U.S. stock futures edged up slightly on Thursday as investors awaited the release of initial weekly jobless claims data and September retail sales figures at 8:30 a.m. ET. These reports are expected to provide insights into the health of the labor market and consumer spending in the U.S. Additionally, corporate earnings reports are set to continue, with Travelers, Blackstone, and Elevance Health among the major companies reporting Thursday morning. Regional banks, including KeyCorp, M&T Bank, and Truist Financial, are also scheduled to release their earnings, adding to the day’s financial data.

European markets saw an uptick on Thursday morning as traders anticipated the upcoming monetary policy decision from the European Central Bank (ECB). The banking sector led the charge, with the banking index rising nearly 1.3%, while telecom stocks saw a slight decline of 0.5%. The ECB is expected to announce its third interest rate cut of the year, responding to inflation risks in the European Union that are diminishing more rapidly than anticipated. In September, inflation in the euro area cooled to 1.8%, falling below the ECB’s 2% target.

Most Asia-Pacific markets experienced a downturn on Thursday following a lackluster briefing from China’s housing ministry, which failed to meet investor expectations and led to a significant drop in the country’s property stocks. In Japan, exports declined by 1.7% in September compared to the same month last year, while import growth for the same period was 2.1%, falling short of forecasts. Meanwhile, Australia reported a slight decrease in its unemployment rate for September, which came in at 4.1%, marginally lower than the figure predicted by a Reuters poll.

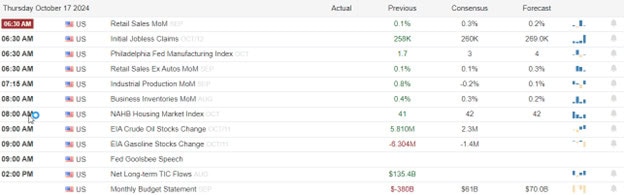

Economic Calendar

Earnings Calendar

Notable reports for Wednesday before the bell include BMI, BX, CMC, ELV, HBAN, IIIN, IRDM, KEY, MTB, MAN, MMC, SNA, TCBI, TRV, TFC, WBS, & WNS. After the bell reports include NFLX, OZK, CCK, ISRG, FNB, WDFC, & WAL.

News & Technicals’

TSMC reported a net income of 325.3 billion Taiwanese dollars ($10.1 billion) for the July-September quarter, exceeding the LSEG estimate of 300.2 billion Taiwanese dollars. The company’s net revenue for the third quarter reached $23.5 billion, marking a 36% increase year-on-year. As the world’s largest producer of advanced chips, TSMC continues to serve major clients like Apple and Nvidia, highlighting its pivotal role in the global semiconductor industry.

Novavax announced that the Food and Drug Administration has placed a hold on its application for a combination shot targeting both Covid-19 and influenza, as well as a stand-alone flu vaccine. This decision, which caused a sharp decline in the company’s shares, stems from a single report of nerve damage in a patient who received the combination shot during a phase two trial completed in July last year. This development represents a setback for Novavax, which is urgently working to introduce new products to the market amid declining global demand for its Covid-19 vaccine.

Shares of Lucid Group declined during after-hours trading following the announcement of a public offering of nearly 262.5 million shares of its common stock. The electric vehicle startup plans to use the proceeds from this offering for general corporate purposes, which may include capital expenditures and working capital. This move aims to bolster the company’s financial position as it continues to expand its operations and market presence.

The Biden administration announced the forgiveness of an additional $4.5 billion in student debt, benefiting over 60,000 borrowers. This latest round of relief stems from the U.S. Department of Education’s improvements to the Public Service Loan Forgiveness program, which has faced challenges in the past. Eligible borrowers can expect to receive notifications about their cancelled debt in the coming weeks, marking a significant step in the administration’s ongoing efforts to address student loan burdens.

With a big round of earnings and economic reports that begin with initial weekly jobless claims, expect some price volatility with the T2122 indicator flashing an overbought warning. We will also have to digest Retail Sales, Philly Fed Mfg., Industrial Production, Business Inventories, Housing Market Index, Natural Gas, Petroleum and more Fed talk from Goolsbee. So, buckle up it could be a wild and woolly day!

Trade Wisely,

Doug

Comments are closed.