul Wong, market strategist at Sprott Asset Management. This surge is driven by factors such as increased central bank buying, rising U.S. debt, and a potential peak in the U.S. dollar. Wong’s comments follow gold’s recent climb to a record high of $2,700 per ounce. Many analysts are optimistic that this upward trend will continue, with some forecasting that gold prices could surpass $2,800 within the next three months.

The price volatility is likely to expand as the earnings season accelerates with about 15% of the SP-500 expected to report throughout the remainder of the week. Before establishing any new trade, it would be wise to check the earnings date before pulling the trigger. There is a growing concern that earnings estimates are to high so plan carefully and be prepared if reports happen to disappoint.

Trade Wisely,

Doug

Comments are closed.