Stock futures remained flat as investors wait for directional signals of follow-through up or down. This week’s earnings reports have been a mixed bag, with strong performances from major banks being counterbalanced by weaker outlooks from companies like UnitedHealth Group and Dutch chipmaker ASML. Investors are particularly focused on upcoming reports from Morgan Stanley and Abbott Laboratories, due before the market opens. Bryn Talkington, managing partner of Requisite Capital Management, mentioned on CNBC’s “Closing Bell” that the stock market is expected to be volatile in the coming weeks as investors navigate through earnings season and the presidential election.

European markets saw a decline as global market sentiment deteriorated. However, the FTSE 100 stood out among major regional indices, rising by 0.6% following the release of U.K. data indicating a significant drop in the inflation rate to 1.7% in September. Among individual stocks, LVMH experienced a notable drop of 6.3% at the opening, while British hotel group Whitbread emerged as the best performer, with its shares increasing by 3.7%.

Asia-Pacific markets experienced a downturn as investors remained cautious, anticipating potential stimulus measures aimed at bolstering China’s real estate sector. The upcoming press briefing by China’s housing minister on Thursday is expected to shed light on these measures. Meanwhile, New Zealand reported a 2.2% increase in its consumer prices index for the third quarter, indicating rising inflationary pressures. In South Korea, the seasonally adjusted unemployment rate slightly increased to 2.5% in September from 2.4% in August, reflecting minor fluctuations in the labor market.

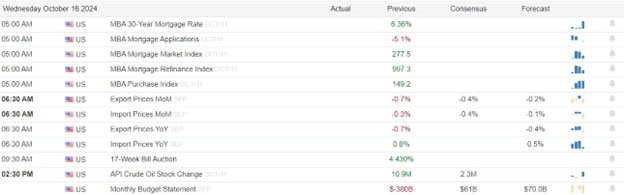

Economic Calendar

Earnings Calendar

Notable reports for Wednesday before the bell include ABT, ASML, DFG, FHN, MS, OFG, PLD, SYF, USB, & WAFD. After the bell reports include AA, CNS, CCI, CSX, DFS, EFX, FR, HOMB, KMI, PPG, REXR, SLG, STLD, & SNV.

News & Technicals’

United Airlines reported third-quarter revenue and earnings that exceeded Wall Street expectations, signaling a strong performance. The airline also announced a $1.5 billion share buyback, marking its first repurchase since the onset of the Covid-19 pandemic. Additionally, United’s fourth-quarter earnings estimate surpassed analysts’ forecasts, further highlighting the company’s positive financial outlook.

On Wednesday, Asian and European chip stocks declined following disappointing sales forecasts from Dutch semiconductor equipment maker ASML, which negatively impacted global stocks in the sector. In Asia, Japan’s Tokyo Electron experienced the most significant losses, with its stock plummeting nearly 10%. Meanwhile, in Europe, ASML’s stock fell for the second consecutive day, losing 4% of its value. ASML’s CEO, Christophe Fouquet, highlighted customer caution in the company’s early released results, noting that the recovery is progressing more gradually than previously anticipated.

Boeing announced plans to raise up to $25 billion to strengthen its balance sheet, a move aimed at enhancing its financial stability. In a separate filing, the company disclosed that it has secured a $10 billion credit agreement with banks. Despite these efforts, Boeing is under scrutiny from credit ratings agencies, which have issued warnings that the company could lose its investment-grade rating. This highlights the ongoing financial challenges Boeing faces as it navigates a complex economic landscape.

Venture funding for cloud startups in the U.S., Europe, and Israel is expected to increase by 27% year-over-year, marking the first rise in three years, according to a report from VC firm Accel. Of the $79.2 billion raised by cloud firms, 40% was allocated to generative AI startups. Philippe Botteri, a partner at Accel, highlighted the dominance of AI in the sector, stating that “AI is sucking the air out of the room” in an interview with CNBC. This trend underscores the growing focus and investment in AI technologies within the cloud industry.

Mortgage Apps number came with a substantial disappointment this morning as investors wait for directional signals of what the follow-though will look like today. The ASML early report had bearish effects not only here in the U.S. but also translated into selling around the world last night. Of course, earnings results or the economic numbers are likely to provide the inspiration for the bulls or bears to make that decision. Remember that Thursday is a very big day of economic reports so plan your risk accordingly.

Trade Wisely,

Doug

Comments are closed.