Talk that the U.S. may block Chinese firms from using cloud-computing services engaged the bears on Wednesday but once again the desire to buy up a handful of tech giants reduced the bearish impact. Not surprisingly the Fed minutes add to the odds of more rate hikes on the way with core inflation remaining well above the committee’s 2% target. Today we have a busy day of economic reports that could prove to be market moving along with a very light day of earnings to find inspiration. Volume could remain light as we wait for the big bank’s reports to kick off 3rd quarter’s earnings still a week away.

Asian markets extended the selloff with Hong Kong leading the way down 3.02% in reacting to the future rate increases from the Fed. European markets are also decidedly bearish this morning with red across all indexes. With a busy morning of economic reports ahead, the U.S. futures suggest a bearish open with the bears showing a bit more vigor in the tech sector than we have seen for some time.

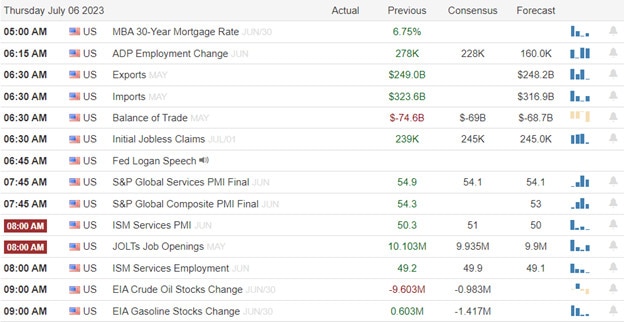

Economic Calendar

Earnings Calendar

Notable report for Thursday is LEVI after the bell.

News & Technicals’

Meta, the company formerly known as Facebook, has launched a new text-based messaging app called Threads. The app is designed to look and feel like Twitter but with some key differences. Users can sign up with their Instagram usernames and follow the same accounts they already follow on Instagram. This could give Threads an edge over Twitter, which has been struggling with various problems since it was acquired by Tesla CEO Elon Musk. Threads aim to offer a simpler and more engaging way to communicate with friends and influencers.

The world economy is facing a serious threat of recession as commodity prices plunge to their lowest levels in a year. The S&P GSCI Commodities index, which tracks the prices of 24 major commodities, has fallen by more than 25% since last November, reflecting weak demand and oversupply. Commodities such as oil, copper, iron ore, and soybeans are vital for industrial production and consumption, and their falling prices signal a slowdown in global growth and trade. Market watchers warn that the commodity slump could trigger a vicious cycle of deflation and debt.

OpenAI, the artificial intelligence research company, is facing a legal challenge from two authors who accuse it of using their books to train its chatbot, ChatGPT, without permission. ChatGPT is a conversational agent that can generate natural language responses based on user input. The authors, Paul Tremblay and Mona Awad claim that ChatGPT can produce “very accurate summaries” of their novels, “A Head Full of Ghosts” and “Bunny”, respectively. They argue that this implies that ChatGPT was trained on their copyrighted works, which would constitute an infringement of their intellectual property rights.

On Wednesday, stocks fell as reports of a U.S. plan to block Chinese firms from using cloud-computing services increased geopolitical tensions and reduced risk appetite after the holiday break. The sector performance and the lagging of small-caps showed a slight preference for defensive sectors, which will be tested by the economic and inflation indicators in the coming days. The June jobs report on Friday, the June consumer price index (CPI) report and the second-quarter earnings season next week will be the main events to watch. Analysts expect core CPI to drop from 5.3% in May to 5.0% (year-over-year) in June. These employment and inflation data will have a significant impact on the market expectations for the Fed’s actions and the stock- and bond-market behavior as the summer goes on.

Trade Wisely,

Doug

Comments are closed.