Investors rushed into big tech names on Monday as bulls surged higher, speculating earnings will support the higher prices. Though the SPY and QQQ were the big winners of the day, they fell just short of breaking the longer-term bear trend established in early 2022. With a big day of earnings that includes a report from MSFT after the bell, big point moves are possible as the indexes swing widely between substantial support and resistance levels. Plan carefully!

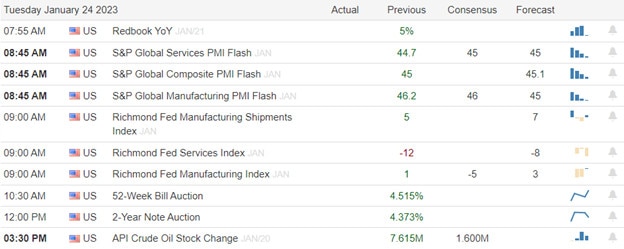

While Asian observes Lunar holiday celebrations, markets rise as the global surge higher continues. However, European markets trade modestly bearish this morning despite a better-than-expected PMI reading. With U.S. markets in a short-term overbought condition, U.S. futures point to modest declines with a big day of earnings data to inspire the bulls or bears depending on the results. Plan for price volatility.

Economic Calendar

Earnings Calendar

The pace of earnings picks up today, with more than 30 companies listed. Notable reports include MMM, AGYS, CNI, COF, DHR, DHI, FFIV, GE, HAL, ISRG, IVZ, JNJ, LMT, MSFT, NAVI, ONB, PCAR, RTX, TXN, TRV, UNP, VBTX, VZ, WSBC & WAL.

News & Technicals’

The FBI said it was “able to confirm” that Lazarus Group and APT38, two hacking groups linked to North Korea, were responsible for the attack on the so-called Horizon bridge last year. Hackers stole $100 million worth of cryptocurrencies in the attack on the Horizon bridge, which traders use to swap digital tokens between different blockchain networks. The FBI also said that this month, the North Korean cyber actors used the Railgun system to launder over $60 million worth of the token ether stolen during the June 2022 heist.

U.S. markets are underperforming global stock markets, but analysts expect more of the same. As of Monday morning, the Russell 3000 benchmark for the entire U.S. stock market was up around 4.85% over the three months since late October. By contrast, the MSCI World ex-U.S. index had surged more than 19%, while the pan-European Stoxx 600 was up more than 12%.

Google CEO Sundar Pichai and executive leaders addressed employee questions at a town hall meeting on Monday after last week’s job cuts. “I understand you are worried about what comes next for your work,” Pichai said. Pichai said executive bonuses are getting cut.

The bulls charged forward on Monday and extended the T2122 indicator into another short-term overbought condition as investors rushed into big tech names, speculating on positive earnings reports as layoffs continue. While the SPY and QQQ surged to higher highs in the recent bullish trend, they fell just short of breaking the longer-term bear trend that began in 2022. This morning we face a significant number of earning reports along with a PMI reading that consensus expects to continue to show economic contraction. Price volatility is likely as the data rolls out, and with MSFT reporting after the bell, a substantial gap Wednesday at the open is not out of the range of possibilities. Plan carefully with big point index moves possible between index support and resistance levels.

Trade Wisely,

Doug

Comments are closed.