A milder-than-expected inflation report than analysts forecast produced a huge morning gap that continued to extend in wild bullish exuberance. Although the T2122 indicator suggests a short-term extreme overbought condition there is a very good chance the QQQ will make a new high for the year in the remarkable reversal. The bull or bears will look for inspiration in Mortgage Apps, PPI, Retail Sales, Empire State MFG, Business Inventories, Petroleum Status, Fed speakers, and a dozen or so notable earnings reports. Avoid the fear of missing out chase as it is highly likely a pullback or at a minimum a longer choppy market consolidation is just around the corner. I would not rule out a substantial whipsaw to punish those last-minute buyers.

While we slept Asian markets reacted in kind closing green across the board with Japan and Hong Kong zooming while China was only able to muster a 0.55% gain. Across the pond, European markets are looking to extend the bullish celebration currently decidedly green across the board. U.S. Futures also want to keep the party going headed for another gap up open ahead of earnings and economic reports.

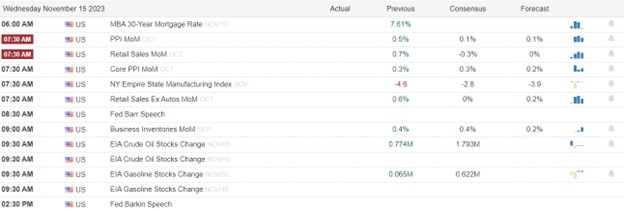

Economic Calendar

Earnings Calendar

Notable reports for Wednesday include AAP, CTLT, CSCO, CPA, DAVA, HI, JJSF, JD, KLIC, PANW, SONO, TGT, TTEK, & TJX.

News & Technicals’

Congress has reached a last-minute deal to avoid a government shutdown that would have affected millions of Americans. The House passed a bill on Saturday that would fund the government for another 45 days, with bipartisan support from both Republicans and Democrats. The bill also includes billions of dollars for disaster relief but does not include any new aid for Ukraine, which was part of a separate agreement in the Senate. The Senate quickly approved the bill by unanimous consent, and President Biden signed it into law. The bill will give lawmakers more time to negotiate a longer-term funding solution and address other pressing issues, such as the debt ceiling and the Biden administration’s request for additional security assistance to Israel and Ukraine.

The economy shrank by 2.1% year-on-year in the third quarter, reversing the 4.8% growth in the previous quarter, according to the latest data from the Bureau of Economic Analysis. This was worse than the 0.6% contraction that analysts had expected. The economy also contracted by 0.5% quarter-on-quarter, compared to a 0.1% decline that was forecast. The data showed that the recovery from the pandemic-induced recession was losing momentum, as consumer spending, business investment, and exports all slowed down. The third quarter GDP data was the last major economic indicator before the presidential election on November 7.

The U.K. inflation rate dropped to its lowest level in two years in October, according to the latest data from the Office for National Statistics. The consumer price index, which measures the changes in the prices of goods and services, fell to 4.6% year-on-year in October, down from 6.7% in September. This was lower than the 4.8% that economists had predicted. On a monthly basis, the consumer price index was unchanged in October. The core consumer price index, which excludes the prices of food, energy, alcohol, and tobacco, also declined to 5.7% year-on-year in October, from 6.1% in September. The main factors that contributed to the lower inflation rate were the decreases in the prices of clothing, footwear, furniture, household goods, and recreation and culture. The inflation rate is still above the Bank of England’s target of 2%, but the central bank expects it to fall further in the coming months. The lower inflation rate could ease some of the pressure on consumers, who have been facing higher costs of living and lower wage growth.

The stock market raced higher on Tuesday after a milder-than-expected inflation report, which showed both the overall and the core CPI inflation rates lower than what analysts had forecasted. All the sectors in the S&P 500 index gained, with the real estate sector leading the way with a 5% increase. The sectors that benefit from economic growth, such as technology, communication, consumer discretionary, and small-cap stocks, also performed well. The bond market reacted positively to the inflation report, as the yields on the 10-year and the 2-year Treasury bonds dropped to around 4.45% and 4.85%, respectively. Today we have about a dozen notable earnings reports with Mortgage Apps, PPI, Retail Sales, Empire State MFG, Business Inventories, Petroleum Status, and some Fed speakers for the bull or bears to find inspiration. The T2122 is now in a short-term extreme overbought condition so a pullback or consolidation could begin at any time but expect the price action to be wildly volatile if the current exuberance begins to fade.

Trade Wisely,

Doug

Comments are closed.