The bull ran hard Thursday on better-than-expected economic data surging through resistance with no regard to the uncertainty that lies before the market today. It would seem that the market has full confidence that the big banks will report strong enough to support current prices and that the pending economic data will also be rosy. If they are correct look for more upside but watch for possible whipsaws from this short-term extended condition. However, if the data disappoints be prepared for a substantial bear attack that could quickly change market sentiment. Anything is possible so plan carefully.

Asian markets closed green across the board overnight responding to the bullish U.S. prices surge on better-than-expected inflation data. European markets trade with modest gains this morning as they wait and hope for bullish bank reports to support current market pricing. However, after yesterday’s buying spree the U.S. futures point to a slightly bearish open but that could all change as investors react to all the market-moving data ahead.

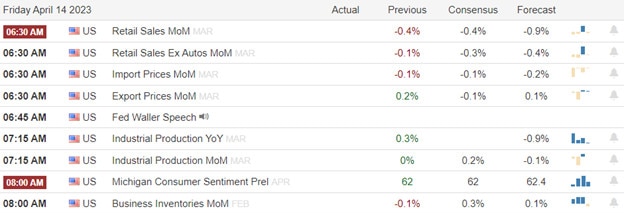

Economic Calendar

Earnings Calendar

The day the market has been waiting for is here, the kick-off of 2nd quarter earnings begins today. Notable reports for Friday include JPM, BLK, C, PNC, WFC, & UNH.

News & Technicals’

The health of Europe’s commercial real estate market is causing concerns among investors. Some are questioning whether it could be the next sector to blow. Following March’s banking crises, fears have arisen of a so-called “doom loop,” in which a potential bank run could trigger a property sector downturn. According to Morningstar Direct data, European funds invested directly in real estate recorded outflows of £172 million ($215.4 million) in February. Some analysts now see real estate stocks falling by 20%-40% by next year. However, it’s important to note that the situation is not the same across all countries in Europe. Some countries are doing better than others. For example, according to a report by Savills, the UK commercial property market is expected to grow by 3% in 2023. It’s also worth noting that the real estate market is cyclical and downturns are not uncommon. However, these downturns are usually followed by periods of growth.

Chinese President Xi Jinping’s signature foreign policy idea, the Belt and Road Project, was announced in 2013. The ambitious plan aimed to build infrastructure trade links across Eurasia and beyond. However, observers say that a decade after the project’s rollout, it is losing steam. Xi reportedly invited President Vladimir Putin to travel to China for the third Belt and Road Forum this year in an attempt to inject new momentum into the massive endeavor.

The bull ran hard on Thursday as producer price index (PPI) inflation data surprised to the downside. The PPI came in at 2.7% YoY for March, well below last month’s 4.9% reading. This comes after headline U.S. consumer price index (CPI) inflation in March also moved lower for the ninth consecutive month. In addition, jobless claims inched higher this week, up to 239,000, another sign that the labor market may be starting to soften. Markets are still pricing in about a 70% probability of a 0.25% Fed rate hike at its May meeting, although they expect a pivot to rate cuts by the second half of the year*. In our view, the Fed likely has one additional rate hike ahead of it, followed potentially by a longer pause in its rate-hiking cycle. However, today is a big day of data that could keep the bullish party going or dramatically shift sentiment. Prepare for a wild morning of price gyrations and watch out for big point whipsaws from these short-term overbought conditions.

Trade Wisely,

Doug

Comments are closed.