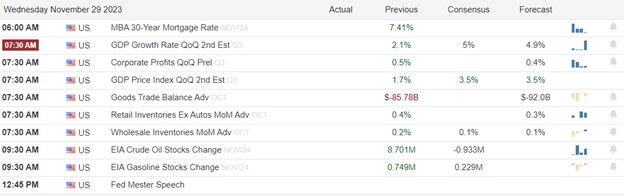

Equity markets sea-sawed on low-volume Tuesday as investors weighed better-than-expected consumer confidence data against the mixed signals on inflation and rates from the Fed governors. The one thing consistent with their statements is the 2% inflation target that they say will require the rate to stay higher for longer. That aside, today traders will grapple with GDP, International Trade, Inventories, Petroleum Status, Fed Speak and Beige Book reports. Along with that busy day of earnings with a theme of retail for the bulls or bears to find inspiration. Futures are popping with confidence this morning but expect considerable price volatility traders react to the data.

Asian markets closed the day mostly lower with China hitting a one-month low and the tech-heavy HIS declined more than 2%. However, European markets trade mostly bullish this morning hoping to finish the month strong with only the FTSE trading modestly lower. U.S. futures point to another gap-up bullish open seemingly very confident the pending data with support the higher prices but remember anything is possible so be prepared!

Economic Calendar

Earnings Calendar

Notable reports for Wednesday include ARWR, BILI, CRDO, CRM, DCI, DLTR, FTCH, FIVE, FL, HRL, LZB, NTNX, OKTA, PDCO, WOOF, PVH, SNOW, SNPS, VSTS, VSCO, ZUO.

News & Technicals’

Apple, the tech giant, is considering ending its partnership with Goldman Sachs, the bank, on its credit-card and savings account products, according to a report by Bloomberg. Apple has reportedly given Goldman Sachs a proposal to terminate the partnership within the next 12 to 15 months. The partnership, which was launched in 2019, involved offering the Apple Card, a credit card that is integrated with Apple Pay and the iPhone, and the Apple Savings, a savings account that offers high-interest rates and cash-back rewards. The partnership was seen as one of the most prominent examples of the collaboration between a tech company and a bank and was expected to attract millions of customers and generate billions of dollars in revenue. However, the partnership has also faced some challenges, such as regulatory scrutiny, customer complaints, and technical glitches. The report said that Apple and Goldman Sachs have not reached a final decision on the partnership and that both companies declined to comment on the matter.

The economic outlook for the G7 countries in 2024 is very pessimistic, according to some of the major banks and asset managers. Deutsche Bank has the most gloomy forecast, predicting that Canada will have the highest GDP growth among the G7 at only 0.8%, while the other countries will have negative or zero growth. Goldman Sachs Asset Management economists are also skeptical about the prospects of a rate cut by the Fed next year unless the growth slows down much more than expected. JPMorgan Asset Management strategists also warn that the risk of a U.S. recession is not gone, but only postponed, as the higher interest rates will eventually hurt the economy. These forecasts suggest that the G7 countries will face a lot of challenges and uncertainties in 2024, as they try to recover from the pandemic and deal with the inflation and debt pressures.

Okta, a leading provider of identity and access management solutions, has admitted that a recent cyberattack compromised the data of all its customers. The company had initially claimed that the breach only affected less than 1% of its clients, but a new message sent on Tuesday revealed the full extent of the damage. The hackers exploited a vulnerability in Okta’s customer support system and gained access to sensitive information such as names, email addresses, passwords, and security questions. The news of the massive data breach sent Okta’s stock price tumbling by 11% on Tuesday, adding more pressure on the company as it prepares to announce its third-quarter earnings on Wednesday. Okta has apologized for the incident and said it is working with law enforcement and security experts to investigate the attack and prevent future ones.

Equity markets ended the day slightly higher on Tuesday, as investors weighed data from a consumer confidence report against the mixed signals from Fed officials about the future course of monetary policy. While Fed Governor Waller expressed confidence that the current policy stance is adequate to bring inflation back to 2%, Fed Governor Bowman warned that the Fed may need to tighten policy further to lower inflation to 2%, as inflation readings have not eased enough in recent months. Higher for long has been the montara of the but overall the market seems convinced the Fed will soon cut rates. However, those decisions are a bit further down the road while the task at hand will be today’s earnings events and the pending GDP figures. Futures are pushing with confidence that those numbers will support more bullishness but if it happens to disappoint be prepared for a morning of volatility if the bears wake up.

Trade Wisely,

Doug

Comments are closed.