The bears relived some of the short-term overbought conditions on a light volume day as the uncertainty of what comes next inspired a bit of profit-taking as we wait for the FOMC. The selling created no technical damage, but the market appears on the cusp of a big decision. With the massive amount of pending economic and earnings data support the current bullish trend, or will it bring the bear back to work, resuming the longer-term bear trend in the SPY and QQQ? One thing is for sure were likely to see price volatility in the next few days that will challenge even the most experienced traders.

Asian markets traded modestly lower overnight, led by Hong Kong, down just 1.03%. Though a preliminary GDP report topped estimates, European markets trade lower across the board this morning. Facing a big day of earnings and economic reports on the eve of an FOMC decision, U.S. futures point to a lower open. Still, I would not expect the bulls to give up easily, so expect substantial price volatility as the data rolls out.

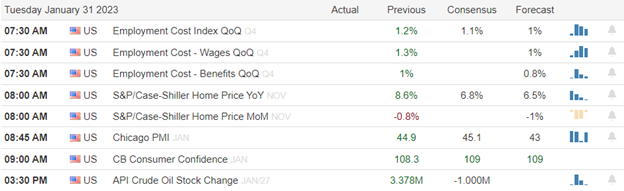

Economic Calendar

Earnings Calendar

Notable reports for Tuesday include AMD, AMGN, AOS, ASH, CAT, CP, GLW, DOV, EW, EA, XOM, GM, HA, IP, JNPR, MPC, MTCH, MCD, MDLZ, NVR, PFE, PSX, PBI, PHM, SNAP, SMCI, SYY, UPS, & WDC.

News & Technicals’

Preliminary Eurostat data released Tuesday showed the euro zone grew 0.1% in the fourth quarter. According to Reuters, economists had pointed to a 0.1% contraction over the same period. Energy prices cooled off in the latter part of 2022, bringing some relief to the euro zone’s broader economic performance.

Norway’s Government Pension Fund Global, among the world’s largest investors, returned -14.1% last year. “The market was impacted by war in Europe, high inflation, and rising interest rates. This negatively impacted both the equity and bond markets simultaneously, which is very unusual,” said Norges Bank Investment Management CEO Nicolai Tangen.

UBS reported $1.7 billion of net income for the fourth quarter of last year, bringing its full-year profit to $7.6 billion in 2022. “The rate environment is helping the business on one side, and that offsets some of the lower activity that we see on the investment side,” CEO Ralph Hamers told CNBC’s Geoff Cutmore Tuesday. The Swiss bank said it would purchase more shares this year.

As we approach the FOMC, uncertainty about what comes next brought some profit-taking on Monday, reliving some of the overbought conditions on another light volume day. However, the selling created no technical damage, and though the VIX registered an increase in fear, the bulls still controlled the overall trend. The intensity of market-moving reports picks up sharply today, hitting a fevered pitch by Thursday when GOOGL, AMZN, and AAPL earnings. If that’s not enough, toss in a slew of economic reports that include an FOMC rate decision and likely hawkish press conference from Powell. Plan for intraday whipsaws, overnight reversals, and fast, challenging price action to test even the most experienced trader.

Trade Wisely,

Doug

Comments are closed.