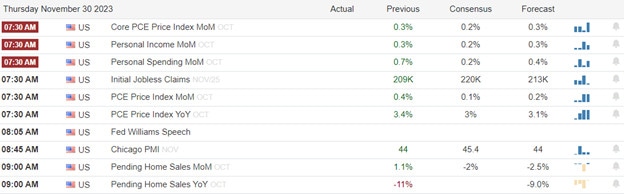

After an energetic gap up to begin the Wednesday session, it faded away after more tough-talking Fed speak to end the mostly flat suffering from low-volume and declining market breadth. Today has the potential to a wild on with Jobless Claims, PCE figures, and a dozen or notable earnings events for investors to decipher. With pre-market futures pumping hard this morning working to finish the month strong we can’t rule out the possibility of a big point whipsaw so be prepared. If OPEC decides to cut production in today’s meeting it would be wise to keep an eye on the energy sector as well.

While we slept Asian markets closed the day green across the board despite another month of manufacturing declines in China. European markets are also bullish this morning as they work to close November strong. Overnight futures gained strength pointing to a gap up that may well pop the Dow to a new high for the year but be careful the data out this morning could provide considerable price volatility including big point whipsaws.

Economic Calendar

Earnings Calendar

Notable reports for Thursday include ASO, AMBA, AMWD, BIG, CBRL, DELL, DOMO, FRO, KR, PD, RY, TITN, TD, UBS, ULTA, PATH, ZUMZ.

News & Technicals’

Sweden’s bid to join NATO has been delayed by the opposition of two member states, Hungary and Turkey. Sweden, along with Finland, applied to join the military alliance in May 2022, hoping to strengthen their security and cooperation with other European countries. Finland became a full member of NATO in April 2023, but Sweden’s accession has been stalled by the veto of Hungary and Turkey, who have expressed concerns over Sweden’s stance on human rights, migration, and regional conflicts. In July 2023, at a NATO summit, Turkish President Erdogan agreed to lift his veto and allow Sweden to join the alliance, after receiving assurances from Sweden’s Prime Minister Stefan Löfven on various issues. However, the Turkish Parliament still has to ratify the decision, and it is unclear when that will happen. Sweden’s NATO membership remains uncertain, as the country awaits the final approval from its last obstacle.

China’s factory activity contracted for the second consecutive month in November, as the country faced slowing demand and supply chain disruptions amid the COVID-19 pandemic. According to the official manufacturing Purchasing Managers’ Index (PMI), which measures the activity level of large and state-owned enterprises, China’s manufacturing sector shrank to 49.4 in November, down from 49.5 in October and below the median forecast of 49.7. A reading below 50 indicates contraction, while a reading above 50 indicates expansion. China’s non-manufacturing PMI, which covers the services and construction sectors, also weakened to 50.2 in November, from 50.6 in October. The data suggests that China’s economic recovery is losing momentum, as the country faces challenges from domestic outbreaks, power shortages, environmental regulations, and external pressures. China’s central bank has recently taken steps to ease monetary policy and support growth, such as cutting the reserve requirement ratio for banks and injecting liquidity into the financial system. However, analysts expect that China’s growth will remain subdued in the fourth quarter and the first half of 2024.

The Fed may face a difficult decision in 2024, as the market expects it to slash interest rates aggressively to support a weakening economy and a rising unemployment rate. According to Fed funds futures, which reflect the market’s expectations of future monetary policy, the Fed is expected to cut its benchmark rate by 1.25 percentage points in 2024, or five times by 0.25 percentage points each. However, some analysts doubt that the Fed will deliver such a dovish policy stance, as it may have to balance the risks of inflation, financial stability, and policy effectiveness. “The market keeps trying to front-run these rate cuts, only to be disappointed,” said Kathy Jones, chief fixed income strategist at Charles Schwab. The Fed has indicated that it will be data-dependent and flexible in its policy decisions, but it may face challenges in communicating and managing the market’s expectations.

The stock market ended the day mostly flat, whipsawing on low-volume and declining market breadth after attempting a break to a new annual high Dow. However, investors continued efforts to front-run lower interest rates but one might have to consider the hot 5.2 GDP provides the Fed all the coverage it needs to keep rates up. Today, we will look to Jobless Claims, PCE, PMI, Pending Home Sales, and several notable reports to find inspiration to keep the buying party going until the end of the month. It may be wise to keep an eye on the energy sector as well if Thursday’s OPEC+ meeting results in an overall production cut due to the weakening demand. With the big effort to gap the market higher this morning watch for clues of whipsaw from this very extended market condition.

Trade Wisely,

Doug

Comments are closed.