Stock futures saw a slight rebound following a challenging day on Wall Street, where rising oil prices and bond yields exerted downward pressure on the markets. On Tuesday morning, these factors eased somewhat, improving investor sentiment. The 10-year Treasury yield notably climbed above 4%, reaching its highest level since early August, while West Texas Intermediate oil futures rose above $77 per barrel, impacting the broader market negatively. However, the energy sector benefited from the rise in oil prices, making it the only one of the 11 sectors in the S&P 500 to close Monday in positive territory. Investors are now turning their attention to upcoming economic data on small businesses and the trade deficit.

European markets continued to decline as regional sentiment worsened amid ongoing concerns about the Middle East conflict. Mining stocks led the losses, dropping 4.54%, while household goods fell by 2.37%. European luxury stocks, including major brands like LVMH and Kering, also opened lower as hopes for a demand boost from Chinese stimulus measures faded. This downturn follows a shaky start to the week, reflecting broader investor apprehension.

Chinese markets experienced a volatile session following a briefing from the National Development and Reform Commission that lacked specifics on additional stimulus measures. The CSI 300 index in mainland China surged over 10% at the opening but eventually trimmed its gains to close 5.93% higher at 4,256.1. Meanwhile, Hong Kong’s Hang Seng index saw a dramatic drop of over 10% before recovering slightly to end with a 9% loss. Other Asia-Pacific markets also faced declines, influenced by Japan’s economic data showing a 1.9% year-on-year decrease in household spending for August, marking the steepest decline since January.

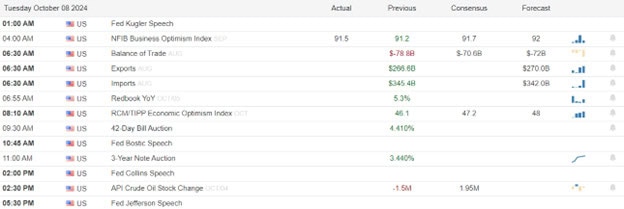

Economic Calendar

Earnings Calendar

Notable reports for Monday before the bell notable reports include PEP, & ACCD. After the bell there are no notable reports.

News & Technicals’

Uber is enhancing its platform with new sustainability-focused features. One notable addition is the “EV preference” option, allowing customers to choose fully electric vehicles by default when hailing a ride. On the delivery side, Uber Eats is expanding its offerings to include farmers’ market produce in New York City and Los Angeles. For drivers, Uber is introducing an “EV Mentor” program and an AI chatbot powered by OpenAI’s ChatGPT, designed to assist drivers with questions about purchasing and using battery electric vehicles instead of traditional gas-powered ones. These updates reflect Uber’s commitment to promoting environmentally friendly practices across its services.

A Delaware bankruptcy judge has approved FTX’s reorganization plan nearly two years after the cryptocurrency exchange filed for bankruptcy. The company has amassed between $14.7 billion and $16.5 billion in assets, which it intends to distribute to its creditors. Under the court-approved plan, 98% of FTX’s creditors are expected to receive 119% of their allowed claims, marking a significant recovery for those affected by the exchange’s collapse.

On Tuesday, South Korean tech giant Samsung Electronics announced that it anticipates lower-than-expected profits for the third quarter. The company, a leading memory chip manufacturer, projected an operating profit of approximately 9.10 trillion won, a significant increase from last year’s 2.43 trillion won. However, this figure falls short of the 11.456 trillion won ($7.7 billion) forecasted by analysts polled by LSEG for the quarter ending September 30.

Super Micro shares surged by 15% after the computer server company announced it is shipping over 100,000 graphics processing units (GPUs) per quarter, driven by the growing demand for artificial intelligence. As a major player in the AI boom, Super Micro provides computers that serve as servers for data storage, websites, AI training models, and more. Despite this positive momentum, the company is currently about nine weeks behind in releasing its annual report, which was initially expected in August.

Although the easing bond yields are providing a slight rebound this morning, we should remember the indexes remain within their choppy range and market breadth remains very low. Of course, big moves are possible if something changes in the Middle East. Other than that, the market will likely continue to chop until waiting on FOMC minutes, CP, PPI and beginning of earnings season on Friday. Trade wisely and try not anticipate ahead of these big data points.

Trade Wisely,

Doug

Comments are closed.