S&P 500 futures point upwards on Thursday morning as the bulls look to extend the one stock that rules them all, NVDA. In addition to monitoring the stock market’s movements, investors are gearing up to dissect a slew of new economic data slated for release in the latter half of the week. Key among these are the initial jobless claims figures and housing starts data, both due this morning.

European stock markets opened on an optimistic note on Thursday morning, buoyed by a series of key monetary policy announcements. The Swiss National Bank (SNB) contributed to the positive sentiment by reducing its policy rate by 0.25 percentage points to 1.25%, marking a cautious yet significant move in its monetary stance. Meanwhile, Norway’s central bank has opted for stability, maintaining its policy interest rate at 4.5%. All eyes in the United Kingdom are now turned towards the Bank of England’s rate decision, which is due later today.

In a day marked by a general downturn in the Asia-Pacific markets, China stood out by maintaining stability in its monetary policy, holding its one- and five-year loan prime rates steady at 3.45% and 3.95%, respectively. On a brighter note, New Zealand’s economy showed signs of resilience, emerging from a technical recession with a 0.2% growth quarter-on-quarter in the initial three months of the year.

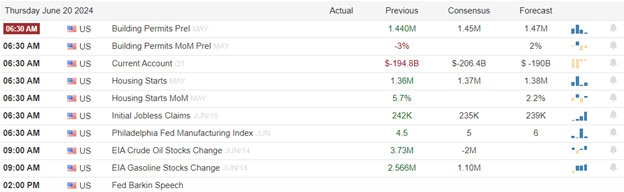

Economic Calendar

Earnings Calendar

Notable reports for Thursday before the bell include ACN, CMC, DRI, GMS, JBL, KR, & WGO. After the bell include SWBI.

News & Technicals’

Amid escalating tensions in the Middle East, Hezbollah has issued a stark warning, indicating a stance of no restraint or “no red lines” should a comprehensive conflict break out between Lebanon and Israel. The militant group’s Secretary General, Sayyed Hassan Nasrallah, has publicly claimed that Hezbollah possesses intelligence suggesting Israel is actively engaging in military exercises within Cyprus as a precursor to war with Lebanon. In response to these allegations, Cyprus’ President Nikos Christodoulides has firmly denied any involvement in such hostilities. On Wednesday, he emphasized Cyprus’ neutral position, asserting that the nation is not a participant in the conflict but rather a contributor to the peace process. This statement from the Cypriot leader seeks to clarify the island nation’s role and dispel any misconceptions about its stance amidst the growing regional unrest.

The Swiss National Bank (SNB) has reduced its key interest rate by 25 basis points, bringing it down to 1.25%. This marks the institution’s second rate cut within the year, aligning with the predictions of two-thirds of the economists surveyed by Reuters. The consensus had been leaning towards this exact quarter-percentage-point reduction. Meanwhile, Switzerland’s inflation rate has stabilized at 1.4% in May, following a transient increase the previous month. The SNB forecasts that this inflation rate will maintain a steady average throughout the entirety of 2024. This proactive approach by the SNB reflects its commitment to balancing economic growth with price stability, amidst a landscape of fluctuating global financial conditions.

The mortgage landscape has seen a slight easing this week, as the average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances (up to $766,550) experienced a dip to 6.94% from the previous 7.02%. This marginal decrease comes amidst a broader context where mortgage applications for home purchases have shown a modest uptick of 2% over the week. However, this figure still trails by 12% compared to the same period last year, underscoring a year-over-year slowdown in the housing market. Initially, mortgage rates inched higher at the start of the week, but the trend reversed following Tuesday’s announcement of weaker-than-anticipated retail sales data, which prompted a pullback in rates. This fluctuation reflects the ongoing responsiveness of mortgage rates to economic indicators and market dynamics.

Despite its already extended condition NVDA looks to gap higher as the once stock that rules them all becoming the most valuable company in the world last Tuesday. Leadership in the market is however extremely thin so watch these tech titans careful as a turn lower could a trigger a painful pullback for those chasing in a fear of missing out.

Trade Wisely,

Doug

Comments are closed.