Market uncertainties abound with currency gyrations, weakening economic conditions, a litany of talking head doublespeak, and geopolitical tensions. I suspect that condition will continue today with a few earnings reports, several economic reports, and a blizzard of flip-flopping Fed speak. A substantial bounce is not out of the question from this short-term oversold condition, but we can’t rule out the pile-on effect as data rolls out. Whipsaws and overnight reversals are likely to keep price action challenging, so plan your risk carefully.

Asian markets closed higher with modest gains as the healthcare sector rallied. Across the pond, European markets also trade with modest gains this morning in a choppy price action session. Seeing treasury yields relaxing slightly, U.S. futures point to a substantial gap up ahead of several potential market-moving reports. Hope for a relief rally but be prepared for fast-moving prices that could whipsaw in a heartbeat due to news sensitivity.

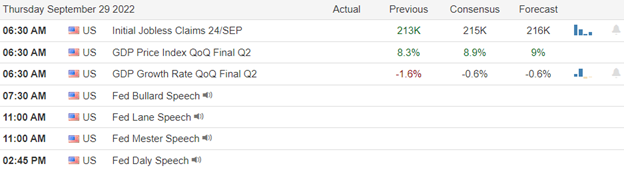

Economic Calendar

Earnings Calendar

We have a bit more activity on the earnings calendar for Tuesday, with 15 confirmed reports. Notable reports include BB, CALM, CBRL, JBL, NEOG, PRGS, & UNFI.

News & Technicals’

The sudden sell-off in the pound and U.K. bond markets led economists to anticipate more aggressive interest rate hikes from the Bank of England. In a series of tweets Tuesday morning, Harvard professor Summers said that although he was “very pessimistic” about the potential fallout from the “utterly irresponsible” policy announcements, he did not expect markets to capitulate so quickly. The likening of the U.K. to an emerging market economy has recently become more prevalent among market commentators. Speaking to CNBC’s “Squawk Box Europe” on Tuesday, Evans said he remains “cautiously optimistic” that the U.S. economy can avoid a recession — provided there are no further external shocks. His comments come shortly after a slew of top Fed officials said they would continue to prioritize the fight against inflation, which is currently running near its highest levels since the early 1980s.

The British pound hit an all-time low against the dollar in the early hours of Monday morning, dropping below $1.04, while the U.K. 10-year gilt yield rose to its highest level since 2008. The announcement featured a volume of tax cuts not seen in Britain since 1972 and a return to the “trickle-down economics” promoted by the likes of Ronald Reagan and Margaret Thatcher. However, Vasileios Gkionakis, head of European FX strategy at Citi, told CNBC on Monday that the market was demonstrating an “erosion of confidence” in the U.K. as a sovereign issuer, leading to a “textbook currency crisis.” Bitcoin topped $20,000 on Tuesday, hitting its highest level in more than a week, but is still struggling to break out of its tight trading range. With another U.S. Federal Reserve interest rate out the way, traders may be positioning themselves for a peak in U.S. dollar strength, which would be positive for bitcoin, one analyst said. Bitcoin’s rally happened despite a fall in U.S. stocks, with the S&P 500 closing at its lowest level of 2022 on Monday, a potential sign the correlation between the two asset classes may be lessening.

Uncertainties abound, whipsawing the Monday markets as currencies fluctuate, and a flurry of Fed speakers and talking head doublespeak points fingers of blame though still promoting their positions. Add in the geopolitical issues, and it’s not hard to understand why the market is a mess. Sadly, we now look to the same people that created the mess to clean it up and get things back on track. What could go wrong with that? Technically speaking, the indexes are in a short-term severely oversold condition, suggesting a relief rally could soon occur. Still, we will have to keep a close eye on the deteriorating conditions of our economy and other major economies’ stumbling blocks keeping the bears active. Today we face a blizzard of Fed speakers as well as Durable Goods, Case-Shiller, Consumer Confidence, and New Home Sales reports. Plan for price action to remain challenging. If a relief rally does begin, be willing to hold thorough substantial whips in price or stand aside because the bear market is not likely finished with market-moving surprises.

Trade Wisely,

Doug

Comments are closed.